This article was first published on Deythere.

- Big Money Meets DeFi: The Apollo Morpho Partnership

- What This Apollo Morpho Partnership Deal Means for DeFi Lending

- Market and Token Reaction to Announcement

- Institutional Flows Into On-Chain Credit Near New Highs

- Conclusion

- Glossary

- Frequently Asked Questions Apollo Morpho Partnership

- What is the Apollo Morpho Partnership?

- For what reason does Apollo need MORPHO tokens?

- How did the market respond to this collaboration?

- What other companies does Morpho count as partners?

- Does this collaboration have an impact on lending via Morpho?

- References

Apollo Global Management has announced a partnership with the Morpho Association, the group behind the Morpho DeFi lending platform.

As part of the agreement, Apollo and its affiliates have committed to purchasing a maximum of 90 million MORPHO tokens over the next four years as well as partnering with Morpho to fund on-chain lending markets.

There are also tangible price reactions and increased interest from the institutional market in response to this news.

Big Money Meets DeFi: The Apollo Morpho Partnership

Apollo Global Management is one of the largest alternative asset managers in the world; it manages approximately $940 billion and its investment deal with the Morpho Association extends over four years.

Under the agreement, Apollo and its affiliates can purchase up to 90 million in MORPHO governance tokens, which constitute around 9% of the supply by utilizing a range of channels such as open market purchases and over-the-counter trades. Trading and Transfer restrictions are in place to promote orderly market conduct.

According to the Morpho Association, the two groups are working together to enhance on-chain lending markets on Morpho’s protocol; without disclosing full technical details of how the collaboration will work.

The Apollo Morpho partnership news set off a market response, driving MORPHO token prices up by 17% over the weekend that followed the announcement.

Morpho is distinguished for its lending markets and highly guarded vaults where users can earn yield and borrow assets in a decentralized way. The protocol is a top DeFi lending platform, managing billions of dollars in assets across multiple chains.

What This Apollo Morpho Partnership Deal Means for DeFi Lending

The Apollo Morpho partnership means more than a simple financial investment. Apollo’s involvement goes beyond token speculation, as the firm is now considered to be one of the important stakeholders in governance and infrastructure for a leading DeFi lending protocol.

Governance tokens such as MORPHO offer holders the opportunity to influence decisions such as risk parameters, fees and product roadmap.

This integration follows other institutional collaborations with Morpho. Bitwise Asset Management also launched a non custodial vault on Morpho in January 2026 that offers as much as 6% APYs on USDC stablecoin holdings.

Additionally, products like Bitcoin Smart Accounts implemented in collaboration with other companies have started to connect Morpho’s lending infrastructure as well.

