Australia’s financial regulator has introduced new measures aimed at making the distribution of the AUDM stablecoin smoother and more efficient.

By offering exemptions for intermediaries, regulators are signaling both a willingness to encourage digital asset growth and a cautious approach to consumer protection. This marks an important moment for the Australian market, where the balance between innovation and oversight has long been debated.

ASIC’s New Exemption for AUDM Stablecoin

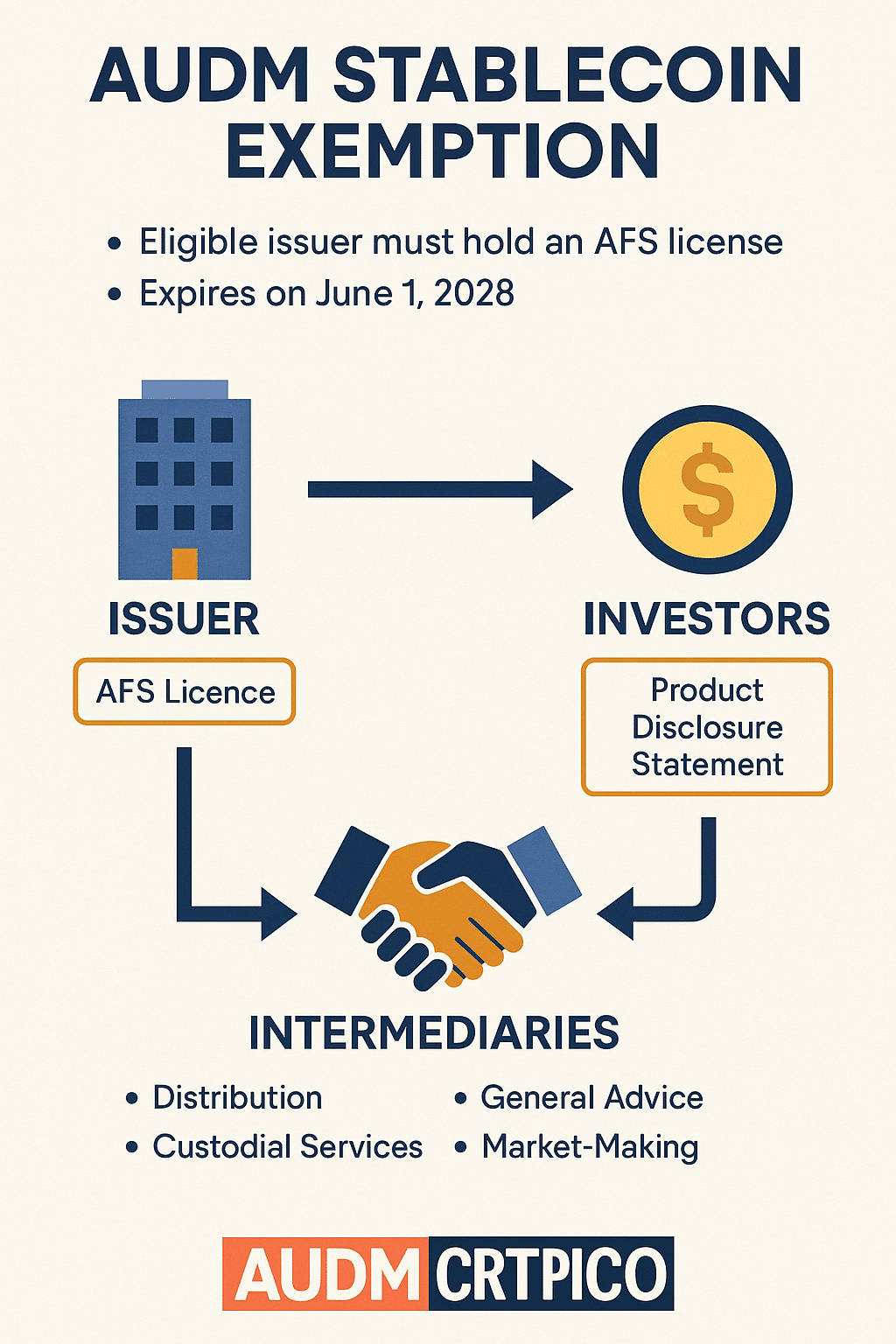

The Australian Securities and Investments Commission (ASIC) has approved the Stablecoin Distribution Exemption Instrument 2025/631. Under this framework, intermediaries that distribute the AUDM stablecoin are no longer required to hold multiple financial licenses, provided the issuer, Catena Digital Pty Ltd, already has an Australian Financial Services (AFS) licence.

