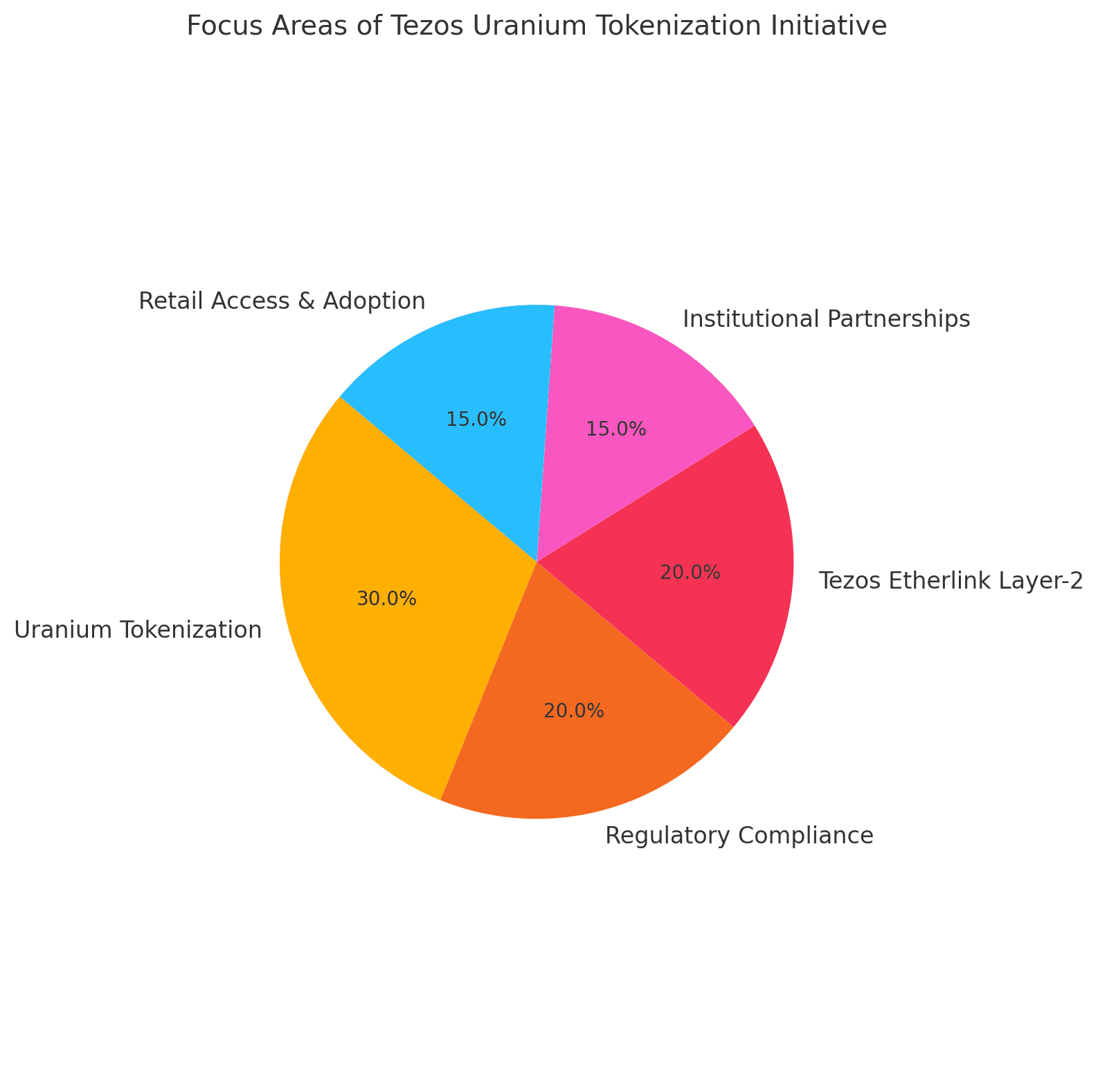

Arthur Breitman, the visionary co-founder of Tezos, is taking an ambitious leap into the world of real-world asset (RWA) tokenization, and he’s doing it with one of the world’s most powerful and controversial commodities: uranium.

In what could be Tezos’ boldest comeback move yet, Uranium.io, a new platform built on Tezos’ Etherlink Layer-2 network, is set to revolutionize the way investors access the uranium market, an industry historically reserved for high-net-worth institutions and government entities.

