The crypto market is witnessing a surge in stablecoins pegged to the US dollar, reaching record levels. This, coupled with an increase in large Bitcoin (BTC) transactions, could set the stage for a broader rally in the coming weeks. Historically, Bitcoin has performed strongly in October, and this trend could continue with the current market conditions.

The Link Between Stablecoin Liquidity and Bitcoin

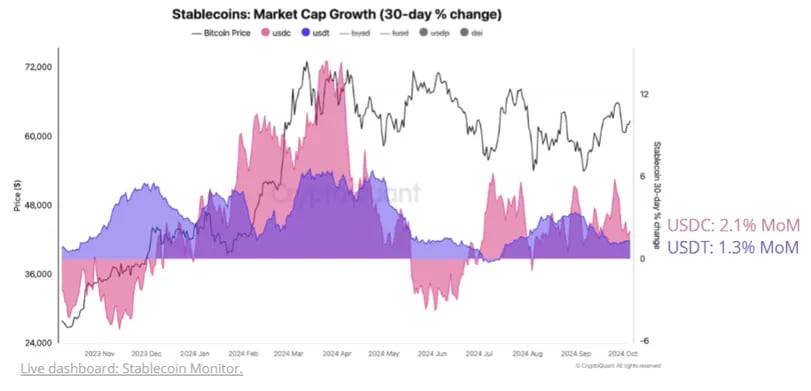

At the end of September, stablecoin liquidity saw a 31% increase since the start of the year, reaching an all-time high of $169 billion. According to CryptoQuant data, this spike is primarily driven by major stablecoin players such as Tether (USDT) and Circle’s USDC. USDT’s market capitalization surged by $28 billion to nearly $120 billion, maintaining its 71% market share. Meanwhile, USDC’s market cap rose by 44%, reaching $36 billion with a 21% market share.

Stablecoins are known for maintaining price stability by being pegged 1:1 to fiat currencies like the U.S. dollar or assets like gold. Backed by equivalent fiat reserves, stablecoins increase the real-world liquidity flowing into the crypto market.

Most crypto spot and futures trades occur through stablecoin pairs, making the rise in stablecoin supply a potential indicator of liquidity available for future crypto purchases. Historical data shows a clear correlation between the amount of stablecoins held on exchanges and Bitcoin’s price movements. This year, stablecoin balances on exchanges have grown by 20%.

CryptoQuant’s Take on the Correlation

Julio Moreno, Research Director at CryptoQuant, commented, “The increase in stablecoin balances on exchanges is positively correlated with the prices of Bitcoin and other cryptocurrencies. Since the beginning of the current bull cycle in January 2023, the total amount of USDT (ERC20) on exchanges has risen from $9.2 billion to $22.7 billion, marking a 146% increase.”

Bitcoin’s Outlook for the Coming Months

Bitcoin has dropped more than 6% since the start of October. Historically, it has only closed negatively in this month twice. However, price increases of up to 16% after October 15th are common, and the current stablecoin accumulation could support such a rally.

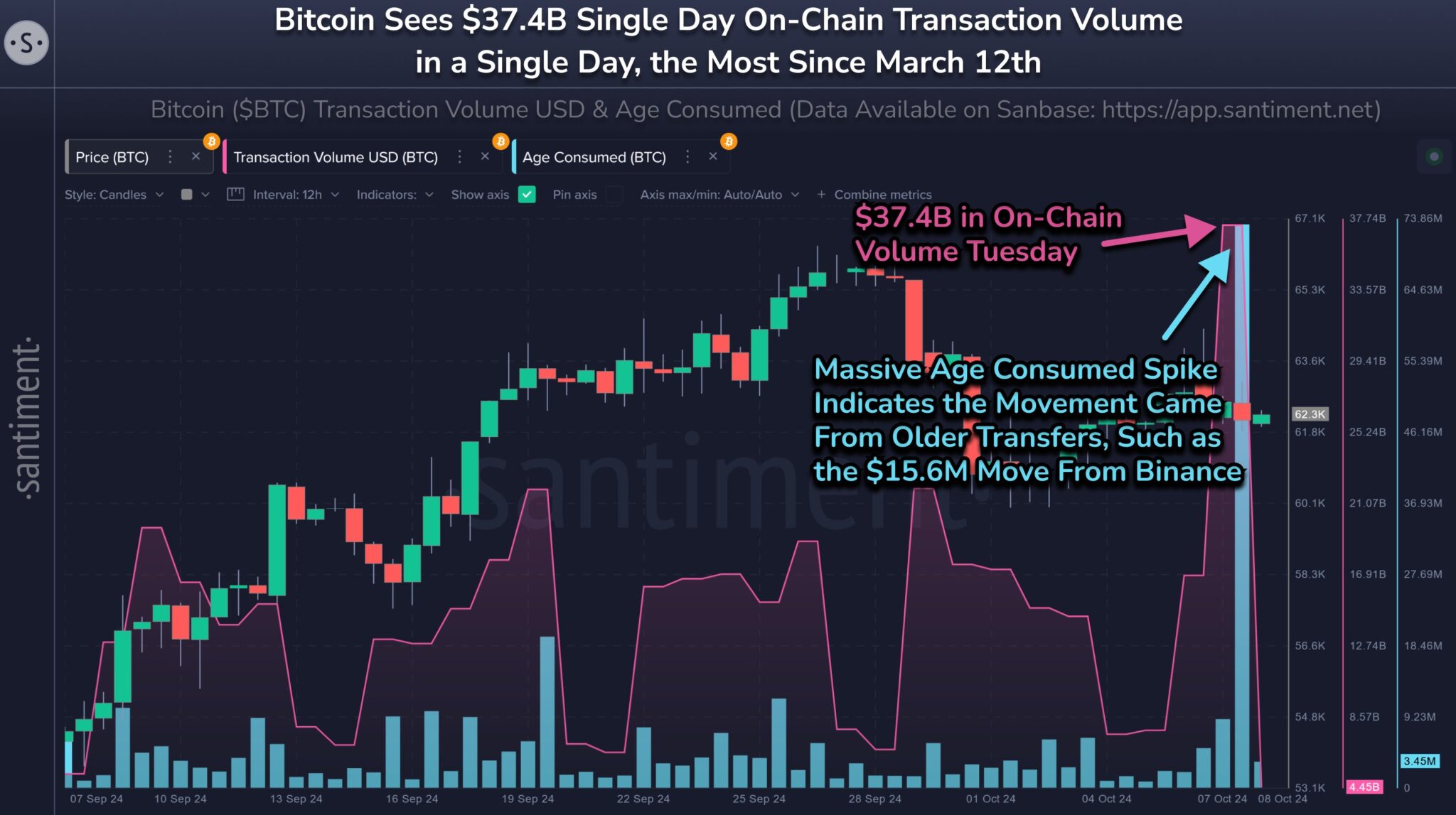

Upcoming factors, such as the U.S. presidential election, central bank policies, and crypto regulations, will play key roles in the market’s direction. On-chain analytics firm Santiment reported a rise in transactions by whales (large holders) on the Bitcoin network. Historically, these transactions have often preceded significant price rallies. Santiment added, “Our metrics show a revival of dormant activity in the Bitcoin network, with on-chain volume reaching $37.4 billion, the highest in seven months.”

The growing stablecoin supply, increased whale activity, and the potential for a mid-October price surge all indicate that Bitcoin may be gearing up for a rally. Investors should keep a close eye on these developments, as the crypto market could see significant moves in the near future.

Bitcoin, stablecoin liquidity, USDT, price rally, whale activity