This article was first published on Deythere.

Algorand stablecoin payments are no longer an experiment discussed in white papers. They are already moving real money for real people, often in places where traditional banking barely works. While global markets debate price cycles, a quieter story is unfolding in which blockchain does its job.

This shift matters because payments reveal the truth faster than speculation. According to publicly available blockchain and market data, stablecoins now support daily economic activity at scale, especially in underbanked regions where speed and reliability decide adoption, not marketing.

When Technology Disappears, Utility Takes Over

The most successful financial tools rarely feel technical. That principle explains why HesabPay Algorand has gained wide traction across Afghanistan’s utilities ecosystem. Users pay their electricity bills, buy mobile airtime, and send funds without ever interacting with a blockchain interface.

Under the hood, Algorand stablecoin payments settle in seconds at near-zero fees. The network’s consistency matters in environments where outages and delays are part of daily life. When systems fail often, reliability becomes a form of trust.

A Local Stablecoin Built for Daily Use

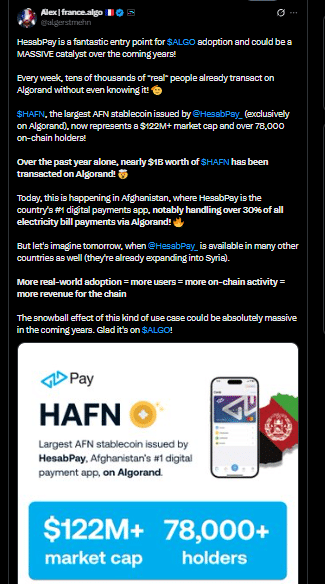

An Afghani-denominated stablecoin has been created on Algorand: called HAFN and pinned to the Afghani (local) currency, it is not a speculation token in the sense that Bitcoin is but rather reflects what people living there can buy with their money and sustain their daily lives. Records on-chain seem to suggest a market capitalization above $122 million and more than 78,000 holders.

Transaction records indicate nearly $1 billion in on-chain volume over the past year. Verified market data also shows Algorand trading near $0.11, with daily volume above $43 million, based on aggregated exchange reporting from a leading crypto market tracker. These numbers highlight how Algorand stablecoin payments generate activity without chasing hype.

From Emergency Aid to Everyday Commerce

HesabPay Algorand did not begin as a commercial product. It emerged during a humanitarian crisis, when aid groups needed a safer way to move funds. Digital wallets solved delays and reduced friction for beneficiaries.

Independent research on digital cash assistance shows blockchain-based systems can improve transparency and delivery speed in fragile economies, as documented in a global humanitarian payments study frequently cited by development agencies. That same foundation now supports routine consumer payments via Algorand stablecoin, proving that emergency tools can evolve into lasting infrastructure.

Why Developers and Analysts Are Watching Closely

Developers value Algorand for its predictable fees and uptime. Financial analysts focus on something more telling. Sustained usage. HesabPay Algorand demonstrates that stablecoins can function as payment rails, not just trading instruments.

Recent cross-chain upgrades have expanded Algorand’s connectivity, but the appeal remains simple. Algorand stablecoin payments work quietly, even during network stress, and that reliability attracts both builders and institutions studying real adoption.

Expansion Points to a Broader Pattern

Plans to move into neighboring regions signal that this model is transferable. Many countries face similar banking gaps. Analysts tracking financial inclusion trends often note that stablecoins succeed where cash is risky and banks are absent.

For students, developers, and analysts, Algorand stablecoin payments offer a clear lesson. Blockchain adoption grows fastest when it solves ordinary problems without demanding attention.

Conclusion

Slogans or short-term rallies will not shape the future of digital finance. It will be built by systems people rely on without thinking twice. Algorand stablecoin payments, powered through HesabPay Algorand, show how blockchain earns trust by staying out of the spotlight. That quiet progress may define the next phase of global finance.

Glossary of Key Terms

Stablecoin: A digital currency linked to the U.S. dollar or local currencies: its value is kept consistent for at least one day so that it can be accepted by business people; and in order not to depreciate.

Algorand: A blockchain system designed for fast, low-cost and secure transactions, often used in payments and other financial applications.

On-chain Volume: The total value of transactions recorded on a blockchain during one period.

Financial Inclusion: Measures to make good financial services within reach of those who lack access to a bank account or have no tradition of using banking.

FAQs About Algorand Stablecoin Payments

What are Algorand stablecoin payments used for?

They support everyday transactions such as bill payments, transfers, and aid distribution with fast settlement and low fees.

Why is HesabPay necessary for Algorand adoption?

HesabPay shows how blockchain can power real payments without requiring users to have technical knowledge.

Is HAFN a speculative cryptocurrency?

No. HAFN is designed for daily use and is linked to local currency value rather than price trading.

Does Algorand price volatility affect stablecoin payments?

Stablecoin transactions remain stable because they are not tied to Algorand’s market price.