The crypto market is once again buzzing, with traders pointing to signs that a new altcoin rally may be taking shape. After weeks of turbulence, several major assets have completed what analysts call a bullish retest, a technical signal where prices revisit old resistance levels, confirm them as support, and bounce higher. It is a setup that often precedes a strong upswing, though not without risks.

Bullish Retests Spark Optimism

Market watchers note that Ethereum, Solana, and Cardano have shown promising patterns in recent sessions. A bullish retest is essentially a stress test for an asset’s resilience.

When buyers step in at a previously contested level, it indicates growing conviction. This dynamic is why many see the current setup as the early foundation of an altcoin rally.

Prominent trader El Crypto Prof wrote on X, “Altcoins have retested their macro support. This is where cycles often flip bullish”. His observation captures the mood among many investors who believe this phase resembles previous market cycles where altcoins surged once strong support held.

Market Indicators Back the Trend

The enthusiasm is not built on charts alone. Several key indicators align with the bullish outlook. Open interest in altcoin futures has steadily climbed, suggesting that traders are adding exposure. Funding rates remain balanced, signaling that the rally is not purely speculative.

Meanwhile, the Fear & Greed Index has shifted from “fear” into neutral territory, showing that sentiment is stabilizing.

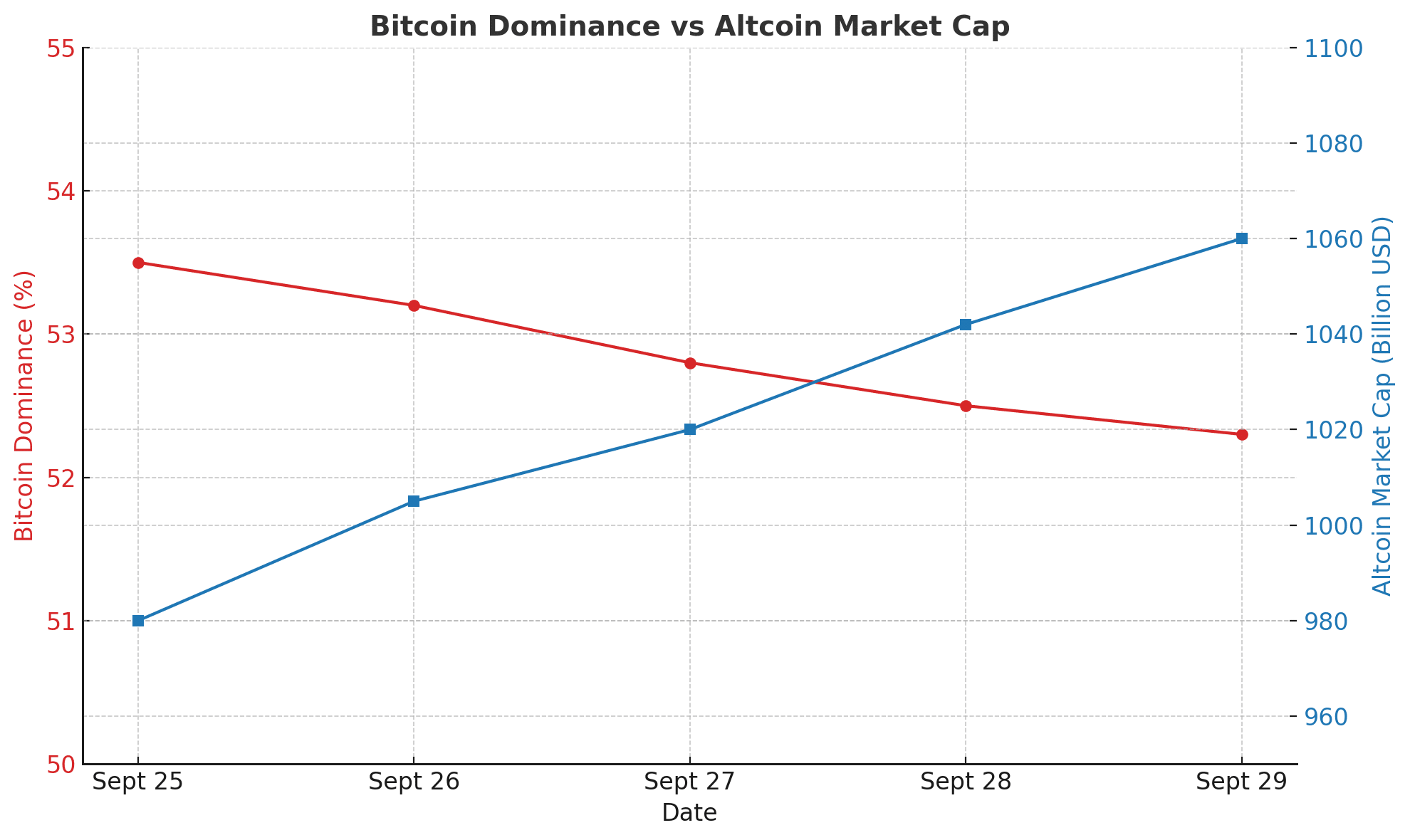

Historical data adds more weight. Across past cycles, altcoin rally phases typically emerged once Bitcoin dominance eased, allowing capital to rotate into smaller assets. That trend is beginning to show again, with BTC’s share of total crypto market value dipping slightly as altcoins capture inflows.

Capital Rotation and Altseason Narrative

The idea of “altseason” has re-entered the conversation. Traders use the term to describe periods when altcoins significantly outperform Bitcoin. A sustained altcoin rally usually requires this rotation of capital. Evidence of such a shift can already be seen in strong volume flows into Layer 2 projects, DeFi tokens, and AI-linked digital assets.

Mike Novogratz, CEO of Galaxy Digital, commented on X, “We’re watching a healthy rotation. Bitcoin sets the tone, but the altcoin rally will define the next leg”. His statement echoes what many in the industry believe: that altcoins, with their innovation narratives, are well-placed to lead gains if the macro environment cooperates.

