This article was first published on Deythere.

- Why the Analyst Expects a 2026 Rebound

- The Death Cross Signal: What It Means Now

- Macro Risks: Liquidity, DXY & Treasury Flows

- Historic Precedent and Liquidity Timing – How That Affects 2026’s Outlook

- The Implications for Investors and Markets in 2026

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Early-2026 Crash Warning

- What’s the main warning here?

- Who’s saying this?

- Why does the TGA matter?

- What’s does the death cross mean here?

- References

A top crypto analyst has laid out a warning that Bitcoin could see a big bounce in early 2026, but that it might be a trap.

According to the analyst, a combination of macro conditions, treasury liquidity tightening and on-chain technicals like the upcoming “death cross” could lead to a bigger drop later in the year.

He claims that investors may cheer the short-term pop, but the warning is that it won’t be the start of a new bull run.

Why the Analyst Expects a 2026 Rebound

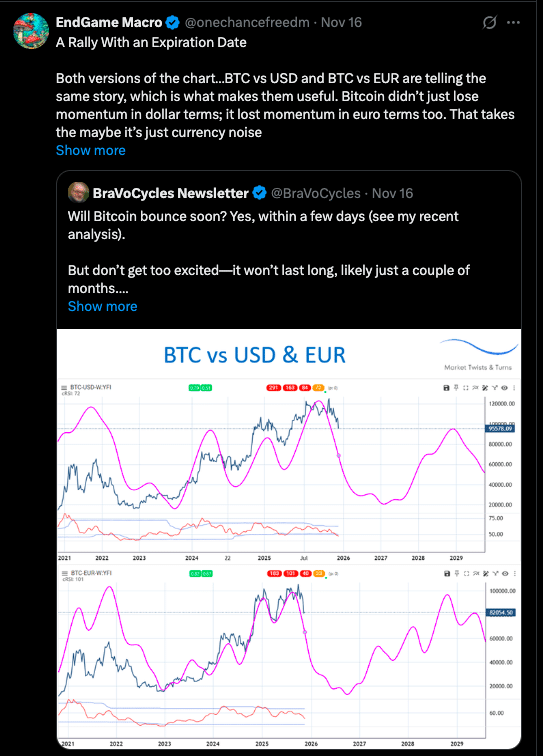

The warning comes from on-chain and macro analysis by a crypto strategist called EndGame Macro who sees similarities between Bitcoin’s current price structure and the patterns we saw earlier in 2025.

According to the analyst’s take, liquidity will rebound temporarily, driven by seasonal flows and market reactions, before receding in Q2.

One of the key arguments is the U.S. Treasury General Account (TGA) which the analyst expects to build up and pull liquidity out of the system. This tightening combined with higher risk aversion could pressure Bitcoin after the initial pop.

He claims the bounce won’t be the start of a new rally but a temporary reprieve before a bigger drop.

The Death Cross Signal: What It Means Now

Technical analysis backs up the warning. According to previous reports in the year, Benjamin Cowen, founder of Into The Cryptoverse, has been warning about the risk of a death cross forming in Bitcoin’s charts when the 50-day moving average falls below the 200-day moving average.

Historically, death crosses are bearish signals. But there’s a twist: in this cycle, past death crosses have coincided with local bottoms. The analyst argued if Bitcoin doesn’t mount a strong recovery soon, the death cross will confirm a “macro lower high” and the rebound will be just a corrective bounce in a bigger downtrend.

Macro Risks: Liquidity, DXY & Treasury Flows

Beyond technicals, macro dynamics are at play. The analyst points to a liquidity drain as the U.S. Treasury rebuilds its TGA (Treasury General Account), a move that will tighten financial conditions and reduce excess cash in the system.

This will erode risk appetite just when Bitcoin’s rebound fades. Another factor is the U.S. Dollar Index (DXY). A rising DXY is good for the dollar and bad for risk assets like Bitcoin. If the DXY trend reverses, Bitcoin will face headwinds just as short term optimism builds.

Also, expectations around rate cuts have cooled. According to the data, the analyst is citing the probability of a Federal Reserve rate cut in December has dropped significantly and therefore the dollar may stay strong.

All these macro variables feed into the thesis that a short term pop will lull investors into a false sense of security before conditions tighten again.

Historic Precedent and Liquidity Timing – How That Affects 2026’s Outlook

The analyst points out that a potential bounce in Q1 2026 could look suspiciously like previous recoveries right after a major correction. However, it likely won’t be the real deal, and more probably will be just another false breakout, a pattern where the price goes up briefly, then caves in to even bigger declines.

Timing is absolutely important here. Early in the year, a bounce can attract a lot of new money, especially from investors looking to buy the dip. But if the analyst is right, if liquidity continues to dry up afterwards, then those gains are likely to quickly reverse.

It’s not just the charts or speculative ideas: on chain data, treasury flow forecasts, and overall macro liquidity trends all add up to suggest this

The Implications for Investors and Markets in 2026

If this happens, then it has a bunch of important implications for market players. A Q1 2026 bounce may not mean the bull cycle is back, it could just be a countertrend move.

Investors who don’t get that risk getting caught out thinking a short term rally is going to last.

Those who are hoping for another all time high are probably going to have to rethink their timing and risk.

Macro risk is still high, if the tighter liquidity and higher dollar strength keep going, then Bitcoin could face serious selling pressure right after the rebound.

Overall, this idea could change how institutional and retail players position themselves. Some might want to lock in some quick gains, others might stay on guard for a sign of a more durable rally.

Conclusion

The warning of a Bitcoin crash in 2026 might not just be a wild bearish guess, analysts have shown that it is rooted in loads of technical, macro, and historical signals.

Analysts are saying that while a bounce is likely to happen, it probably won’t be the start of a sustained uptrend. And with the looming death cross, combined with Treasury moves making liquidity tighter and the dollar getting stronger, the stage is set for a potentially much bigger fall later in 2026.

It all comes down to whether investors see the upcoming rebound as the real deal; or a costly trap.

Glossary

Bitcoin (BTC): the original, first and most traded cryptocurrency.

Death Cross: A technical indicator where the short term moving average (50 day) crosses below the long term moving average (200 day) bearish indicator.

TGA (Treasury General Account): the US Treasury’s bank account at the Federal Reserve; changes in the balance can have a big impact on overall liquidity.

DXY (U.S. Dollar Index): an index that measures the strength of the dollar; versus a basket of major foreign currencies.

Macro Lower High: a way of looking at price structures where the top is lower than a previous big high; a sign that the trend is down.

Frequently Asked Questions About Bitcoin Early-2026 Crash Warning

What’s the main warning here?

The big caveat is that the recovery is likely in early 2026 not to be part of a new bull market, but more like setting everything up for an even bigger crash later that year.

Who’s saying this?

The view is based on the views of a crypto strategist referencing on on-chain, treasury, macro liquidity data and technicals like the death cross.

Why does the TGA matter?

If the US Treasury builds up its TGA, it means cash is being moved out of markets into the treasury account which tightens liquidity and reduces risk appetite.

What’s does the death cross mean here?

The death cross could be a “macro lower high” if Bitcoin doesn’t break out strongly after it forms, means weakness not a bullish signal.