This article was first published on Deythere.

- Altcoins Exploded: This Is What Happened

- Market-Wide Context: Why Altcoins Are Behind the Curve

- What the Season Index and Capital Flows Are Saying

- What a Long-Term Altcoin Rebound Would Need

- Conclusion: Is This the Beginning of a New Cycle?

- Glossary

- Frequently Asked Questions About Altcoin Rebound 2025

- What led to the early December altcoin rebound?

- Is the bounce back a signal that altcoin season is underway?

- Why are altcoins underperforming in spite of intermittent surges?

- Is there still a chance of revival for altcoins by the end of 2025?

- References

Major altcoins staged an upsurge this early December, prompting a frenzy across the crypto market. Coins like Ethereum (ETH), Solana (SOL) and Sui (SUI) gained double-digits following a brutal period of sentiment-led selling.

However, despite the fast bounce being indicative of a refreshed risk appetite, metrics such as market-cap trends and the CMC Altcoin Season Index suggest that this recovery is more of a temporary sentiment-driven than a return to altcoin dominance.

Altcoins Exploded: This Is What Happened

From late November into early December 2025, the crypto sentiment shifted sharply. Through social feeds and trading forums, panic turned more to optimism after a round of negative headlines, particularly around speculation about forced sales connected to MicroStrategy and its sizable holdings in Bitcoin started to fade.

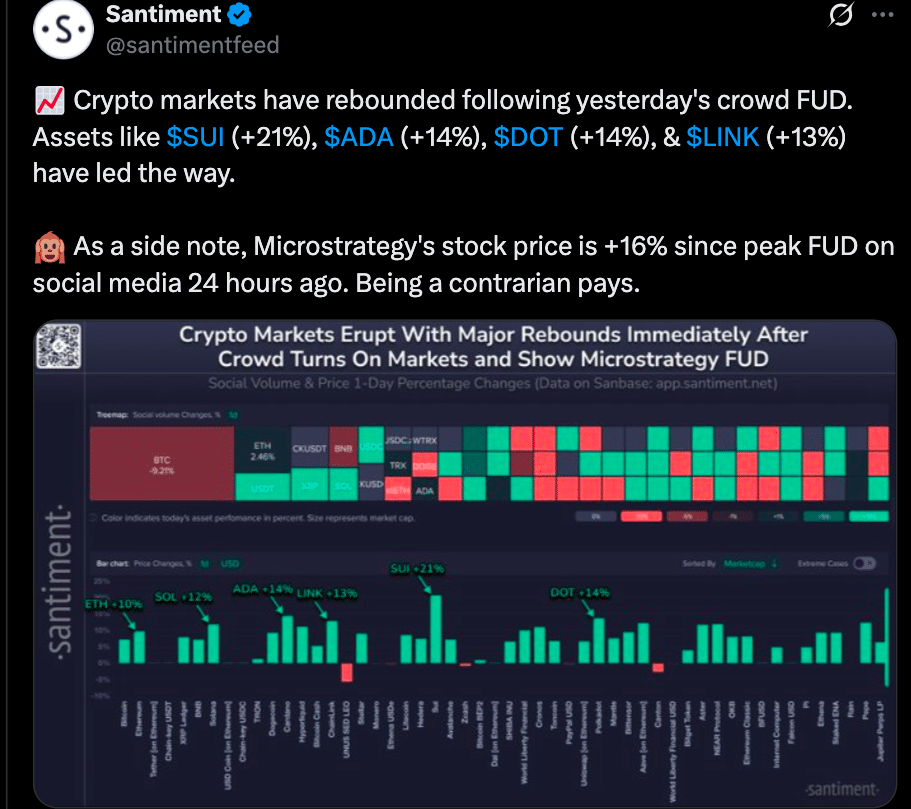

Santiment reported that It has been a “crowd-driven reversal” and it has really brought that risk-on buying back, based on the social-data analytics firm’s observation.

The bounce had big altcoins soaring in price: Ethereum, Solana and Sui each posted gains of between 10% to 21% over the rebound window.

Traders called it “relief buying,” a bounce that arose not from fresh fundamentals but from exhaustion on panic-selling.

But while prices spiked, structural signals in the market remained subdued. The greater altcoin sector capitalization, already caught in a downward trend previously, did not change.

Altcoin market cap plunged from around $1.36 trillion to approximately $1.29 trillion over the past week, according to numbers cited by exchanges.

This divergence between individual coins muddying through on price spikes, and continued weakness of the overall altcoin sector suggests a disconnect: A short-term pop, not a structural base.

Market-Wide Context: Why Altcoins Are Behind the Curve

Last month, November featured one of the biggest liquidation events in this cycle. Total crypto market value saw about $1 trillion being swiped out across bouts of forced liquidations, US spot Bitcoin ETF outflows and large cuts in derivatives open interest.

