This article was first published on Deythere.

- How the Aave Savings App Works

- Trust and Safety: $1M in Balance Protection

- Regulation and On-ramp: Aave’s MiCA Authorization

- Compared to TradFi Yield Advantage

- Conclusion

- Glossary

- Frequently Asked Questions About Aave Savings App

- How do users make a deposit into the Aave savings app?

- What is the yield offered?

- Is the user’s balance safe?

- Is this regulated?

- Can users withdraw anytime?

- References

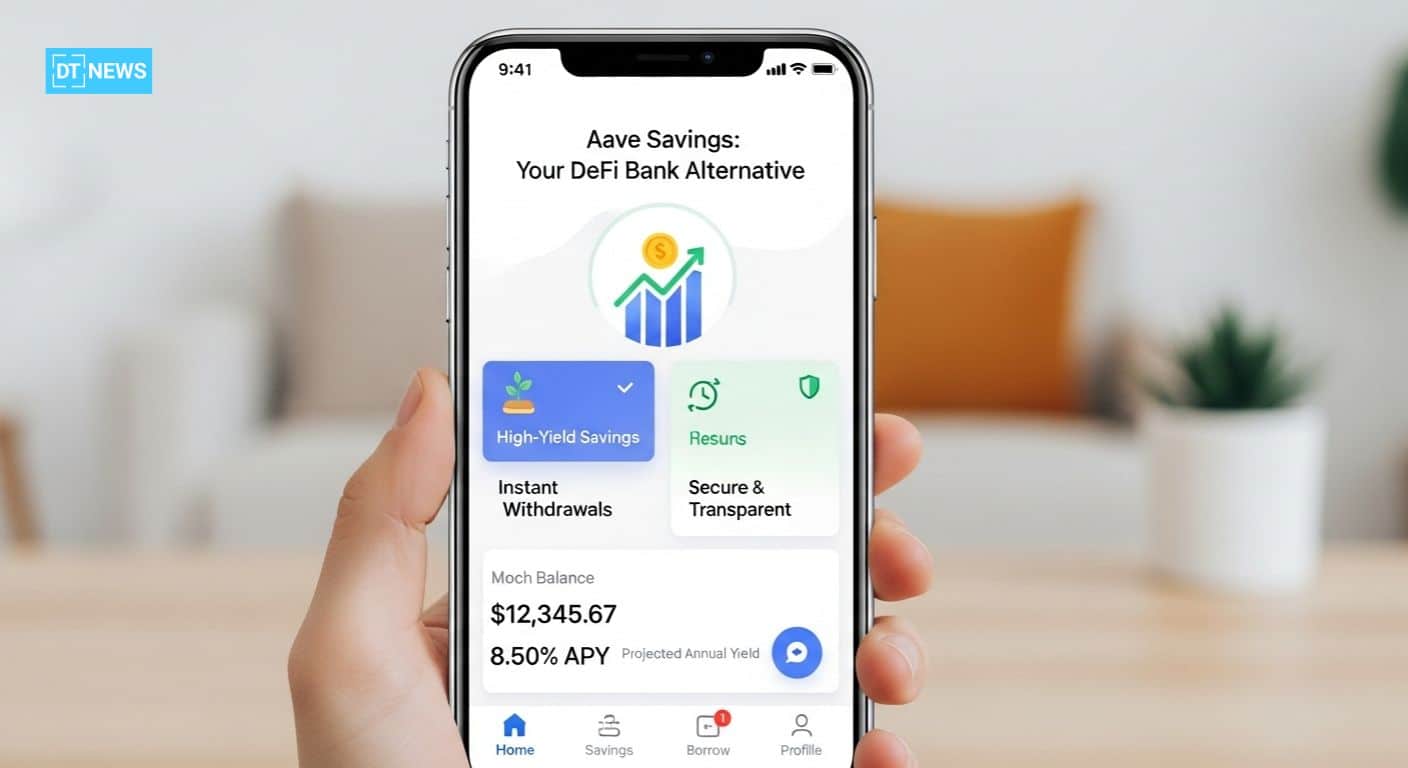

Aave is set to officially dip its toes into mainstream finance with the launch of its Aave savings app that is designed to make DeFi work and feel like one is in a traditional bank branch.

Instead of needing a complicated wallet, gas fees or seed phrase, users can just deposit fiat or stablecoins and the app takes care of all crypto complexity in the background.

