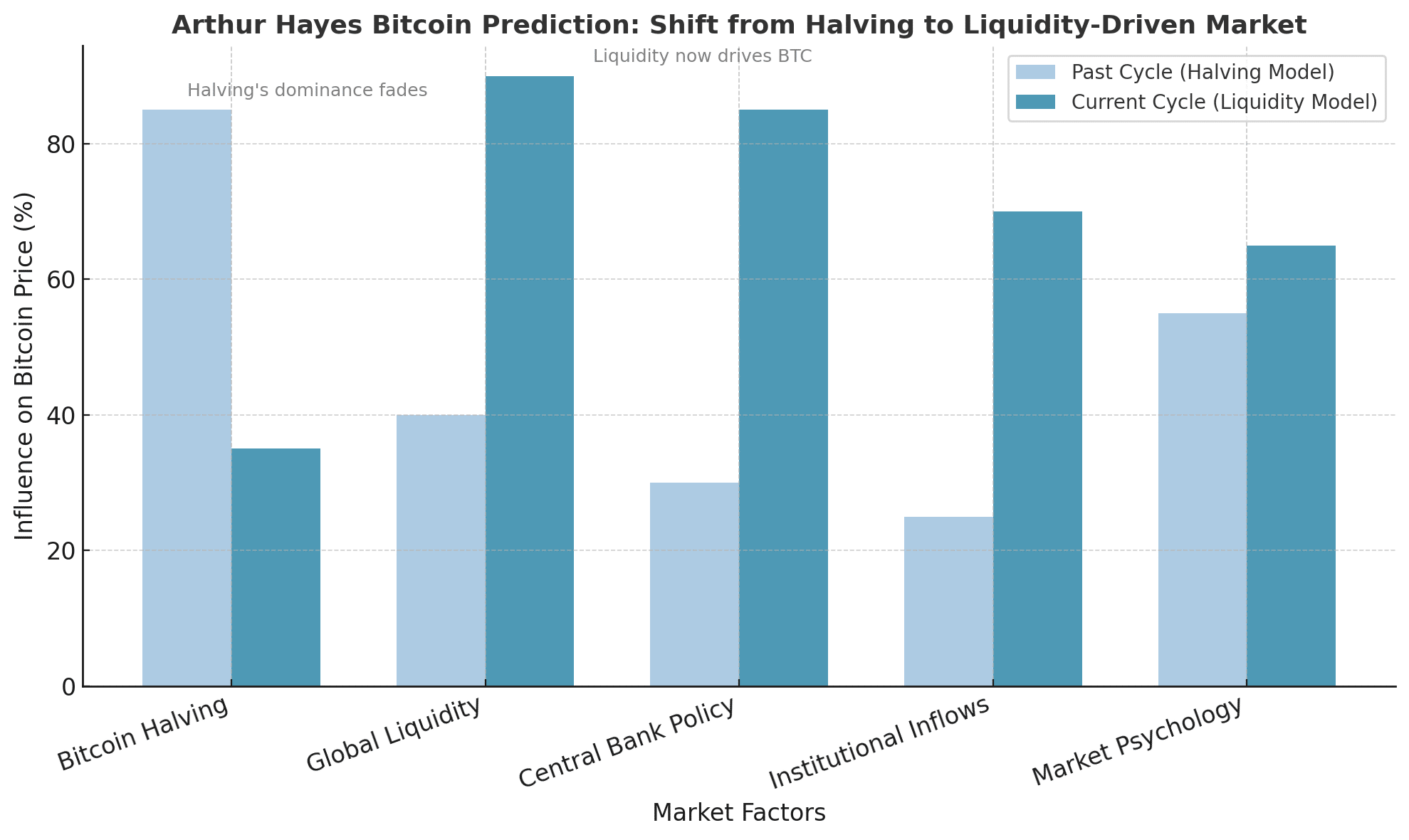

Arthur Hayes Bitcoin prediction has once again sent shockwaves across the crypto space. The outspoken co-founder of BitMEX and CIO of Maelstrom believes the traditional four-year cycle that has defined Bitcoin for over a decade is officially dead. Instead, Hayes argues that global liquidity and central bank policies are now the true engines driving Bitcoin’s momentum.

His view challenges years of data-backed belief in halving-driven bull runs. In his words, “The halving is not the heartbeat of Bitcoin anymore. Liquidity is.” The statement sparked debate among analysts, traders, and macroeconomists, many of whom still swear by the predictable rhythm of Bitcoin’s historical pattern.

A Shift From Halving to Global Liquidity

Since 2009, Bitcoin’s market cycle has closely followed its halving events, which occur roughly every four years. Each time the block reward is cut in half, scarcity increases, leading to rallies that have historically peaked about 12 to 18 months later. But the Arthur Hayes Bitcoin prediction paints a different picture for this era.

Hayes insists that central banks now wield more influence over Bitcoin than its internal code. As he explained in a recent post, “The real halving is when liquidity tightens. When the Fed drains the system, Bitcoin falls. When they print, Bitcoin flies.”

His theory aligns with recent macro data. Over the past two years, Bitcoin’s correlation with the global M2 money supply has surged. As the United States, China, and Japan expanded their balance sheets to support fragile economies, Bitcoin responded with aggressive price growth, rising over 200 percent from late 2023 to 2025.