In particular, spot Bitcoin ETFs saw net redemptions of around $3.48 billion, the second-highest monthly redemption ever recorded and stablecoin cap tables also contracted for the first time in more than two years.

The aftershocks rippled through Meme coins, NFTs, gaming and DeFi-related tokens fell 20-33%, pulling many altcoins down or making them sit in the mud.

In this structure, any relief bounce, let alone a big one, faces structural headwinds. Limp capital inflows into Altcoins, elevated risk-off bias, and liquidity roosting in safer plays or large-cap crypto assets like Bitcoin (BTC).

What the Season Index and Capital Flows Are Saying

One popular metric measuring whether altcoins are indeed regaining momentum is the CMC Altcoin Season Index.

This index measures the extent to which of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) have beat Bitcoin over any given 90-day period.

A reading above 75/100 suggests overall altcoin dominance; readings below 50 but especially under 30 are Bitcoin season readings.

As of the beginning of December 2025, the index stood at a mere 21/100. That low level is confirmation that despite the recent rally, what traders and institutions still want is Bitcoin, and capital isn’t broadly rotating into altcoins.

Meanwhile m, money flow data supports what the index is saying. Outflows from Bitcoin ETFs, the contraction in the supply of stablecoins, and shortfalls on speculative assets en masse suggests that many are folding back into those safer positions or taking a timeout to watch and wait.

What a Long-Term Altcoin Rebound Would Need

For the altcoin market to become anything more than relief rallies, at least two things need to happen.

Altcoin Market cap needs to reverse back above 1.35 – 1.40 trillion, and confirm the renewed appetite. Analysts note that this level corresponds with previous periods when altcoins have been strong.

The Altcoin Season Index also has to rise, hopefully a rally above the 25-30 area on an imminent basis, then pressing toward 50+ over subsequent weeks.

That would be a testament to a substantial altcoin outperformance to Bitcoin, signifying capital rotation and not isolated trades.

Remove either of those two conditions and the rebound is no more than a transitory sentiment-driven bounce rather than a change in market dynamics.

Conclusion: Is This the Beginning of a New Cycle?

The current surge begs the question: Is the market entering a new altcoin cycle? Some believe so.

The bounce suggests “early-bull signals” as alts finally have found short-term support after months of downward trends.

However, history suggests caution. The fourth quarter was marked by a fierce deleveraging in which the meme coins, NFTs and smaller altcoins, took the biggest hit.

Technical analysts point out that leverage players and short-term horizon ETF investors disproportionately participated in that sell-off, meaning that the path ahead depends on whether new money comes in, not whether those who were holding come back.

Currently the market shows a structurally long consolidation. There is no floor on altcoin valuations yet, liquidity flows remain anemic and long-term investor faith looks under-inspired.

Glossary

Altcoin – A generic term for any cryptocurrency that is not Bitcoin.

Altcoin market cap – The total market capitalization for all altcoins (excluding Bitcoin and stablecoins).

CMC Altcoin Season Index – A measurement that shows how many of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) have done better than Bitcoin over the past three months. A reading above 75 indicates altcoin season and below 50 indicates Bitcoin dominance.

Crowd-induced reverse – Change in market sentiment that is brought about by general investor response, such as panic selling and then optimism.

Deleveraging – To reduce exposure to leveraged or high-risk positions, usually following margin calls or forced sales.

Frequently Asked Questions About Altcoin Rebound 2025

What led to the early December altcoin rebound?

The Altcoin rebound was mostly the result of a change in market mood. Data analytics showed that a massive wave of negative sentiment, particularly around MicroStrategy, had flipped to positive, ultimately sending traders diving back into risk assets and launching a relief rally for most major altcoins.

Is the bounce back a signal that altcoin season is underway?

Not yet. Though individual coins have rallied, broader signals are still bearish. The altcoin market cap is still down, and the CMC Altcoin Season Index stays low. Such conditions indicate Bitcoin market dominance continues, so a proper altcoin season may not happen unless capital rotation gains momentum.

Why are altcoins underperforming in spite of intermittent surges?

The larger crypto market saw a major deleverage in the past few weeks. Exit pressure of ETF, contraction of stablecoin, and liquidation of leverage all caused liquidity compression and risk preference to decline. So capital is flowing to safer investments, such as Bitcoi,n instead of altcoins.

Is there still a chance of revival for altcoins by the end of 2025?

It might, especially if macroeconomic circumstances solidify, money streams into crypto projects and major projects come out with positive news. But based on current data, any rebound would probably be more selective and temporary than broad and sustained at this point.

References

Alpha Node Capital

KuCoin

KuCoin

The Market Periodical

Finestel