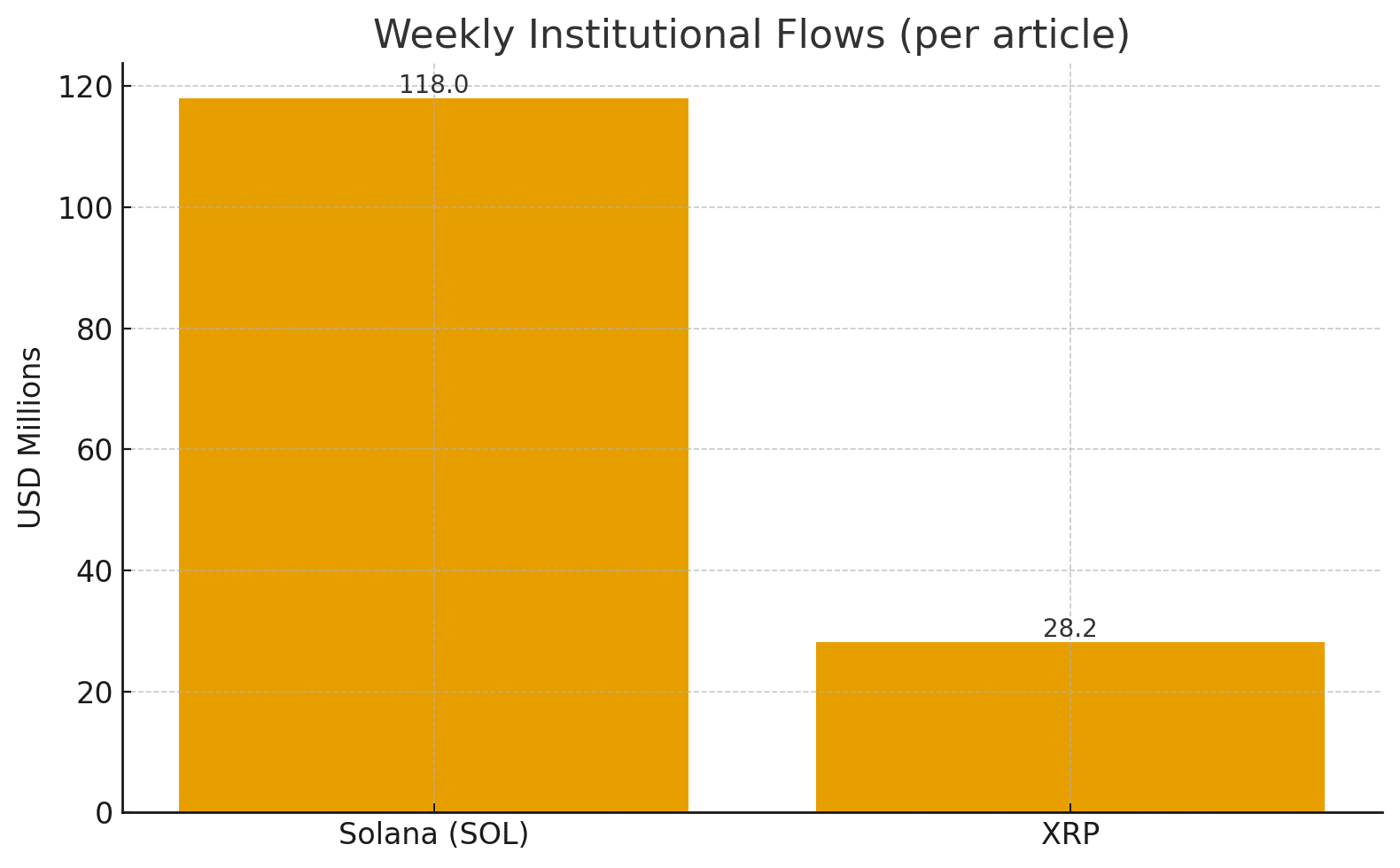

Solana just seized the spotlight with an estimated 118 million dollars in weekly institutional inflows. The broader market’s rebound pushed the Altcoin Season Index to 100, a level that often sparks talk of an altseason. The question is simple, but the answer is layered. Capital is moving, yet leadership remains narrow and the bar for sustained rotation stays high.

