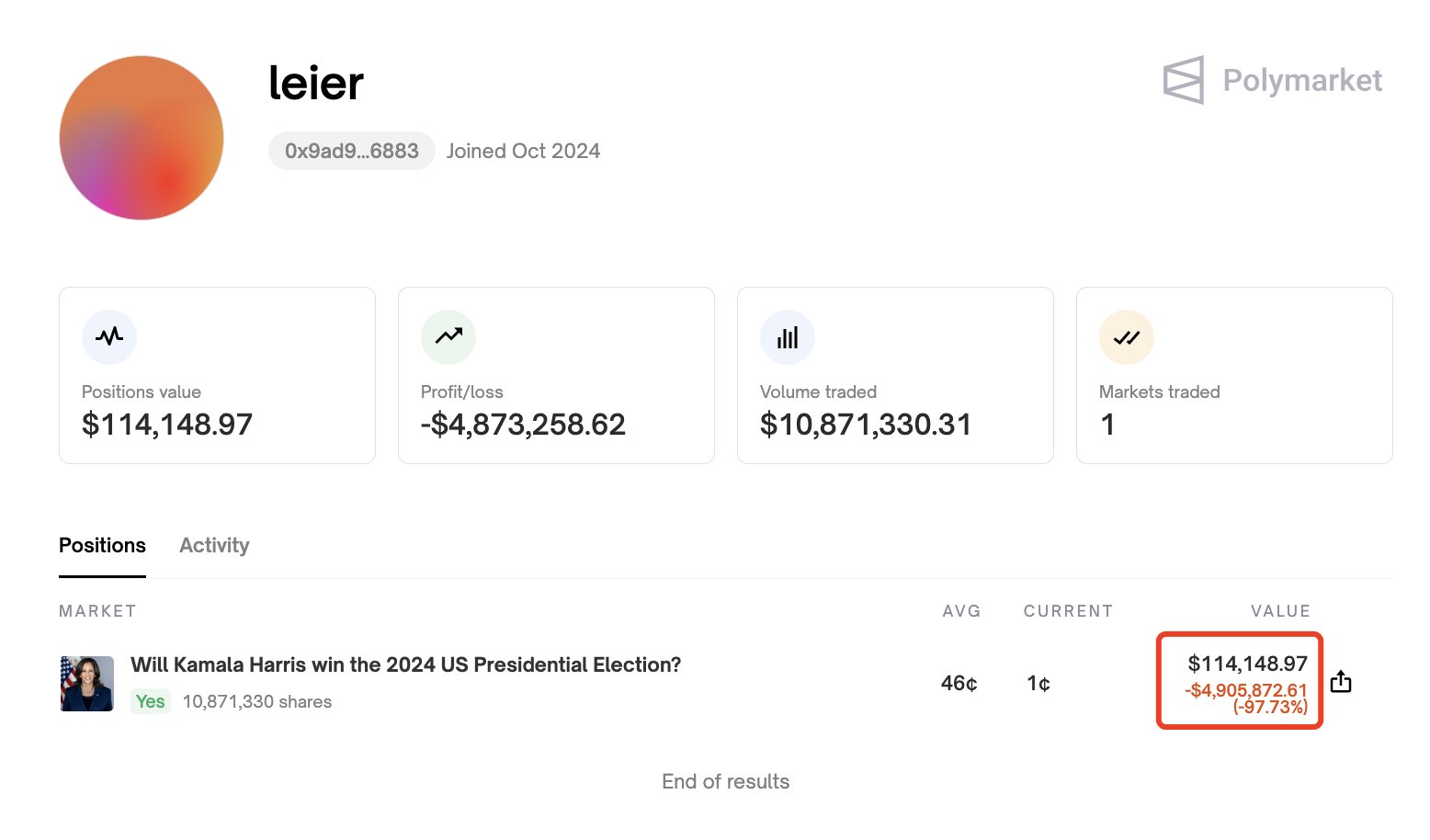

An intriguing development has emerged for the crypto market community, as a whale-level investor faces potential significant losses due to a high-stakes bet on the U.S. presidential election outcome. According to crypto analytics platform Lookonchain, this investor wagered $5 million in USDC on Vice President Kamala Harris securing a win in the election. However, with the current lead favoring Donald Trump, the investor’s position is now down by roughly $4.9 million—a staggering 97.7% loss.

A High-Risk Gamble on Harris

This bold move underscores the uncertainty and inherent volatility of both politics and the crypto market. The substantial $5 million USDC wager has sparked curiosity among crypto enthusiasts, highlighting the massive risks and rewards associated with high-stakes investments. Lookonchain’s analysis revealed that the investor withdrew $5 million in USDC from Binance on November 4, shortly before placing the election bet. At the time, the investor seemed confident in Harris’s victory; however, the unfolding results have so far led to significant losses.

The Risks of Crypto Bets for Investors

Whale investors often attract attention with their substantial moves, and bets on events like the U.S. election can trigger both excitement and volatility in the crypto market. This example of a possible $5 million loss serves as a reminder that even large investors can face unexpected outcomes with considerable losses.

As election results remain uncertain, so does the fate of this bold wager. Yet, the current trajectory shows Harris’s chance of victory dwindling. This case, as highlighted by Lookonchain, emphasizes the high risks associated with crypto investments and the importance of careful decision-making.

crypto market, $5 million loss, Kamala Harris, high-stakes bet, USDC