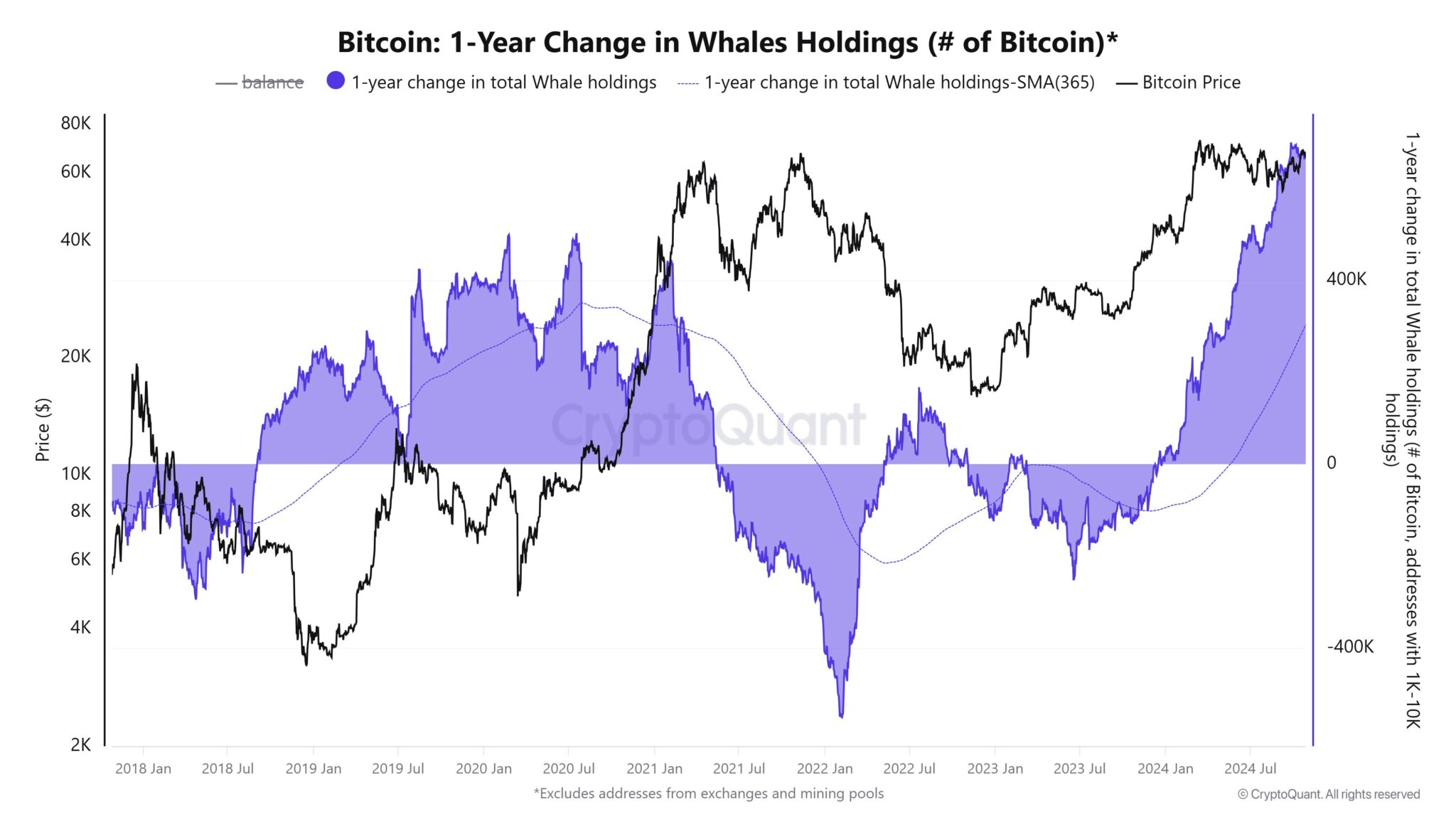

On October 29, CryptoQuant CEO Ki Young Ju reported a substantial increase in institutional demand for Bitcoin. Notably, the volume of BTC transferred to “whale” wallets—those holding large amounts of cryptocurrency—has surged, including transactions outside exchanges and mining pools. During the past year, around 278,000 BTC entered U.S. spot ETFs, with about 80% of these inflows attributed to individual investors.

Institutional Demand Outpaces Individual Investors by Twofold

Ki Young Ju highlighted that institutional investors are increasingly focused on security, opting for secure storage solutions. Currently, whale wallets holding over 670,000 BTC largely consist of these high-security institutional accounts. In contrast, individual investors’ wallets with holdings exceeding 1,000 BTC often lack these specialized storage solutions.

Differences Between ETF and Whale Wallets

According to Ju, most ETF wallets hold under 1,000 BTC, while the majority of large wallets are managed by institutional investors. This trend underscores a preference for secure storage solutions among institutions, signaling future growth in both spot Bitcoin ETFs and secure storage services.

With institutional investors increasingly prioritizing security-focused solutions, there’s growing anticipation for heightened institutional interest in spot Bitcoin ETFs and secure wallet options. Bitcoin’s price has risen by 3.90% over the past 24 hours, hovering around the $71,000 mark. Meanwhile, trading volume has surged, with CoinMarketCap data showing a 145.55% increase to $47.48 billion over the same period. Over the past seven days, Bitcoin’s price has climbed by more than 5%, according to recent metrics.

institutional demand, Bitcoin, spot ETFs, secure storage, whale wallets