Institutional flows flip the script

Fresh fund flow tallies show a clear divergence. While aggregate crypto products recorded heavy outflows, Solana stood out with about 118 million dollars in net inflows for the week. Bitcoin and Ethereum products, by contrast, saw sizable redemptions, signaling a selective hunt for growth and throughput rather than a blanket risk chase. This split view is typical in the early stages of any potential altseason where capital tests the waters in a few high-conviction names before broadening out.

Why Solana, and why now

The pitch to institutions is straightforward. Solana’s throughput, falling transaction latency, and deepening developer stack position it as a growth rail for consumer apps and DeFi activity.

Several coverage notes highlight back-to-back weeks of strong inflows, with year-to-date totals that point to durable demand rather than a one-off squeeze. In a market still digesting macro crosswinds, investors appear willing to fund execution stories that do not rely solely on Bitcoin’s direction. That backdrop aligns with chatter that a measured altseason can develop even while headline indices chop.

The altseason signal with context

The Altcoin Season Index hitting 100 is a clean headline, but traders know it is a noisy indicator. It captures breadth over recent lookbacks, not the quality of flows or the health of order books. In past cycles, a high reading without rising spot volumes, improving market depth, and steady derivatives funding often faded.

Today, the on-chain and market microstructure picture looks mixed. Liquidity has improved in a handful of large caps, yet smaller caps have not enjoyed the same bid, which argues for a cautious definition of altseason rather than a full-throttle melt-up.

Key indicators to watch

Professionals will keep an eye on three buckets. First, sustained net inflows into altcoin ETPs and funds, with Solana as the bellwether. Second, market breadth across the top 100 assets, measured by the share closing above the 50-day moving average and rising open interest that is not over-levered. Third, relative strength versus Bitcoin on multi-week timeframes.

If these confirm together, the altseason narrative tends to stick. If they diverge, the result is usually a rotation that stalls at resistance. Recent data underscores that nuance, pairing Solana’s strength with uneven flows in other majors.

For now, Solana is carrying the banner while the market debates whether this is a durable altseason or a sharp relief pop. Momentum can absolutely expand, but history rewards patient entries on retracements, not chases into overbought prints. If weekly fund flows broaden and volumes hold up across more large caps, the altseason case grows stronger. Until then, disciplined risk control remains the edge.

Conclusion

Solana’s $118 million inflow is a real signal. The Altcoin Season Index at 100 adds heat to the conversation. Still, an altseason worthy of the name usually shows wide participation, healthier liquidity, and confirmation across multiple indicators. The tape is improving, but it is not unanimous yet.

Frequently Asked Questions

Is this officially an altseason?

Not yet. A true altseason typically features broad leadership, expanding volumes, and firm relative strength across many large caps, not just a select few. The index reading is strong, but confirmation is incomplete.

Why did Solana attract inflows while Bitcoin and Ethereum saw outflows?

Flows suggest investors are rotating into higher growth exposure. Recent reports show Solana products gaining while Bitcoin and Ethereum products faced redemptions, reflecting a preference for throughput and app momentum.

What would confirm an altseason from here?

Sustained multi-week inflows into a wider set of altcoin funds, rising spot volumes, stable funding, and breadth metrics turning up together would strengthen the case.

Glossary of key terms

Altcoin Season Index

A composite gauge that assesses whether altcoins are outperforming over a recent lookback window. A print at 100 signals extreme altcoin leadership.

Institutional inflows

Net capital entering exchange-traded products and managed funds that track digital assets, often used as a proxy for professional demand.

Breadth

The share of assets participating in a move. Strong breadth supports a durable advance and is often cited when confirming an altseason.

Relative strength

A comparison of one asset’s performance versus another. Rising relative strength versus Bitcoin is a common hallmark in an altseason.