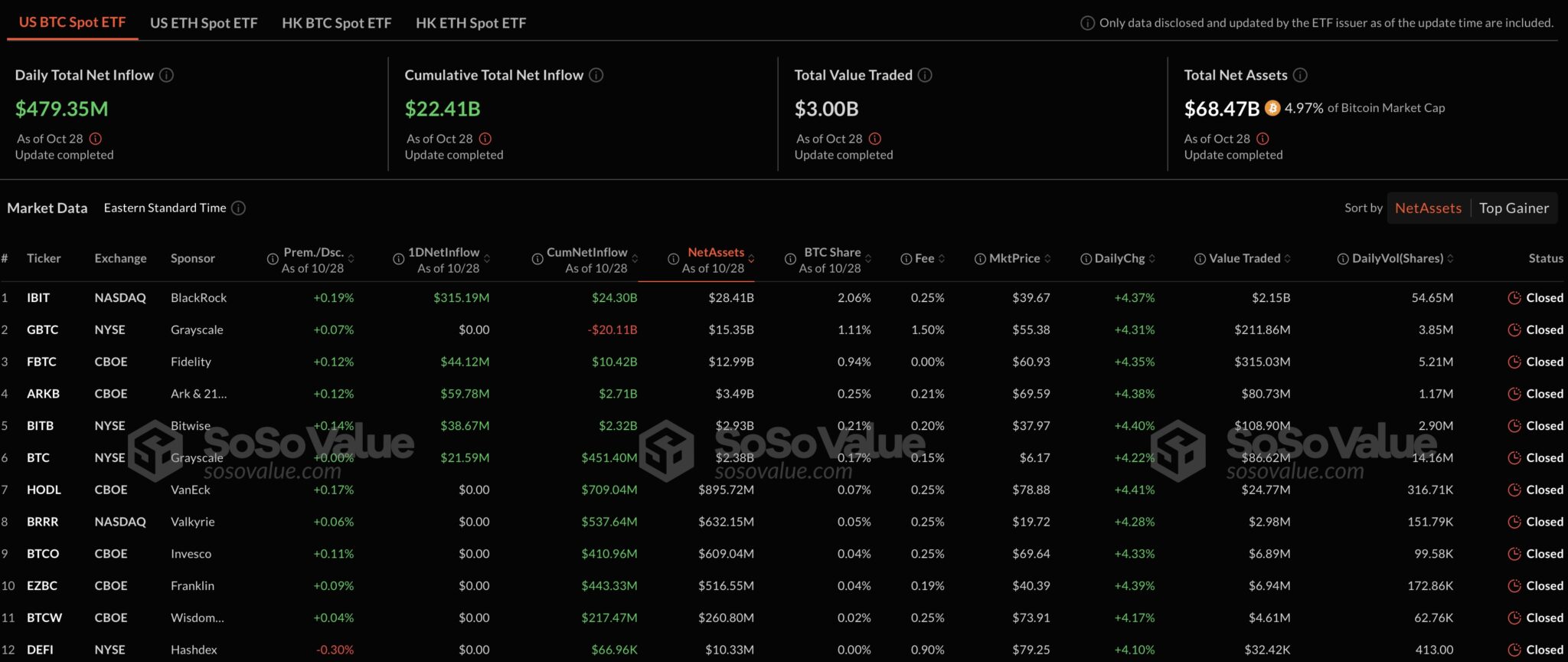

On the first trading day of the week, U.S. spot Bitcoin ETFs saw a remarkable inflow of $479.4 million, marking the highest daily entry since October 14. Leading the pack in net asset growth, BlackRock’s IBIT fund attracted $315.19 million, maintaining positive flows for the 11th consecutive day.

Growing Interest in Spot Bitcoin ETFs

In addition to BlackRock’s IBIT, the ARKB fund from Ark Invest and 21Shares drew $59.78 million, making it the second most popular ETF. Fidelity’s FBTC fund followed with an inflow of $44.12 million. Meanwhile, Bitwise’s BITB and Grayscale’s Bitcoin ETFs saw respective flows of $38.67 million and $21.59 million. However, the other seven spot Bitcoin ETFs recorded no notable flows.

This spike in activity contributed to a total ETF trading volume of $3 billion on Monday, a rise from Friday’s $2.9 billion volume. Over the past 24 hours, Bitcoin has surged by 4.75% to $71,200, reaching its highest level since June. During this period, Ethereum also gained 5.11%, climbing to $2,624.

Outflows in Spot Ethereum ETFs

Contrary to the record inflows in Bitcoin ETFs, spot Ethereum ETFs saw a net outflow of $1.14 million on Monday, following a $19.16 million outflow on Friday. Grayscale’s ETHE recorded the largest outflow at $8.44 million, which was partially offset by a $5.02 million inflow to Fidelity’s FETH and a $2.28 million inflow to BlackRock’s ETHA.

Total trading volume for the nine Ethereum ETFs decreased to $187.49 million on Monday, down from $189.88 million on Friday. This surge in spot Bitcoin ETF interest highlights growing investor confidence in Bitcoin, with many following the price movements influenced by recent volatility.

Bitcoin ETFs, spot Bitcoin, BlackRock IBIT, Ethereum ETFs, trading volume