Risks Lurking Beneath the Hype

Of course, not every bullish retest guarantees follow-through. Analysts warn that false breakouts are common, especially when liquidity is thin. If support levels fail, the current optimism could quickly reverse into sharp losses. Regulatory uncertainty, central bank policy, or a sudden Bitcoin correction could also derail an altcoin rally.

Still, traders argue that risk is part of the process. The difference this time, they say, is that technical structures are aligning with sentiment shifts and capital flows. That cocktail has historically been the recipe for major moves in the altcoin space.

Conclusion

The conversation around a fresh altcoin rally is heating up, driven by bullish retests, improving sentiment, and signs of capital rotation. While risks remain, the technical and fundamental backdrop appears stronger than it has in months.

For traders and long-term investors alike, the coming weeks could set the stage for whether this rally solidifies as the beginning of another altseason, or merely another head fake in crypto’s famously volatile journey.

FAQs about the altcoin rally

1. What is an altcoin rally?

It refers to a broad upward surge in the prices of cryptocurrencies other than Bitcoin, often fueled by capital rotation.

2. Why are bullish retests significant?

They confirm whether previous resistance levels can hold as support, often signaling the start of stronger upward moves.

3. What role does Bitcoin dominance play?

When Bitcoin’s market share declines, it frees capital to flow into altcoins, fueling their relative outperformance.

4. Can an altcoin rally fail after a bullish retest?

Yes. If support levels break or macro conditions shift negatively, a rally can quickly collapse into sharp corrections.

Glossary of Key Terms

Altcoin: Any cryptocurrency other than Bitcoin, such as Ethereum, Solana, or Cardano.

Bullish Retest: A technical pattern where price revisits former resistance as support before moving higher.

Altseason: A market phase when altcoins outperform Bitcoin significantly.

Bitcoin Dominance: The percentage of total crypto market value held by Bitcoin.

Funding Rate: A fee exchanged between long and short traders in futures markets to balance positions.