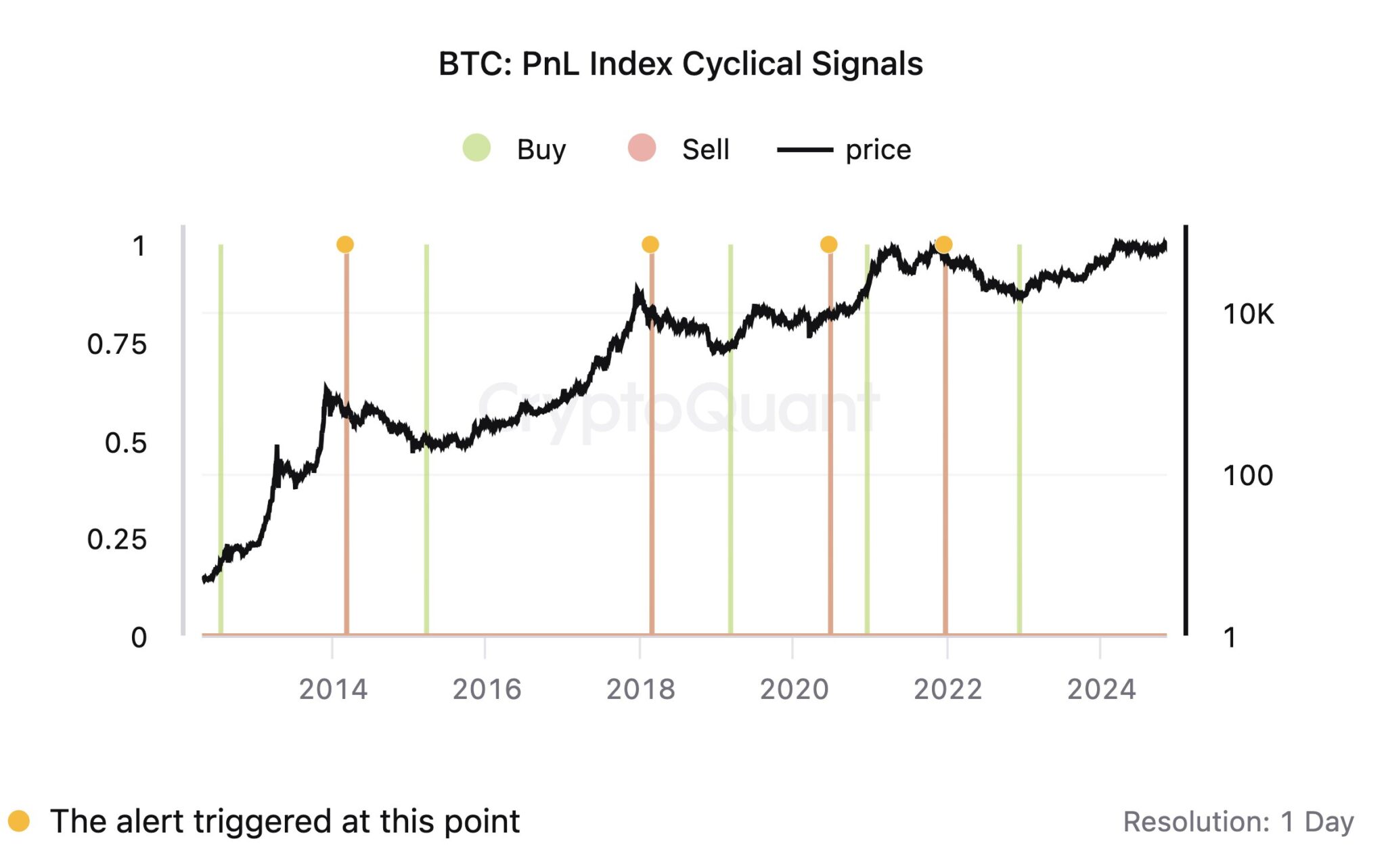

CryptoQuant CEO Ki Young Ju has highlighted a significant buy signal for Bitcoin (BTC) in its current price cycle. In a post on November 8, Ju shared that CryptoQuant’s on-chain, cost-based indicators have identified rare cyclical buy/sell signals that appear only once or twice per cycle, providing long-term guidance for investors.

Bitcoin Wallet Profitability Analyzed

According to Ju, on-chain data reveals the current profitability of Bitcoin wallets. On average, wallets are seeing a 127% profitability rate, with the current metrics signaling a “buy.” Historically, profitability has dipped to around -24% during cycle lows, while reaching as high as 298% in peak phases. This cyclical profit/loss pattern is crucial for long-term investors, as it helps them navigate Bitcoin’s market volatility with pre-defined alerts.

Signals as a Guide for Investors

Ju’s analysis demonstrates that these historically inspired signals can be a strong guide for investors. Rarely triggered, they serve as potential indicators for buy or sell opportunities, suggesting that Bitcoin’s current price level presents a favorable opportunity for long-term investors.

These signals empower investors to be better prepared for Bitcoin’s cyclical fluctuations, allowing for more strategic moves in response to market shifts.

Currently, Bitcoin has seen a 1.78% increase over the last 24 hours, trading at $76,205, and a 9.94% gain over the past seven days. With a market cap of $1.5 trillion, Bitcoin remains the largest and most valuable asset in the crypto market.

Bitcoin, CryptoQuant, buy signal, market cycle, profitability