Following the latest market reports, crypto markets were rocked by one of the biggest single-day events in history. $19 billion in liquidations triggered by a flash crash tied to US-China tariff threats. Yet within 48 hours, a sharp rebound emerged, led by Cardano (ADA) and Dogecoin (DOGE).

Optimism returned, macro tensions cooled, and institutional flows stood strong. The price reset was brutal but this latest bounce is showing the bullish structure of major assets is still intact.

$19B Liquidation Shock

Late Friday, markets tanked after President Trump announced a 100% tariff on Chinese imports and a cascade of leveraged liquidations ensued across crypto. According to Santiment, $19 billion in leveraged positions were wiped out, the biggest single-day crypto liquidation on record. Of that; $16.6 billion was from longs and the rest from shorts.

Bitcoin fell 16% and briefly touched $104,100 before starting to recover. Alts were hit harder: Litecoin 51%, TON 41%, DOGE 39%. 6,300 wallets were liquidated on Hyperliquid alone, many due to auto-deleveraging.

The crash was a cascade of deleveraging; circuit breakers triggered, insurance funds drained and liquidity disappeared under stress. It tested market mechanics and exposed weaknesses in derivative structures and leveraged traders to macro surprises.

Also read: Trump’s Tariff Stimulus Proposal Sparks Talk of Crypto Liquidity Surge

The Bounce: ADA and DOGE Lead the Way

Two days later, and crypto market rebound seem to be ensuing. Bitcoin is up 3%, Ethereum 8.5%, and crypto ecosystems seem to be back in motion.

Among altcoins, Cardano (ADA) and Dogecoin (DOGE) were the stars. They rose 10% in 24 hours as bargain hunters came in and valuations looked oversold. $XRP and Solana are also back up by about 8%.

Analysts have come out to say the bounce isn’t just about speculative reentries but sentiment restoration. As one analyst put it:

“What we just saw was a massive emotional reset. ETF inflows are strong, exchange balances are near cycle lows and the broader narrative is arguably stronger after the washout.”

So the bounce was partly a relief rally, helped by macro and structural support in liquidity and on-chain flows.

Signals That Helped The Recovery

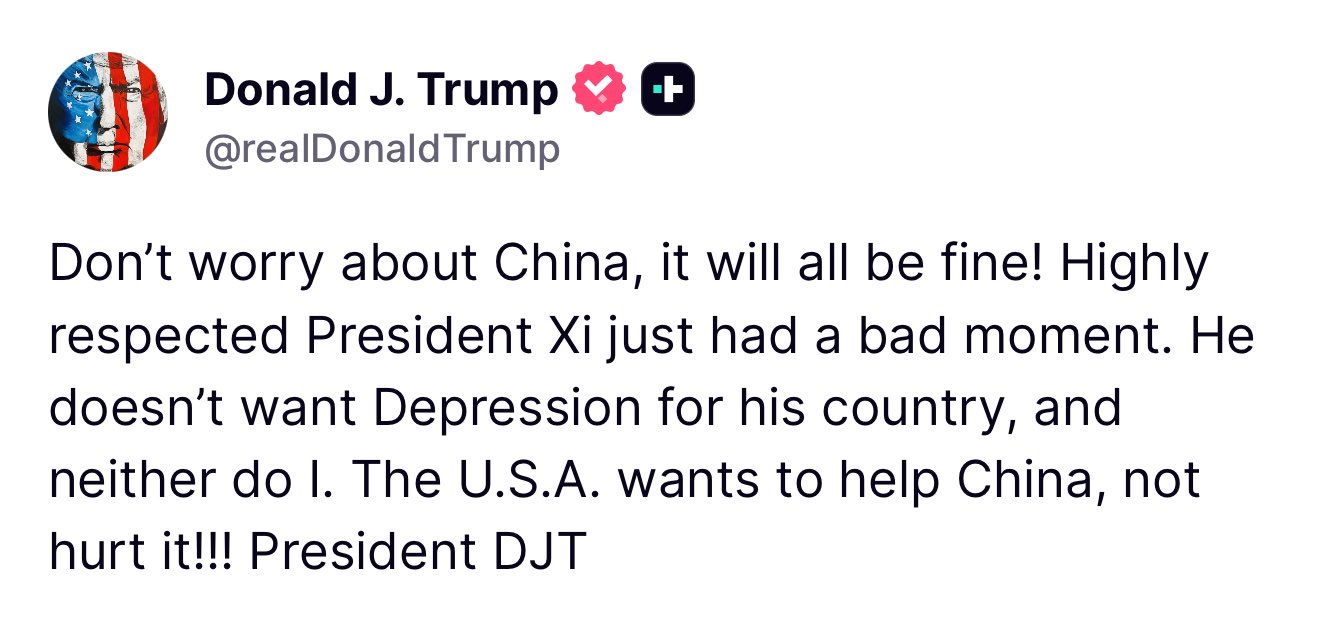

Several macro and flow dynamics helped this crypto market rebound. Firstly, the US-China tensions eased. China’s Ministry of Commerce said rare-earth export controls would not be blanket bans and Trump tweeted “the U.S.A wants to help China, not hurt it”. This de-escalation brought back risk appetite.

Secondly, ETF inflows remained strong. Despite the sell-off, institutional Bitcoin flows continued. This was a financial backstop, supporting price under renewed demand pressure.

Exchange balances also hit cycle lows. With fewer tokens sitting idle on exchanges, basic liquidity tightened which can amplify bounces.

Additionally, strategic accumulation happened. Reports have divulged that Marathon Digital Holdings, a major miner, bought 400 BTC via FalconX post-crash, a sign of institutional accumulation at discounted levels.

Experts have aligned that these signals seemingly flipped sentiment from panic to cautious optimism and allowed momentum to favor buyers over sellers.

Also read: US Government Shutdown Risk Hits 61%: What It Means for Crypto and Markets

Conclusion

Based on the latest research, the crypto market’s $19B liquidation event was brutal, but the quick crypto market rebound led by ADA and DOGE shows there’s resilience underneath. Easing macro pressures, ETF flows and institutional accumulation provided support for the bounce.

While the shock exposed stress in derivatives and liquidity models, it also showed that crypto markets are responsive to flow, sentiment and positioning. The reset may have cleaned off excess leverage and kick-started new trends.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

A $19B liquidation hit crypto markets after Trump’s 100% China tariff announcement, but within 48 hours, $ADA and $DOGE led the bounce. Underneath was macro easing, ETF flows and institutional dip buying. The shock stressed the market structure but confirmed long-term bullishness.

Glossary

Liquidation – Forced closure of leveraged positions when collateral fails margin thresholds.

Auto-deleveraging – A protocol mechanism that closes profitable positions to balance losses when insurance funds deplete.

Exchange balances – Holdings of crypto on centralized exchanges; lower balances mean stronger demand or withdrawal by holders.

ETF inflows – Capital entering exchange-traded funds tied to crypto assets, means institutional demand.

Emotional reset – A big drawdown that forces traders to re-set sentiment and remove overleverage.

Frequently Asked Questions About Crypto Market Rebound

Why did the crypto market crash so fast?

The crash was triggered by tariff shock and massive derivative liquidations, auto-deleverage and cascading stops.

Why did ADA and DOGE rebound the most?

They had oversold valuations, strong community support, and more sensitive to bargain flows in a bounce.

Are fundamentals broken?

Not necessarily. The bounce means demand is still there and structural factors like ETF flows and institutional accumulation are providing a cushion.

Will the bounce fail?

If macro risk resurfaces, rate tightening happens or ETF flows reverse sharply; the bounce may not hold.