With a guaranteed 6.5%+ APY, $1M balance protection, and European regulatory approval of the Aave protocol, the startup is stacking this app to onboard a billion users who have long been intimidated by DeFi’s traditional friction.

How the Aave Savings App Works

In order to provide users with a simplified approach towards saving money, it was paramount that it combined features of simplicity and automation.

Aave’s new app, launched Tuesday on iOS, allows users to deposit in bank accounts, debit cards or stablecoins.

The app pays an annual interest rate of 5 percent on the base, but it promises “boosts” that can increase yields to about 6.5 percent if users follow a set behavior, such as making recurring deposits.

Aave leverages account abstraction to enhance user experience. Users no longer need to handle seed phrases, care about gas fees or fully understand complex wallet flows.

Behind the scenes, the app handles all transactions, smart contracts or lengthy layer 2 bridging and conversion methods, so everything is nice and simple with a banker-style interface.

Money accrues by the second with compounding interest, there’s even an in app simulation that lets users project their savings over a number of years.

Trust and Safety: $1M in Balance Protection

This is also one of the most attention-grabbing features of the Aave savings app. The balances of eligible users are reportedly insured up to $1 million.

This isn’t government-backed insurance (like FDIC) but rather a protocol-native safety net that indicates Aave is confident in its infrastructure. Novices often avoid DeFi over fear of hacks, exploits and loss, and this acts as a form of insurance to bridge that trust deficit.

Regulation and On-ramp: Aave’s MiCA Authorization

Aave Labs obtains MiCA authorization through its subsidiary, Push, licensed by the Central Bank of Ireland. This is what enables Aave to provide users within the European Economic Area with zero fee euro-stablecoin ramps.

By securing this regulatory nod, Aave is forging a bridge between fiat and DeFi. On-ramping euros, converting into its native stablecoin (GHO) or other assets, becomes easy, legal and cheap.

This move takes Aave’s brand from “just” decentralized to that of a regulated provider of financial services, whose products can now look more appealing for mass adoption, especially for users who were fearful of crypto’s legal grey areas.

Compared to TradFi Yield Advantage

The Aave savings app has a great yield story behind it. Savings rates at traditional banks are low in many markets, often less than 1%. Aave’s base rate of 5%, and up to 6.5% with boosts, is a huge premium.

Unlike bank yields, which rely heavily on central bank interest rates, the yield engine for Aave is in on-chain lending demand. That means it’s not hitched to the same monetary policy train, providing a real yield for savers even when conventional rates are kept low.

For people in places with rampant inflation or weak banking structures, this could be especially attractive, a way to store value, or potentially grow it, in a more transparent and decentralized way.

Conclusion

The new mobile Aave savings app is a huge step toward mainstream DeFi.

By bridging high-yield crypto lending with the convenience of a banking app, and propped up by great security in accordance to the regulatory legitimacy under MiCA, DeFi gets real for everyone with Aave.

With this launch, Aave is betting that the next billion users won’t be power users, they’ll be more like everyday savers.

Glossary

Account Abstraction: A design pattern in blockchain that makes how accounts are handled simple and is a user-friendly feature for wallets and transactions.

MiCA (Markets in Crypto-Assets): An EU regulatory framework to standardize crypto assets and safeguard consumers.

Stablecoin: A cryptocurrency whose value is pegged to a stable asset, such as a fiat currency, and used for less volatile on-blockchain transactions.

GHO: Over-collateralized stablecoin of Aave (native here to Aave protocol).

DeFi (Decentralized Finance): Financial services constructed on blockchain that enable lending, borrowing and yield generation without traditional financial intermediaries.

Yield: The revenue made by deposited assets, like interest or rewards in DeFi.

Frequently Asked Questions About Aave Savings App

How do users make a deposit into the Aave savings app?

Users can deposit using bank accounts, debit cards or stablecoins like USDC or USDT.

What is the yield offered?

The app provides a base rate of about 5% APY, and potential “boosts” to about 6.5% or higher, based on how users use the app such as recurring deposits.

Is the user’s balance safe?

Yes, they have balance protection of up to $1,000,000 per eligible account, this is a heavy block layer guarantee.

Is this regulated?

Aave Labs has lined up MiCA authorization in Europe, through its Push subsidiary, for regulated on- and off-ramps of stablecoins such as GHO.

Can users withdraw anytime?

Yes, users are able to access their funds and interest compounds in real time. The app is designed to allow for deposits and withdrawals on a whim.