This article was first published on Deythere.

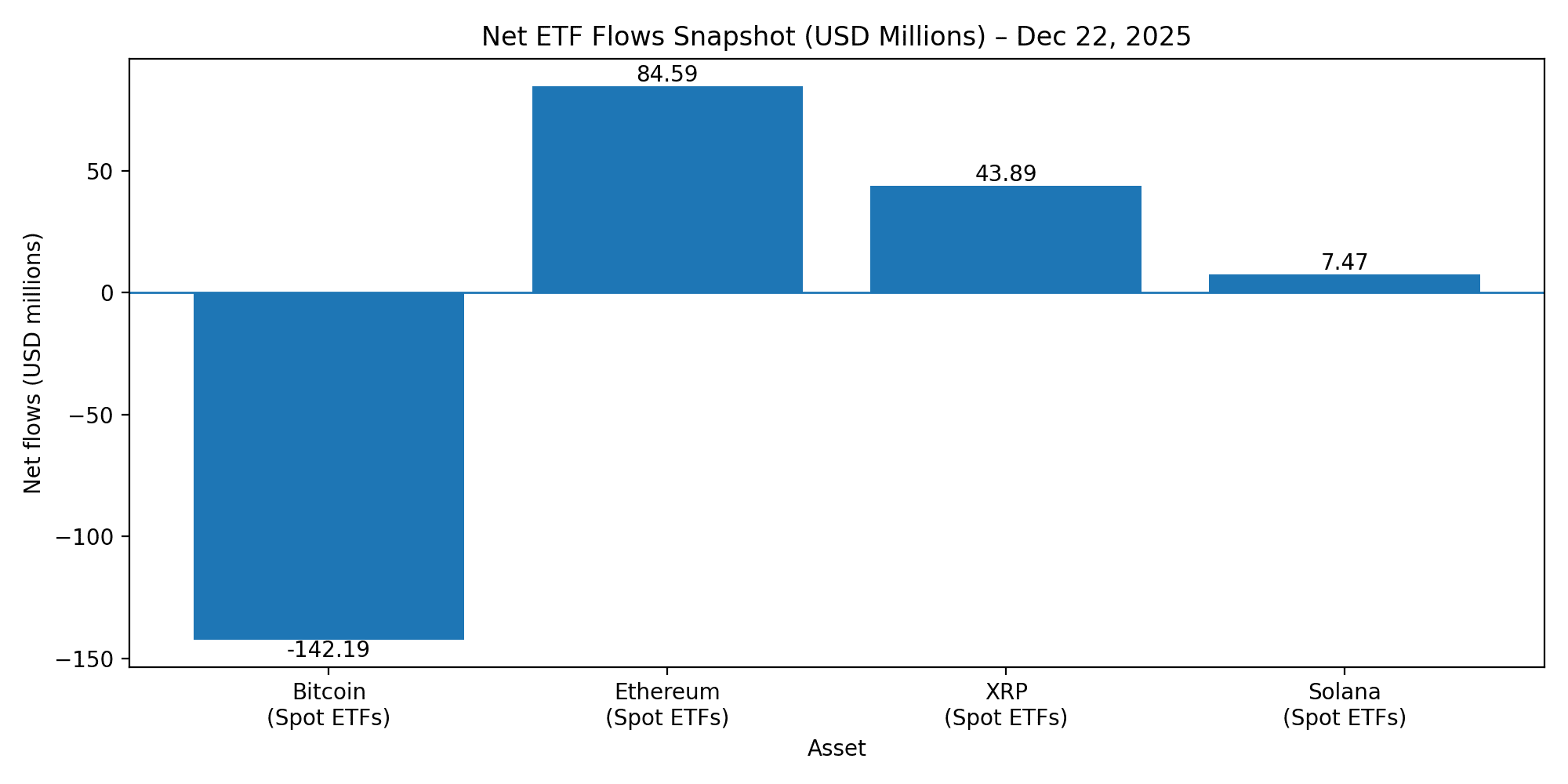

Late December brings thinner liquidity, and the tape fits that pattern. On December 22, U.S. Bitcoin spot ETFs logged about $142.19 million in net outflows, while Ethereum, XRP, and Solana spot ETFs attracted net inflows, a clear case of capital rotating inside the same asset class rather than exiting it. The headline is simple: altcoin ETF inflows showed up on a day when Bitcoin funds bled.

Prices did not collapse, which makes the flow shift more telling. On December 24, Bitcoin traded around $87,303, Ethereum near $2,963, XRP near $1.90, and Solana near $123, suggesting a cautious market that is still willing to reposition. In that environment, altcoin ETF inflows can act like a risk dial, with allocators turning it up slightly without going full throttle.

A year-end rotation, not a stampede

ETF flows are not a perfect mirror of sentiment, but they are real allocation. When redemptions hit the benchmark product while creations rise in the next tier, it commonly points to housekeeping: trimming a crowded exposure, refreshing beta elsewhere, and keeping the portfolio liquid heading into the new year. Altcoin ETF inflows fit neatly into that playbook because they offer diversification without forcing a leap into illiquid corners of the market.

Ethereum led, and the reason is structural

Ethereum spot ETFs led the move with roughly $84.59 million in net inflows. That is where altcoin ETF inflows typically start, because Ethereum has the deepest institutional narrative after Bitcoin: stablecoin settlement, a large developer base, and an ecosystem that supports lending, trading, and tokenized assets at scale.

XRP beat Solana, and that is the tell

The day’s split between XRP and Solana stood out. XRP spot ETFs pulled in about $43.89 million, while Solana products added around $7.47 million. If this were a simple chase for high beta, the gap might have been tighter. Instead, it hints that some buyers are ranking exposures by their catalysts, liquidity, and policy sensitivity.

That is why one-day ETF flows matter less than the pattern. If XRP continues to take a larger share of creations over several sessions, it suggests sustained demand rather than a quick holiday trade, and altcoin ETF inflows would start to look more like a portfolio decision than a headline.

The indicators that can confirm the story

The first indicator is persistence as a single day can be noise, but a multi-day string of altcoin ETF inflows usually reflects an institutional decision to hold a broader basket into January.

The second indicator is liquidity and breadth together. When liquidity is thin, flows can lead price because ETFs absorb demand while spot markets stay choppy. If leadership also spreads from Bitcoin into other large networks, the market often looks healthier than it does on a Bitcoin-only chart, and altcoin ETF inflows are a clean way to track that shift.

Conclusion

The scenario does not prove a new cycle, but it shows how capital is learning to move into crypto as it moves into any sector overall. Bitcoin remains the benchmark, yet altcoin ETF inflows highlight a growing preference for diversified exposure, especially when year-end conditions reward patience and liquidity.

FAQs

What does the December 22 flow mix suggest?

It suggests rotation and risk management, and repeated altcoin ETF inflows would strengthen that interpretation over time.

Do inflows guarantee higher prices?

They do not, because price still depends on broader demand, derivatives positioning, and macro conditions, but steady flows can support liquidity and sentiment.

Glossary of key terms

ETF flows: The net creations or redemptions in an ETF over a set period, often used to gauge demand.

altcoin ETF inflows: Net new money entering non-Bitcoin crypto ETFs, tracked daily to spot rotation within the market.

References