Market and Token Reaction to Announcement

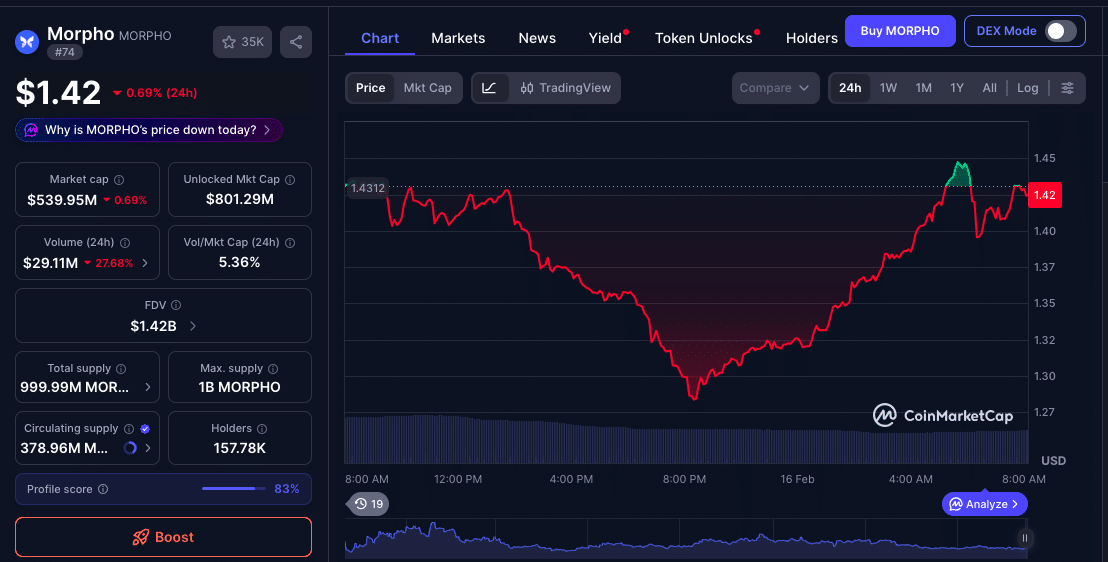

Immediately after the announcement of the Apollo Morpho partnership, there was a noticeable price impact. According to market data, MORPHO’s price rose from about $1.12 before the news broke to trade at around $1.42 at press time, meaning buying has returned after putting sellers in charge over the past several weeks of price pressure.

Investors responded to what was seen by many as an affirmation of institutional faith in Morpho’s lending infrastructure.

Despite the recent gain, MORPHO had been down about 38 percent over the last year, in line with the wider volatility of the crypto market. The recent institutional interest, however, could provide stabilization as long-term players come into the ecosystem.

Galaxy Digital UK Limited acted as sole financial adviser to the parties in what is clearly quite a serious, and mature, institutional-level deal.

Institutional Flows Into On-Chain Credit Near New Highs

TradFi firms have been upping their exposure to DeFi infrastructure, slowly but surely. Over just the last year, Apollo has been a participant in larger moves in the crypto space including partnerships that involved tokenization, stablecoin-credit strategies and blockchain credit funds.

For instance, platforms like Securitize now allow Apollo’s credit funds to be tokenized and employed in a decentralized way.

These developments are quite different to the retail-dominated decentralized finance narratives that are publicized. Institutional involvement, specifically from prominent asset managers such as Apollo and Bitwise, is a sign of faith in the ability of DeFi to scale well and coexist with traditional financial strategies.

Conclusion

The Apollo Morpho partnership is a meaningful venture for decentralized finance as one of Wall Street’s most influential asset managers enters into direct, long-term participation in on-chain lending infrastructure.

With a combined maximum of 90 million MORPHO tokens and strong real DeFi market support, Apollo is changing the previous beliefs around institutional access to decentralized credit. The price increase in MORPHO post announcement, while ongoing ecosystem integration with other institutional players is another testament.

This kind of action could continue to boost greater integration between traditional capital and decentralization systems, particularly in protocols that blend on-chain transparency with governance influence.

Glossary

Apollo Global Management: One of the top global alternative asset managers with nearly 940 billion under assets, actively seeking opportunities in blockchain and DeFi.

DeFi (Decentralized Finance): Financial services constructed on blockchain technology, but that function without central intermediaries.

MORPHO token: The governance token of the Morpho DeFi lending protocol that works for voting and decision-making about the parameters of the protocol.

On-chain lending markets: Digital environments in which loans and yield-generating assets are issued and transferred on public blockchain networks.

Non-custodial vaults: Investing models that allow users to keep custody over their assets while adopting yield strategies.

Frequently Asked Questions Apollo Morpho Partnership

What is the Apollo Morpho Partnership?

Apollo Global Management entered into an agreement enabling the firm to purchase up to 90 million MORPHO tokens over a four-year period and has partnered with Morpho on supporting on-chain lending markets.

For what reason does Apollo need MORPHO tokens?

MORPHO tokens grant governance over the Morpho protocol, effectively allowing Apollo to engage in major decisions for making changes to the protocol and risk parameters.

How did the market respond to this collaboration?

The price of MORPHO spiked by approximately 17% after the news, pointing investors’ enthusiasm for institutions getting involved.

What other companies does Morpho count as partners?

Top-tier asset managers like Bitwise have launched DeFi vaults on Morpho, offering stablecoin yield strategies.

Does this collaboration have an impact on lending via Morpho?

Yes, the deal is designed to support on-chain lending markets and may also improve Morpho’s infrastructure and liquidity with institutional involvement.