What Is Uranium.io?

Uranium.io allows verified retail investors to purchase tokenized uranium-backed assets, specifically U3O8, also known as “yellowcake.” Each token is physically backed by uranium stored in secure facilities managed by industry giants like Cameco.

What sets this apart is the collaboration with trusted custodians and regulated entities:

Archax (UK-based digital securities exchange)

Curzon Uranium (commodity trading firm)

Cameco (one of the world’s largest uranium producers)

Through these partnerships, Uranium.io ensures regulatory compliance and verifiable backing for every token sold.

“Tokenized uranium opens a new chapter in RWA innovation,” said Breitman. “We’re democratizing access to one of the world’s most vital and under-invested commodities.”

Why Uranium, and Why Now?

The global conversation around decarbonization and energy transition has led to a sharp resurgence in interest in nuclear power. Uranium, the essential fuel behind nuclear reactors, is seeing renewed demand amid rising geopolitical tensions and climate urgency.

Uranium prices have surged over 35% YoY.

Global nuclear investment is projected to exceed $1.5 trillion by 2040.

Retail access to uranium has been historically non-existent until now.

Tezos is strategically positioning itself not just as a blockchain for NFTs or DeFi, but as a key infrastructure player for tokenizing hard assets.

Tezos Etherlink: The RWA Power Layer

Uranium.io runs on Etherlink, Tezos’ new high-performance, EVM-compatible Layer 2 designed for scalability, low fees, and seamless DeFi integration.

Etherlink:

Supports smart contracts and oracles for real-world data feeds.

Offers compliance tooling for institutional-grade RWA issuance.

Enables tokenization with off-chain verifiability and on-chain liquidity.

With Ethereum dominating the RWA space via MakerDAO, Ondo Finance, and Centrifuge, Tezos is carving out a unique niche by focusing on commodity-grade tokenization, something rarely attempted at this scale.

Why This Could Be Tezos’ Big Comeback

Tezos (XTZ) was once hailed as a leading smart contract platform with self-amending protocol upgrades and strong governance features. However, it gradually lost momentum to competitors like Solana, Avalanche, and Ethereum L2s.

But Breitman’s uranium initiative could revive Tezos’ narrative as a pioneer in untapped sectors:

Commodity tokenization is a trillion-dollar frontier.

Nuclear energy is rapidly becoming part of ESG-aligned portfolios.

Tezos’ compliance-first approach fits institutional RWA frameworks perfectly.

“This is the type of real-world innovation that brings crypto from speculation to utility,” said RWA researcher Austin Arnold.

Market Snapshot: Tezos (XTZ) Price Update

| Date | XTZ Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

| May 19 | $1.12 | +5.84% | $1.04 Billion |

Tezos is currently trading at $1.12, up nearly 6% in the last 24 hours, reflecting positive sentiment surrounding Uranium.io’s announcement.

Broader Implications for the Crypto Market

This isn’t just about uranium — it’s a case study for the future of asset-backed tokens:

Fractional ownership of physical commodities

24/7 liquid markets for industrial-grade materials

Borderless trading of resources through smart contracts

Transparency and verifiability using blockchain audit trails

As regulators increasingly scrutinize stablecoins and synthetic assets, real-world assets like uranium could become the compliant backbone of tokenized finance.

Final Thoughts: Utility Over Hype

While meme coins grab headlines and speculative altcoins pump and dump, Arthur Breitman is quietly laying the groundwork for a more grounded, asset-backed future that brings Wall Street commodities into Web3 frameworks.

If successful, Uranium.io could become not just a Tezos milestone but a blueprint for tokenizing real-world assets at scale.

FAQs

What is Uranium.io?

A platform on Tezos Etherlink Layer-2 that allows investors to buy tokens backed by physical uranium.

Why is this important?

It democratizes access to uranium and showcases Tezos as a leader in real-world asset (RWA) tokenization.

Who are the partners involved?

Uranium.io collaborates with Archax, Curzon Uranium, and Cameco to ensure security and compliance.

Glossary of Key Terms

U3O8: Uranium oxide used as nuclear reactor fuel.

RWA (Real-World Asset): A tangible, off-chain asset tokenized for blockchain trading.

Etherlink: Tezos’ EVM-compatible L2 focused on scalability and compliance.

Tokenization: The process of converting real assets into digital tokens on a blockchain.