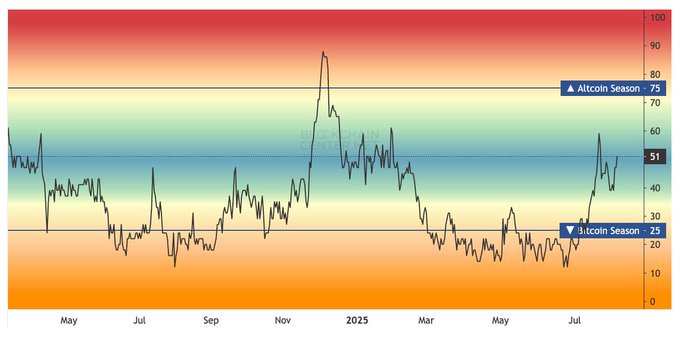

The cryptocurrency market has shown early signs of a potential altcoin revival, as the Altcoin Season Index surged to 51, crossing the midpoint threshold. While not yet a full-fledged “altcoin season,” the rise indicates a shift in investor sentiment. Numerous altcoins have shown signs of trend reversal in recent months, beginning to perform better than Bitcoin.

The Altcoin Season Index tracks the performance of top altcoins against Bitcoin over a 90-day period. When the index hits a value of over 75, it indicates a full-blown altcoin season, where altcoins significantly outperform Bitcoin.

The index is at 51, and yet it is still in its infancy, but it indicates increasing power in megacoins. This development hints at the possibility of an impending altcoin season, where smaller cryptocurrencies begin to capture investor interest.

Bitcoin has headlined the market in the past few months due to its ETF approvals, institutional acceptance, and overall macroeconomic narratives. However, as Bitcoin prices have stagnated, gauging volatility and possible profits, other assets are gaining momentum among traders. As a result of this change, a number of altcoins have returned double-digit gains, specifically in these segments: DeFi, Layer 1s, and AI.

Altcoins Showing Early Signs of Strength

The surge in the Altcoin Season Index is a key indicator of growing strength in altcoins. The fact that the index increased to 51 indicates that investors are showing declining interest in Bitcoin, even though it is slight. Bitcoin has taken up much of the market dominance every few months, but altcoins are beginning to take part of it once more.

Areas like decentralized finance (DeFi), Layer 1 blockchains, and artificial intelligence-linked tokens are performing well. Several of these altcoins have experienced significant gains recently, further fueling the possibility of an altcoin season. This indicates a possible rotation of capital, where investors are moving out of Bitcoin into altcoins to get higher returns.

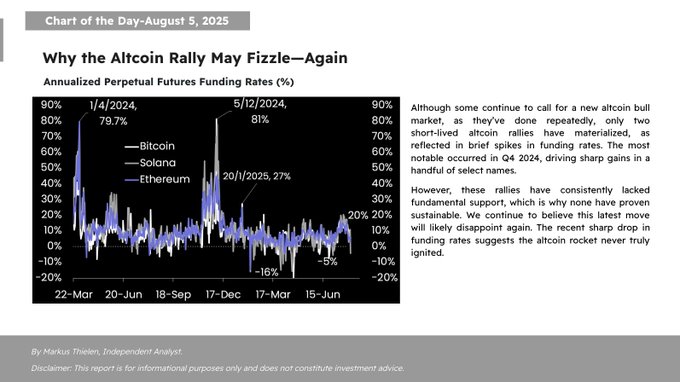

Although the recent strength could be a good sign, analysts note that the altcoins rally might not be maintained. One of the latest publications by Matrixport questioned the vulnerability of the market’s structure. As analyst Markus Thielen highlighted, the last altcoin rallies have been short-lasting because funding rates have immediately started to fall after briefly rising.

Conflicting Signals on Altcoin Season

There are conflicting opinions on whether the current rally will lead to a full-blown altcoin season. While some experts believe altcoins are trending, others do not have much confidence in their sustainability. According to the report by SwissBlock known as the Altcoin Vector, the altcoin market is in the process of moving into a possible breakout point, but this is still perceived as early staging.

They observed that as long as altcoins carry on their ways, smart capital is already shifting into the altcoins, prior to the retail traders. The plan may enable the early investor to profit on rallies in the future. However, SwissBlock cautions that it is not yet a breakout, and further market developments are necessary for a confirmed shift toward an altcoin season.

Further, a group of market analysts are looking at the USDT dominance, which has been within a descending triangle mode over a period of two years. The failure of USDT dominance is normally an indicator that there is an outflow of money into stablecoins and riskier mediums such as altcoins. If this trend continues, it could further fuel an altcoin rally, helping to solidify the growing narrative of an impending altcoin season.

Summary

The Altcoin Season Index has reached 51, signaling early signs of a shift away from Bitcoin dominance in the crypto market. Altcoins in other industries such as DeFi, Layer 1s, and AI are starting to pick up steam, but the analysts are still divided on whether the rally can continue. Whereas others can point to USDT dominance as some of the critical indicators, others raise a red flag on possible reversals. Nevertheless, there is an emerging investor consensus that altcoins are the ticket and the individuals able to jump in early can take strategic advantage of the shift.

For more crypto news or price predictions, visit our platform.

FAQs

What is the Altcoin Season Index?

The Altcoin Season Index tracks the performance of top altcoins against Bitcoin over a 90-day period. It gives the resilience of altcoins in comparison to Bitcoin.

What does an Altcoin Season Index of 51 mean?

An index of 51 indicates early signs of strength in altcoins, but it is not yet a full altcoin season. It demonstrates the fact that Bitcoin is starting to underperform with altcoins.

What are some of the sectors fuelling the altcoin rally?

The most active altcoins are DeFi tokens, Layer 1 blockchains, and tokens based on artificial intelligence, which is driving the interest in altcoins.

Will the rally in altcoin last?

There is a discrepancy among the experts. Some believe momentum is growing, whereas others, such as Matrixport, caution that altcoin rallies could collapse due to the absence of an underpinning.

What is the role of USDT dominance in an altcoin season?

A decline in USDT dominance suggests that capital is moving from stablecoins into altcoins, which could fuel the growth of altcoin markets.

Glossary of Key Terms

- Altcoin Season: A period when altcoins outperform Bitcoin in terms of price and market performance.

- DeFi: Decentralized Finance; financial services use blockchain technology, with no middlemen.

- Layer 1 Blockchains: These are the fundamental blockchain networks that host cryptos such as Ethereum and Solana.

- AI Tokens: The cryptocurrencies associated with artificial intelligence development are usually connected with industry evolution.

- USDT Dominance: The market dominance of Tether (USDT), a stablecoin that is commonly used as a proxy of capital inflows and outflows in and out of the cryptocurrency world.