Altcoin season 2026 shows early rotation in the market, but a full rally is still unlikely. Investors are moving funds into altcoins carefully, mainly to spread risk rather than chase quick profits, as risk-off sentiment and uncertainty continue to influence the market.

- What Does the Potential Altcoin Season 2026 Actually Represent?

- Why Is the Market Cautious Despite Rotation Signals?

- How Are Investors Balancing BTC and Altcoin Opportunities?

- What Do Trading Volumes Reveal About Market Dynamics?

- Why a Full-Blown Altcoin Season Is Unlikely Now?

- Conclusion

- Glossary

- Frequently Asked Questions About Altcoin Season 2026

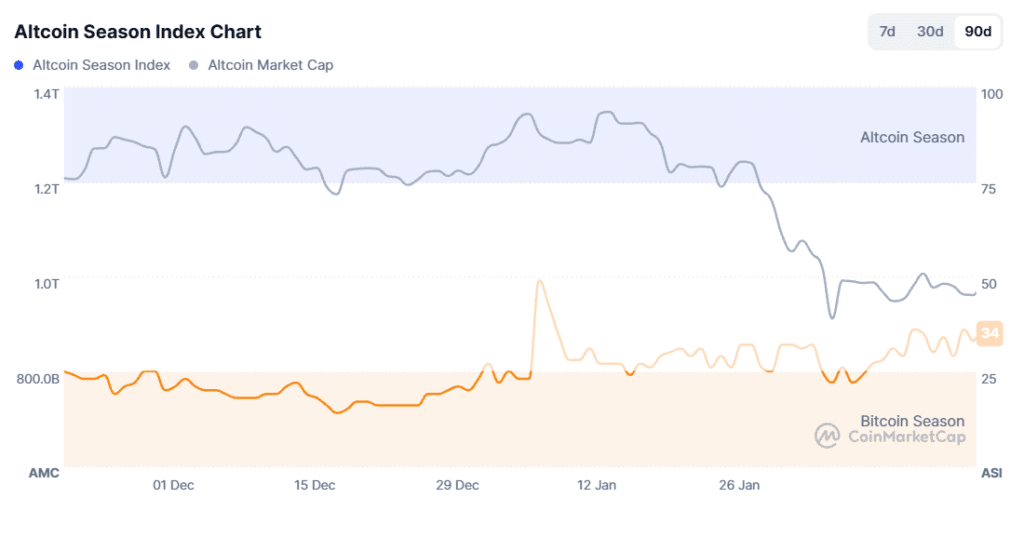

The Altcoin season index has climbed back to levels last seen in early January, suggesting some short-term altcoin activity. However, Bitcoin dominance remains strong, and on-chain inflows show most capital is still favoring Bitcoin, indicating that a broader altcoin surge has not yet taken hold.

What Does the Potential Altcoin Season 2026 Actually Represent?

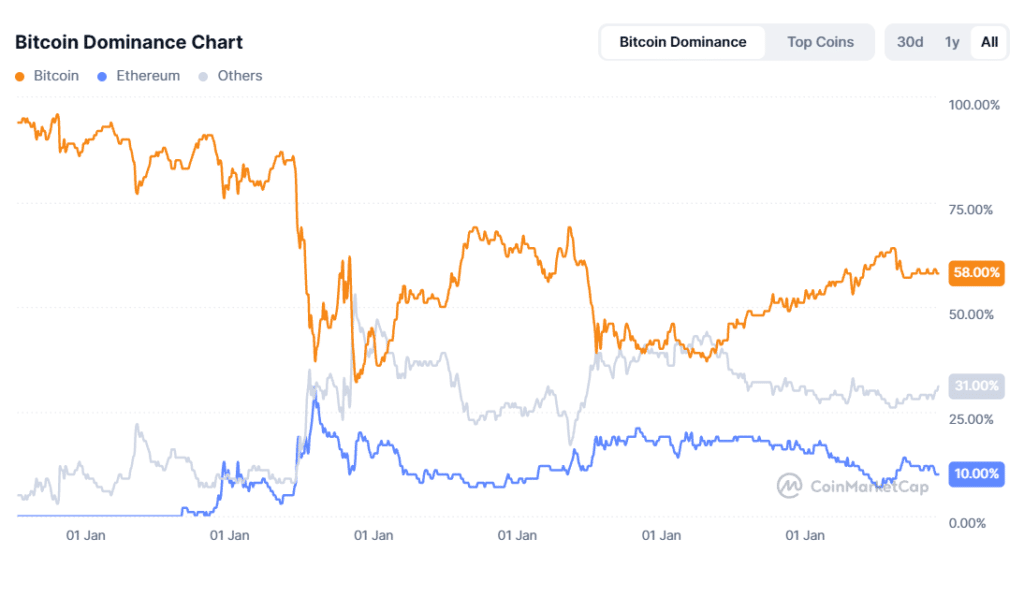

Market activity shows some movement toward altcoins, but the overall trend is still uncertain. ETH/BTC gained 2.6% during the day, reflecting growing interest in Ethereum compared to Bitcoin. At the same time, Bitcoin dominance (BTC.D) fell nearly 2.5%, hitting three weekly lows in a row and failing to climb back above 60%. Historically, these conditions have led to short-term rotations where altcoins see some momentum as Bitcoin slows.

