This article was first published on Deythere.

- Widespread Weakness Across Major Tokens

- Capital Rotation Toward Bitcoin Strength

- Market Structure Highlights Risk-Off Sentiment

- Mixed Signals from Volume and Trading

- Conclusion

- Glossary

- Frequently Asked Questions About Altcoin Market Sell-off

- What is causing the current altcoin market sell-off?

- What is the impact of Bitcoin’s price on altcoins?

- Is this a full altcoin season or just a temporary correction?

- Has the trading volume stayed high during the decline?

- References

The altcoin market sell-off has accelerated in the as large-cap coins outside Bitcoin made widespread losses and the combined capitalization of the crypto space excluding Bitcoin and stablecoins cracked towards $1.2 trillion.

Market data shows the total altcoin market cap is down by almost $50 billion in 24 hours, and high trading volumes indicate active risk reduction rather than low participation.

Widespread Weakness Across Major Tokens

Large-cap altcoins saw sharp and widespread losses. Prices of Ethereum fell below $3,000, seeing daily and weekly drops of about 7%, while Solana dropped to around $127 with weekly losses of more than 11%.

Tokens including XRP, Dogecoin and Cardano saw even larger declines, with many falling over 10% in the past week. Coins often considered on the more defensive side of the spectrum, like BNB and Tron, also entered the negative territory, telling that the downturn has been across the board.

Not even privacy-focused assets like Monero could escape from the crash as they also took about 25% to the negative side.

This wide decline helps illustrate the sharpness of sell pressure that altcoins have been facing over the past few days.

Glassnode analysts have observed that Bitcoin’s fresh slump to below the critical levels of $90,000, seemed to have accentuated the downside action in altcoin prices.

Capital Rotation Toward Bitcoin Strength

Market dominance metrics show rotation back into Bitcoin, commanding about 59-60% of the overall cryptocurrency market capitalization during this downturn.

Long-term tracking shows altcoins have underperformed relative to Bitcoin for multiple years, with capital consistently favoring larger, more liquid assets.

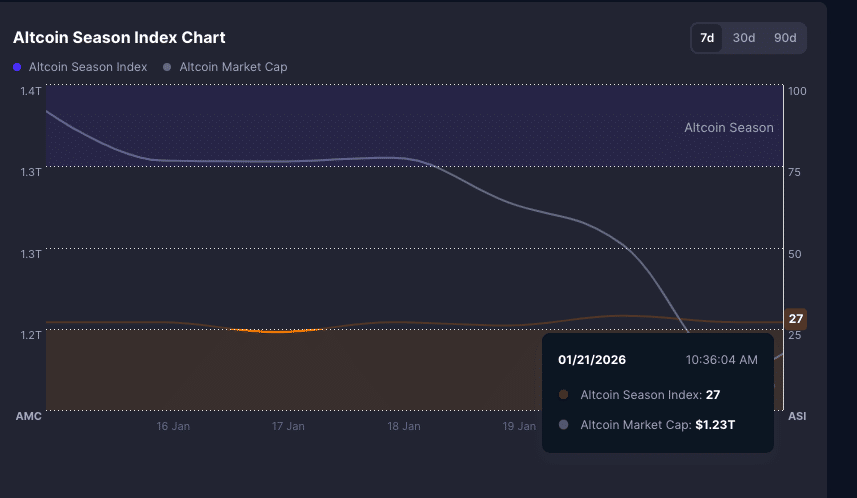

The Altcoin Season Index, which measures whether altcoins perform better than Bitcoin on average over long intervals of time still remains low in 2026, an indication that the market is still dominated by Bitcoin.

Market Structure Highlights Risk-Off Sentiment

The price action and on-chain metrics imply declining appetite to buy altcoins. Momentum indicators like relative strength indexes have broken below major levels to signal declining demand.

The volume spikes with the negative price bars are a strong indication that distribution is what’s actually taking place and not consolidation or accumulation phases.

This is a sign that capital is coming out of altcoins rather than flowing in, especially in market conditions where macroeconomic uncertainty and volatility affect crypto asset allocation decisions.

With the exception of some sporadic trading volumes and brief attempts at short-term rallies that have been made in specific coins, the market’s structure continues to be characterized by lower highs without being able to recover important levels on charts above points last touched as resistance. Hence, selling pressure is still visible throughout the altcoin market.

Mixed Signals from Volume and Trading

While the plunge pushed prices sharply lower, trading volume was high, approaching or exceeding levels that are closely associated with very high activity.

Above-average volumes in sell-offs show that traders are taking risk off the table, not just ducking for cover due to the thin market.

Analysts view this as investor repositioning where market participants are now departing altcoins for what some deem to be safer assets, like Bitcoin and value stores off-chain, such as fiat or gold, which saw notable gains as crypto markets slid.

Conclusion

While Bitcoin has been relatively maintaining dominance in the midst of these current market conditions, there has been a vast altcoin market downturn.

Excluding Bitcoin and stablecoins, the total market value has dropped to around $1.2 trillion. However, the large volumes seen during this down moves hints that that this selloff is the result of active reshuffling, as opposed to dormant involvement.

Glossary

Bitcoin dominance: The share of the cryptocurrency market cap that is held by Bitcoin. Greater dominance points to a higher concentration of capital in Bitcoin compared with altcoins.

Altcoin Season Index: A metric to know when the majority of all altcoins outperform BTC over a given timeframe.

Market capitalization excluding Bitcoin: Value of all cryptocurrencies excluding Bitcoin, and usually also excluding stablecoins; a way to measure the size and movement in the altcoin markets.

Distribution: A market stage during which heavy volume is present on downward price movement, suggesting that selling, not accumulation, is in control.

Frequently Asked Questions About Altcoin Market Sell-off

What is causing the current altcoin market sell-off?

The altcoin market sell-off in January 2026 stems from wide risk-off sentiment, increasing Bitcoin dominance, and active capital rotation from higher-beta altcoins into Bitcoin or safer assets as traders reduce exposure to volatility. Combined with macroeconomic shifts and market structure weakness, this has put pressure on altcoin valuations.

What is the impact of Bitcoin’s price on altcoins?

Price action in Bitcoin can dictate price action across wider crypto markets. These Bitcoin drops can increase the selling pressure in altcoins due to many traders’ over-leveraged positions getting liquidated, risk-off attitudes rising, and funds reallocating to Bitcoin given its better liquidity and institutional backing.

Is this a full altcoin season or just a temporary correction?

According to current data, the majority of altcoin performance is still being driven by Bitcoin and key metrics such as the Altcoin Season Index have failed to signal a prolonged altcoin rally. The market movements are more applicable to a bear trend and strong Bitcoin rather than an altcoin season.

Has the trading volume stayed high during the decline?

Yes, it has remained high even during price declines, which implies that selling is coming from active repositioning and not low liquidity.