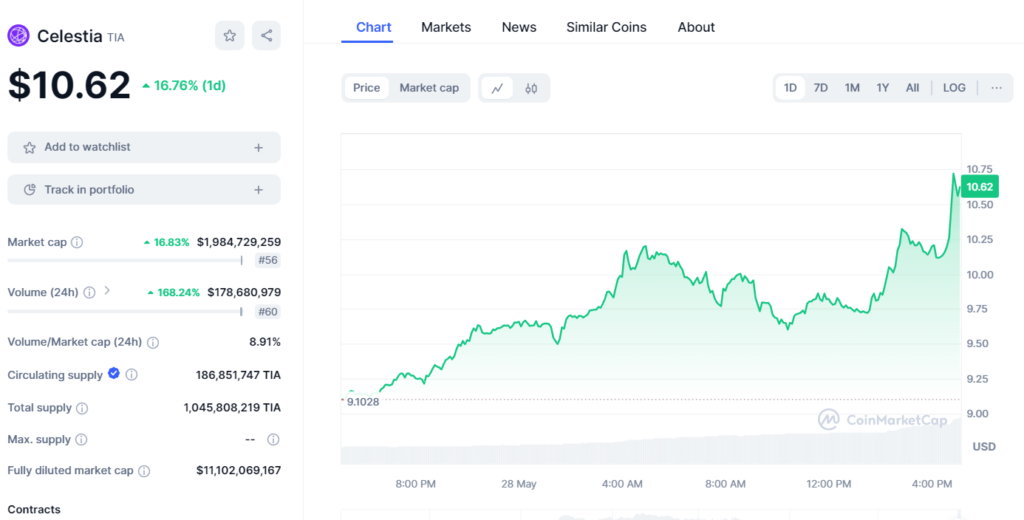

In the context of emerging trends in the ICO market, which is currently experiencing high levels of volatility, Celestia seems to stand out most notably, demonstrating stable growth of the price and turnover rates. Over the past day, Celestia experienced a rise of 16%. The needs of the customers were met by 76% and the resulting price of the product climbed to $10. 62. To immediately move to this position has not only helped to increase the popularity of the coin but the increased its market cap to around $1. 98 billion which almost ranked the company the 56th in the world’s cryptocurrency market.

to 54000, while Celestia saw its trading volume increase at the same level, shooting to 168 percent. 24% to be $177 indicated that it will increase to almost 24% thus reaching nearly $178. 68 million. This increase in its volume representing a strong trading and an evident appreciable business from the trader and investors’ side, depicts a strong liquidity market. The volume to market capitalization ratio stands at 8, X. 91%, and this goes further in supporting this trend, most of the coin’s market capitalization trading was made within the day and such trades often signify active participation in the markets as well as speculative activities.

Supply metrics show that Celestia has around $ 186 Billion altogether and of them, $ 186 Billion is the supply in circulation. As it has 1. 2 billion TIA in total circulation, it possessed somewhat more than 85 million TIA in trading plans. This lack of a maximum supply cap can cause inflation of the coin’s price in the future, but this also has an advantage because it will allow more flexibility in the future of the coin.

This relatively recent revival can be blamed on one of the following reasons. Cryptocurrency is sensitive to technology updates, new cooperations, and changes in management policies that might have contributed to influencers’ impact on the vital Celestia. Also, many other changes in the economic environment such as inflation rates and fluctuations in the technology-based market also affect cryptocurrencies to varying degrees.

Potential tendentious criteria can also be inferred with regard to investor perception and the perceived crossing of pivotal price landmarks. The essence of the current prices being displayed in Celestia As Celestia crosses the $10 mark, there is often an increased probability of FOMO, which will inevitably lead to the price of a coin rising even further due to demand from more investors. However, such a rally should be approached with considerably more caution as there is always the possibility of duping equalling a form of reverse and cryptocurrencies are no different where what rises sharply in a short space of time can just as easily fall.

Looking forward, the prospects of Celestia depend on several variables: the current market situation and conditions, further advancements of the project and the state of Celestia’s ecosystem, as well as the overall sentiment at the crypto market. Therefore, to ensure its sustainability over the years; Celestia will need to sustain technological advancement and build a trusted system that many users in the network will find useful. Moreover, possible a new regulation and changes in the market environment will also help to determine future trends.

Those who are interested in investing in Celestia or any other cryptocurrency should bear in mind that gaining high-profit potential is often tied to high risks that appear with cryptocurrency. That is why before investing in financial instruments subject to high volatility it is possible to invest time and use money to gain comprehensive knowledge about the market situation and own limit of tolerance of the risk. So it appears that Celestia is well-suited for the changes of the world, but it is still uncertain how it will fare in the new conditions – it is only a matter of time before all the opportunities and threats are going to be met.