The U.S. job market showed slower growth than expected in August, prompting an initial positive response from Bitcoin. The unemployment rate in the U.S. decreased slightly from 4.3% in July to 4.2% in August, providing some optimism in the markets. The U.S. job report, which revealed over 160,000 unfilled positions, took many by surprise and led to speculation about the Federal Reserve‘s next steps. This speculation drove Bitcoin to $57,000, although the price later dropped to around $55,000.

Bitcoin’s Initial Surge, Then Drop

The U.S. Department of Labor announced that employers added only 142,000 new jobs in August, significantly below expectations. Combining July and June figures, the three-month average now stands at 86,000, down from the 202,000 average during the same period last year. Despite the job slowdown, the unemployment rate’s slight decline to 4.2% was in line with market forecasts.

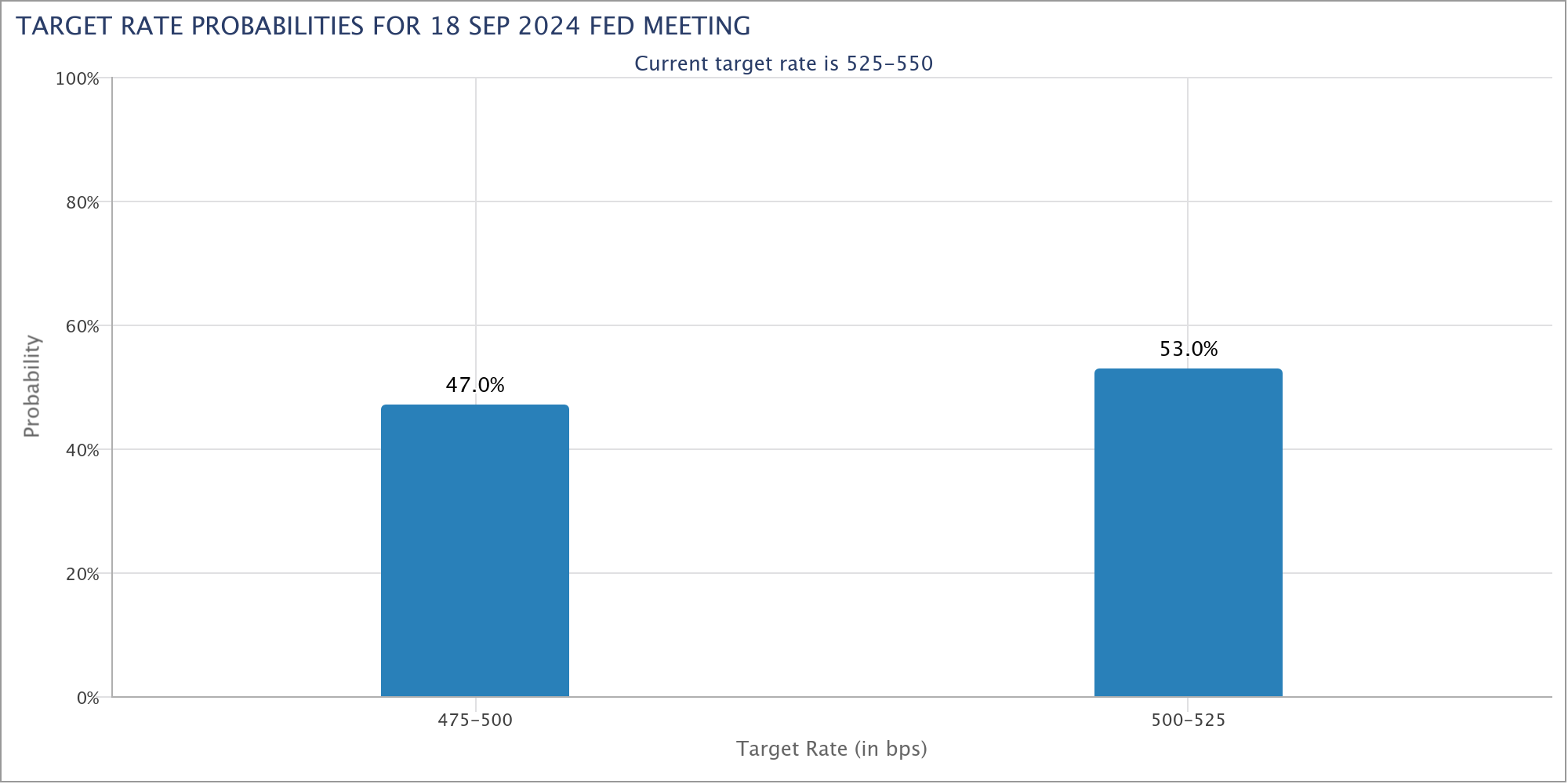

This data suggests the Federal Reserve may cut interest rates by the end of September. Fed Chair Jerome Powell had hinted at this during earlier statements, and most analysts now expect a 25-basis-point cut. Bitcoin responded swiftly to the government’s report, as it remains highly sensitive to major U.S. economic indicators. Bitcoin climbed quickly from $55,500 to $57,000, but it was unable to sustain this rally and dropped back to the $55,000 range.

What’s Next for Bitcoin?

In the wake of the underwhelming U.S. employment data, Bitcoin briefly spiked on September 6, just before Wall Street’s opening bell. The cryptocurrency touched $57,000 before slipping back, ultimately hitting a new monthly low of $54,919 on Bitstamp. The weak non-farm payroll numbers have raised fresh concerns about labor market health.

Meanwhile, a senior Federal Reserve official indicated that the time for rate cuts might be imminent, with the decision likely to be made on September 18. Speaking at the Council on Foreign Relations, New York Fed President John Williams noted, “Our current restrictive monetary policy has helped restore balance to the economy and reduce inflation.” He continued, “With inflation moving toward 2%, it may now be appropriate to reduce the restrictiveness by lowering the federal funds rate.”

The CME Group’s FedWatch Tool now shows that the market is evenly split between 25 and 50 basis point rate cuts, with probabilities at 53% and 47% respectively. While the U.S. dollar rallied following the data release, crypto experts such as Daan Crypto weighed in on the situation. Daan commented on the U.S. dollar index (DXY), “The DXY remains weak, holding above the 101 support level.”