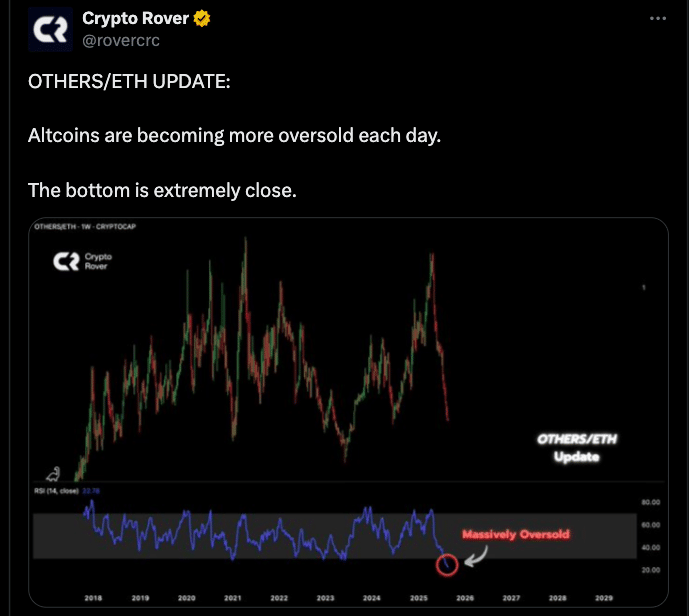

Based on the latest market statistics, altcoins across the crypto universe have fallen into the most oversold territory ever observed. According to Crypto Rover, a respected crypto analyst, the OTHERS/ETH ratio, which measures the strength of altcoins versus Ethereum, has hit all-time lows. This is pointing towards extreme bearish pressure and a possible sign of a big reversal coming.

This current altcoins oversold condition is even more oversold than the COVID-19 crash in 2020 and the 2025 tariff turmoil. In previous times, this sets up for big bounces. On-chain data, including dwindling volumes and capital flow stagnation, supports this bearish exhaustion narrative and hints at a near-term bottom.

Why Altcoins Oversold Condition Matters Now

When markets get this oversold, it means selling has far outpaced buying often resulting to prices falling below intrinsic value. This kind of market extreme tends to precede big turnarounds. In previous cycles, altcoins in this position bounced 50%+ in the following weeks.

The deepest oversold levels today mean collective fear has peaked. Once sentiment shifts just a little, these markets can reverse sharply.

Also read: XRP and Altcoins Under the Microscope: What Top Analysts Are Seeing in the Charts

Tech Signals Point Toward Rebound

Crypto Rover says ratio-based indicators paired with MACD divergences and volume spikes are gaining traction. Especially on ETH-denominated pairs, these signals could be the technical foundation for a near-term bounce if confirmed by chart behavior.

The OTHERS/ETH decline is a clear sign of altcoin underperformance and investor capitulation. But history shows this kind of move often sets up for rapid rotations back into altcoins especially when paired with technical triggers.

What Could Trigger a Rebound?

While the exact timing of the recovery can’t be predicted, analysts point to several catalysts. A change in macro environment, a dovish Fed, or easing inflation could bring capital back into risk assets like crypto.

ETF decisions pending in October could also be the spark to reverse the sentiment. If Bitcoin stabilizes around support levels, altcoins usually follow with bigger gains.

However, investors should remember that oversold doesn’t mean “instantly bullish”. As CryptoQuant researchers said,

“Markets can be oversold longer than we expect, but history shows these periods don’t last forever.”

What Traders Should Watch

Trading from oversold conditions in altcoins is all about context and confirmation. Traders should look for a shift in on-chain behavior such as improved volumes, trendline holds or accumulation spikes.

Solid altcoins, especially those with functional value and depth, could lead the bounce. Right entry and risk controls (stop-losses under key support) could be strong if this altcoins oversold conditions reverse.

Conclusion

Based on the latest research, Altcoins are oversold like never before, deeper than the COVID crash or tariff-induced markets. While analysts can’t know the exact timing for reversals, the technicals and on-chain data predict that a turn is near.

For disciplined traders and long term holders, this is a moment to be cautious, prepared and have a clear plan.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Also read: Altcoin Season Ignites: Ethereum, Solana, XRP Soar as Bitcoin Takes a Breather

Summary

Altcoins are more oversold than ever. Crypto Rover’s OTHERS/ETH ratio shows bearish exhaustion has almost reached its limit. History shows this kind of oversold is a rare market setup often followed by 50%+ bounces. MACD divergence and volume spikes could be the foundation for ETH-pair altcoin recovery.

Glossary

Altcoins –Cryptocurrencies other than Bitcoin

Oversold – A market condition where an asset is trading below its fair value due to heavy selling.

OTHERS/ETH Ratio – A metric comparing the strength of altcoins against Ethereum.

MACD Divergence – A technical signal when price and momentum indicators move in opposite directions.

On-Chain Data – Data from blockchain activity like volume, transactions and wallet behavior.

Capitulation – Rapid and intense selling exhaustion that may be a market bottom.

FAQs for Altcoins Oversold

What does “altcoins oversold” mean?

It means altcoins are trading way below their recent average, meaning intense selling and historically good conditions for a bounce.

How do analysts know this is the worst oversold phase yet?

Crypto Rover’s analysis shows the OTHERS/ETH ratio has gone lower than during the COVID crash and tariff induced markets, this is a unique and extreme oversold scenario.

Which indicators show a possible recovery?

Analysts point to OTHERS/ETH normalization, MACD bullish divergences and rising volumes as early signs of a potential turn.

Should investors act now?

Investors are advised to wait for confirmation; breakout moves or volume surges.