Updated on 23rd October, 2025

This Article Was First Published on Deythere

Arthur Hayes, co-founder of BitMEX and CIO of Maelstrom, has got the crypto community talking. He comes out with scathing criticism of Japan’s fiscal stimulus and doubles down on his $1 million Bitcoin forecast.

He is predicting a Japanese yen collapse potentially to ¥200 per USD, while saying Bitcoin could reach $1 million, framing his views as part of a bigger tale about fiat instability vs decentralized money.

Hayes’s comments come as Japan announced new stimulus measures under Prime Minister Sanae Takaichi to combat inflation.

Hayes’s Critique of Japan’s Stimulus and Fiat Monetary Policy

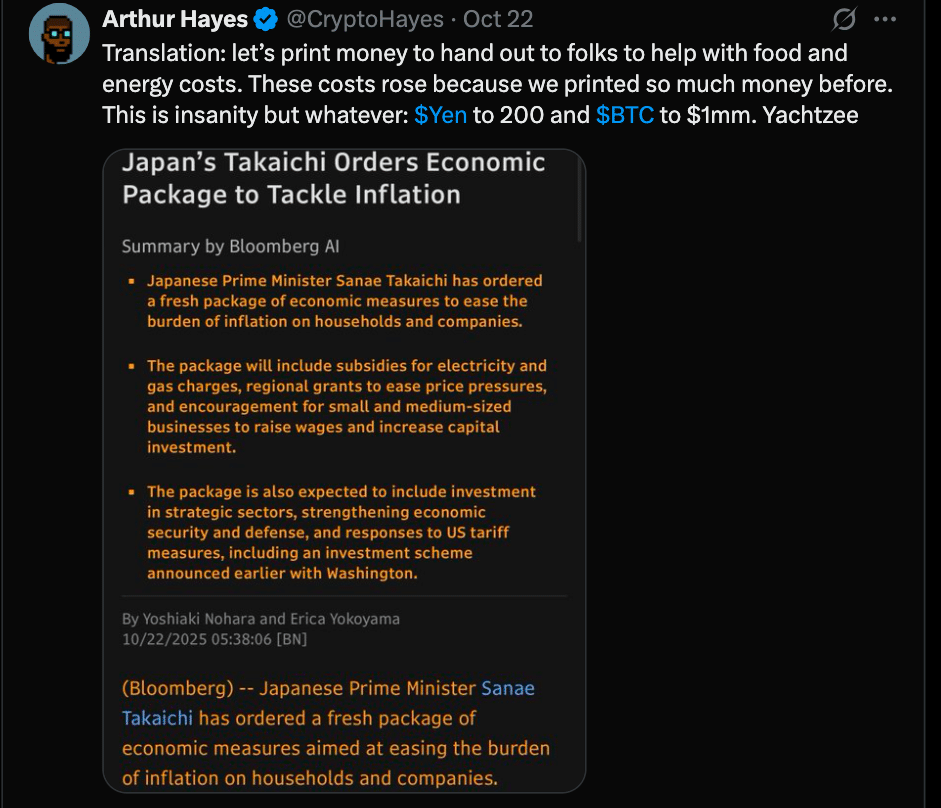

Hayes’s comments are focused on Japan’s recent stimulus package which includes subsidies for energy, wage incentives and local development funding. He calls it politically expedient but economically reckless. On X, he wrote:

“Translation: let’s print money and hand it out to folks to help with food and energy costs. These costs rose because we printed so much money before. This is insanity but whatever: $Yen to 200 and $BTC to $1mm.”

In Hayes’s view; repeated money printing erodes the credibility of fiat currencies and sets up for a big yen depreciation. He frames the stimulus as chronic monetary overreach rather than a short term fix. This makes his projected Japan yen collapse a forecast and a warning in his world.

The Yen at Crossroads: Economic and Policy Pressures

The yen has been under pressure for a while. Experts say the yen’s weakness is due to several structural and cyclical factors. First, persistent inflation in food and energy imports increases Japan’s external price exposure.

Secondly, the Bank of Japan (BOJ) is dovish; that is, favors ultra-loose monetary policy; so yield differentials are less favorable for holding yen vs other currencies.

Again, global capital flows tend to favor higher-yield or more dynamic economies during risk-on periods and Japan’s slow growth profile makes it vulnerable.

In summary, Hayes’s forecast of the Japanese yen’s collapse is based on these fundamental stresses amplified by what he sees as reckless fiscal stimulus packaging.

Linking Yen Collapse to Bitcoin’s Long Term Rise

Hayes’s $1 million Bitcoin forecast is not separate from his view on the yen, it’s connected. He says that as fiat loses credibility and value erodes, decentralized currencies like Bitcoin become a safe haven. In his world, continual monetary expansion leads to inflation, which pushes capital into assets outside traditional finance.

His version is that $BTC’s rise is a direct function of fiat collapse risk. His forecast might be extreme, but not new. In crypto circles, large upside $BTC scenarios often depend on monetary failure or currency debasement.

Hayes seems to be using Japan as a test case for that theory. The implicit assumption is that when fiat breaks, digital alternatives rise.

Market Reception, Risks and Counterpoints

Hayes’s bold call has gotten both attention and skepticism. Market participants like his rhetoric but many think ¥200 per USD or $1 million BTC is extreme. Some central bankers might switch policies before complete collapse; and yen depreciation beyond current levels would likely trigger sharp intervention.

Moreover, Bitcoin’s rise isn’t just about macro narratives but adoption, regulation and ecosystem health.

Critics say projecting collapse as inevitable ignores policy prudence, global interdependence and capital flows. The Japan yen collapse narrative is compelling but execution of macro scenarios is rarely linear.

Conclusion

Arthur Hayes’s recent post puts Japan’s monetary policy and the yen’s future at the center of a big thesis: that stimulus will cause the yen to collapse and drive Bitcoin to $1 million. While his narrative ties these two together under a fiat-decay framework, the road from critique to reality is full of economic counterforces.

Still, his voice opens up a bigger sentiment in crypto that traditional monetary systems aren’t stable. As markets and policy intersect, the Japan yen collapse call forecast be tested by currency dynamics and Bitcoin’s strength.

Glossary

Stimulus package: Government spending or subsidies to support consumption or growth.

Fiat currency: Government issued currency not backed by a commodity, relies on state backing and monetary policy.

Dovish monetary policy: Central bank stance of lower interest rates and more liquidity to support growth.

Capital outflow: Money leaving an economy (or currency) to other financial systems or assets.

Bitcoin as a hedge: The idea of Bitcoin as a store of value or safe haven from fiat decay.

Frequently Asked Questions About Arthur Hayes Japan Yen Collapse Forecast

Did Hayes literally mean the yen will go to 200?

Yes he did, he wrote “$Yen to 200” in his post, as a potential outcome of continuous monetary madness.

Is $1 million BTC possible under some scenarios?

It’s extreme by today’s standards, but in certain models that assume extreme fiat debasement, it becomes a target.

Will Japan intervene before such collapse?

That’s a counter to Hayes’s thesis. Central banks react to exchange rate stress; BOJ intervention is a possible moderating factor.

Does this mean Bitcoin will automatically go up?

Not necessarily. Bitcoin’s rise depends on demand, adoption, regulatory frameworks, infrastructure; not just macro narratives.