The Arthur Hayes Bitcoin prediction also reflects how institutions now trade crypto as a macro asset rather than a niche technology. With Bitcoin ETFs absorbing billions in inflows, its price movements increasingly mirror central bank liquidity and bond yields rather than retail speculation.

The Four-Year Cycle Theory: Outdated or Evolving?

For years, the four-year cycle model acted like a compass for traders. The formula was simple: halving leads to a supply shock, euphoria follows, and then comes the inevitable crash. Hayes, however, says that model broke once institutional liquidity entered the equation.

“The market is no longer driven by miners and retail enthusiasm,” he said. “It is shaped by capital flows, credit conditions, and government deficits.” This perspective redefines the way investors interpret the market. Instead of treating halvings as the ignition point, Hayes urges attention to real-world monetary conditions.

Interestingly, this perspective mirrors how gold and equities respond to macro shifts. Both tend to rise when liquidity increases and struggle when it tightens. Hayes believes Bitcoin has entered that same maturity phase, a digital reflection of the global financial system.

Market Reaction and Community Response

The Arthur Hayes Bitcoin prediction divided the crypto community. Longtime holders remain loyal to the halving narrative, pointing to historical charts that align with supply cuts and subsequent rallies. But macro-focused analysts have largely agreed with Hayes’s reasoning.

Crypto economist Alex Krüger wrote, “Liquidity drives everything now. Arthur Hayes is right, Bitcoin’s price will follow central banks, not calendars.” On social media, the debate became a focal point for both institutional investors and retail traders trying to navigate Bitcoin’s next phase.

Meanwhile, sentiment analysis from major trading platforms shows a growing interest in liquidity-based models. Searches for “Bitcoin liquidity cycle” have tripled in the last three months, suggesting that Hayes’s influence may be shaping investor psychology.

What This Means for Traders and Long-Term Holders

For active traders, the Arthur Hayes Bitcoin prediction represents both opportunity and caution. It emphasizes flexibility over rigidity, a shift from waiting for halving events to monitoring macro liquidity indicators.

This means keeping a close eye on money supply growth (M2), interest rate changes, and fiscal stimulus announcements. “Bitcoin now dances to the rhythm of liquidity,” Hayes said. “Ignore that, and you are trading blind.”

For long-term holders, his prediction suggests more resilience in future bear markets. If global liquidity continues to expand, Bitcoin could see smaller drawdowns compared to past cycles. Instead of crashing by 80 percent, future corrections may resemble 30 to 40 percent retracements, similar to mature commodities or equities.

Beyond Bitcoin: The Ripple Effect Across Crypto

Hayes’s theory extends beyond Bitcoin itself. Altcoins, DeFi platforms, and tokenized assets all respond to liquidity shifts. When capital floods into the system, risk assets outperform, from Ethereum to Solana. When liquidity dries up, the entire market contracts.

In that sense, the Arthur Hayes Bitcoin prediction could reshape how analysts forecast altcoin seasons, stablecoin growth, and even NFT volume. The idea that “money flow dictates momentum” now applies to the entire blockchain ecosystem.

A Contrarian View: Is the Cycle Really Dead?

While Hayes’s thesis is compelling, not everyone is convinced. Some analysts argue that halvings still have a psychological effect on investors. They create anticipation, drive narrative cycles, and attract new participants who treat scarcity as a value signal.

Veteran trader Peter Brandt commented, “Liquidity matters, yes. But narratives drive human behavior, and Bitcoin’s halving remains the strongest story in crypto.”

If that holds true, both forces could coexist, liquidity steering the macro direction, while halvings act as sentiment catalysts. In that hybrid view, Hayes’s liquidity model may explain why Bitcoin moves, while halvings explain when interest peaks.

Conclusion

The Arthur Hayes Bitcoin prediction marks a turning point in how the market interprets Bitcoin’s future. Whether one agrees or not, his insights carry weight because they blend crypto knowledge with macroeconomic awareness. As institutional liquidity deepens and global finance becomes more interconnected, Bitcoin is evolving into a mirror of global money itself.

If liquidity remains abundant, Bitcoin may rewrite history, not as a cyclical asset, but as a perpetual store of value that thrives in inflationary times. And if Hayes is right, this might just be the start of Bitcoin’s longest expansion yet.

Frequently Asked Questions about Arthur Hayes Bitcoin Prediction

1. What is the Arthur Hayes Bitcoin prediction?

Arthur Hayes Bitcoin prediction argues that Bitcoin’s four-year halving cycle is obsolete and liquidity now drives its price.

2. How does liquidity influence Bitcoin?

Liquidity measures how much money is circulating in global markets. More liquidity means more capital chasing assets like Bitcoin.

3. What price level does Hayes see for Bitcoin next?

While he avoids specific targets, his thesis implies that as long as liquidity expands, Bitcoin could move beyond $150,000 before tightening resumes.

4. Will halvings still impact Bitcoin?

Possibly, but less directly. Hayes believes halvings now act more as narrative milestones than fundamental market drivers.

Glossary of Key Terms

Halving: The scheduled event that reduces Bitcoin mining rewards by 50 percent, limiting new supply.

Liquidity: The amount of money and credit available in markets that influence asset prices.

M2 Money Supply: A broad measure of global liquidity that includes cash, deposits, and easily accessible funds.

Macro Policy: Economic actions by central banks and governments that shape financial markets.

Cycle Theory: The belief that Bitcoin’s price follows a predictable four-year pattern tied to halvings.