The exemption covers a wide range of activities, including custodial services, general advice, and market-making. This means distributors can focus on bringing the AUDM stablecoin to retail and institutional investors without the red tape that often slows down adoption.

ASIC, however, requires that every retail client receives access to a Product Disclosure Statement (PDS), ensuring that risks and features are transparent.

Industry Reactions and Expert Opinions

The decision has drawn mixed but largely positive reactions across the crypto community. Investor and commentator Anthony Sassano wrote on X, “This is a smart move by ASIC. It gives room for the AUDM stablecoin to grow while keeping investor protections intact.”

Others believe this is a sign of Australia aiming to position itself as a global hub for regulated digital assets. Blockchain advocate Chloe White noted, “The timing of the exemption is no accident. The government knows the market wants clarity, and the AUDM stablecoin provides a test case for responsible innovation.”

By streamlining the process, ASIC appears to be sending a message: digital currencies like the AUDM stablecoin are here to stay, but they must be integrated into a framework that safeguards both investors and the financial system.

Global Context and Regulatory Momentum

This exemption does not exist in a vacuum. Globally, regulators are wrestling with how to handle stablecoins, which serve as crucial links between fiat currency and the crypto economy. The AUDM stablecoin, pegged to the Australian dollar, adds a local dimension to this international debate.

Observers point out that similar approaches are emerging elsewhere. Japan recently updated its rules to support yen-backed stablecoins, and the European Union is advancing its Markets in Crypto-Assets (MiCA) regulation. By giving the AUDM stablecoin a clearer path, Australia is aligning itself with global leaders while maintaining its unique regulatory stance.

What This Means for Investors

For investors, the AUDM stablecoin offers a way to hold a digital asset that reflects the stability of the Australian dollar while still benefiting from blockchain’s efficiency. The exemption reduces barriers for distributors, likely leading to wider availability in wallets, exchanges, and payment platforms.

Market analyst Michael Miller remarked, “Stablecoins are the backbone of the digital asset ecosystem. By simplifying distribution, the AUDM stablecoin can scale faster and potentially compete with global peers like USDC and USDT.”

The exemption is temporary, expiring in June 2028, which means regulators will closely monitor how the AUDM stablecoin performs. Its success could influence future rules not only in Australia but also across the Asia-Pacific region.

Conclusion

Australia’s move to streamline rules for the AUDM stablecoin is more than a regulatory update—it is a strategic decision that positions the nation at the forefront of digital finance.

By offering relief to intermediaries while enforcing transparency for retail clients, ASIC has struck a balance between innovation and caution. For investors and developers, the AUDM stablecoin now represents both a stable digital asset and a litmus test for the future of crypto regulation.

FAQs about AUDM stablecoin

1. What is the AUDM stablecoin?

It is a digital currency pegged to the Australian dollar and issued by Catena Digital Pty Ltd under an AFS licence.

2. Why did ASIC grant an exemption for the AUDM stablecoin?

The exemption reduces licensing requirements for intermediaries, making distribution easier while ensuring consumer protection through disclosure rules.

3. How long will the exemption for the AUDM stablecoin last?

The exemption is temporary and will expire on June 1, 2028, unless renewed by ASIC.

4. How does the AUDM stablecoin compare to global stablecoins?

It functions similarly to USDT or USDC but is tied to the Australian dollar, offering local investors a stable and regulated option.

Glossary

Stablecoin: A cryptocurrency pegged to a fiat currency or asset to reduce volatility.

AFS Licence: An Australian Financial Services licence required to offer financial products and services.

Product Disclosure Statement (PDS): A document outlining the risks, features, and costs of a financial product.

Custodial Services: Safekeeping of assets on behalf of investors.

Market-Making: Providing liquidity by offering to buy and sell assets at quoted prices.

Regulatory Exemption: A temporary or specific relief from certain licensing or compliance requirements.