However, such patterns alone have not triggered a full altcoin season in the past. Investors are still cautious, influenced by a risk-off environment, and are spreading their funds rather than fully committing to large-cap altcoins. The recent rise in the Altcoin Season Index suggests some rotation, but it does not signal a broad altcoin rally at this stage.

Why Is the Market Cautious Despite Rotation Signals?

During Altcoin Season 2026 investors remain cautious. They are influenced by ongoing FUD and a general risk-off mood in the market. While altcoins have gained some attention, most trading is driven by short-term speculative moves rather than long-term blockchain investment.

CryptoQuant data confirmed this trend, showing that at the time of reporting, Bitcoin trading volumes on Binance had regained dominance, making up 36.8% of total exchange volume, while altcoins accounted for 35.3% and Ethereum 27.8%. This is a significant change from November, when altcoins represented 59.2% of trading volume, falling to 33.6% by mid-February, a drop of almost 50%. These figures indicate that even during the altcoin season 2026, most capital is still flowing back to Bitcoin rather than supporting a broad altcoin rally.

How Are Investors Balancing BTC and Altcoin Opportunities?

The big question for the market during the altcoin season 2026 is whether investors favor Bitcoin’s risk/reward profile over high-cap altcoins. Current inflows suggest that Bitcoin remains the preferred asset during uncertainty. Even with a rising altcoin season index and sideways ETH/BTC movement, the broader rotation into Ethereum and Layer 1 projects remains limited.

Historical patterns indicate that initial hype often drives early altcoin gains, but sustainable adoption and a true altcoin season require longer-term investor commitment. For now, selective speculative plays dominate, and ETH/BTC sits at a key inflection point after failing to hold the 0.033 support in mid-January, triggering a correction.

What Do Trading Volumes Reveal About Market Dynamics?

On-chain metrics show a clear view of investor priorities. Even with recent altcoin gains, Bitcoin’s share of exchange inflows indicates ongoing confidence in its stability. Altcoin trading volumes have fallen from 59.2% in November to 33.6% by mid-February, showing that investors are moving capital back to Bitcoin rather than supporting broad altcoin adoption.

The altcoin season index reading is currently 34, reflecting some short-term activity, but this alone does not signal a full altcoin rally. This rotation shows that investors are focusing on managing risk rather than fully committing to altcoins. While the ETH/BTC ratio and the Index suggest limited rotation, full-scale enthusiasm for altcoins remains constrained by FUD and a continued preference for Bitcoin’s risk and reward during the altcoin season 2026.

Why a Full-Blown Altcoin Season Is Unlikely Now?

Even with signs of rotation, a full altcoin season remains far off. Short-term movements in ETH/BTC and the Altcoin Season Index are mostly driven by speculative trades rather than long-term adoption. Bitcoin dominance, inflows, and trading volume data show that investors are focusing on security and short-term gains instead of committing to broader Layer 1 ecosystems.

Past altcoin seasons only happened after sustained capital rotation and clear adoption signals. Right now, while some altcoins are seeing momentum, the wider market remains cautious. This demonstrates that temporary jumps in altcoin activity during the altcoin season 2026 do not indicate a full-scale altcoin rally.

Conclusion

Potential altcoin season 2026 is showing selective investor interest. But a full rally is not yet confirmed. Key indicators such as ETH/BTC movements, jumps in the Altcoin Season Index, and declining altcoin trading volumes, point to short-term activity while Bitcoin dominance remains strong. On-chain data and trading patterns suggest that speculative positioning is prevailing over broader adoption of Layer 1 projects. Investors are carefully balancing exposure, chasing short-term gains through speculative trades, and rotating capital strategically.

Although some rotation is happening, a full altcoin season is unlikely without sustained inflows and adoption. Current trends highlight the need for measured analysis rather than reactive trades. Overall, the altcoin season 2026 is still in a formative stage, and larger factors, including Bitcoin dominance, FUD and inflows, suggest a broad altcoin surge remains distant.

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice. Cryptocurrency trading involves risk, and readers should conduct their own research before making any financial decisions.

Glossary

Altcoin Season: When altcoins rise faster than Bitcoin.

Bitcoin Dominance (BTC.D): Bitcoin’s share of the total crypto market.

ETH/BTC Ratio: How Ethereum is performing compared to Bitcoin.

FUD: Fear and uncertainty affecting market decisions.

Layer 1 Projects: Core blockchains that run decentralized apps

Frequently Asked Questions About Altcoin Season 2026

What does the Altcoin Season Index of 34 mean?

An index reading of 34 means only a small number of altcoins are outperforming Bitcoin.

Why is Bitcoin still dominant?

Bitcoin is still dominant as most investors trust it more during uncertain market conditions.

Is a full altcoin rally happening now?

No a full altcoin rally is not happening right now as Bitcoin remains dominant.

What happened to altcoin trading volumes recently?

Altcoin trading volumes dropped from 59.2% in November to 33.6% by mid-February.

What is needed for a true altcoin season?

A true altcoin season needs long-term investor commitment and strong adoption. And not just short-term trading.