Michael Saylor, the Chairman of MicroStrategy and a prominent advocate of Bitcoin, recently shared a striking perspective on the current state of the cryptocurrency market. DeyThere reports that Saylor referred to the recent decline in Bitcoin’s price as a “20% discount sale,” suggesting that the downturn is actually a prime buying opportunity. His remarks come at a time when Bitcoin, which once reached an all-time high, has seen a significant drop, causing ripples throughout the financial world.

Saylor’s optimistic stance stands out, especially as many in the financial community express concern over Bitcoin’s recent performance. By framing the price drop as a discounted buying opportunity, Saylor encourages investors to view the dip not as a reason for alarm but as a chance to invest in Bitcoin at a reduced price. His comments have sparked discussions among traders and investors, highlighting the differing opinions on Bitcoin’s future amidst its current volatility.

Bitcoin’s Market Decline: A Golden Opportunity?

Bitcoin, the world’s leading cryptocurrency, once reached an all-time high of $73,679 on March 13. However, in recent days, the value of Bitcoin has dropped by 20%, now trading at $58,625. Michael Saylor, speaking on X, has highlighted this downturn not as a cause for alarm, but rather as a temporary “sale” on Bitcoin. According to Saylor, this is an opportune moment for investors to buy in before the market rebounds.

Saylor’s perspective is far from surprising given his long-standing bullish stance on Bitcoin. Under his leadership, MicroStrategy has been one of the most aggressive institutional buyers of Bitcoin. Despite the downturn, MicroStrategy has continued to increase its Bitcoin holdings, even filing to raise $2 billion, with plans to purchase more of the cryptocurrency. According to news reports, as of now, MicroStrategy holds 226,500 BTC, valued at approximately $13.2 billion based on current prices.

DeyThere reports that Saylor’s latest comment shows his unwavering belief in Bitcoin’s long-term potential. By framing the current market condition as a discount sale, Saylor is encouraging investors to view the downturn as a temporary setback rather than a cause for concern.

Bitcoin Halving and Future Prospects

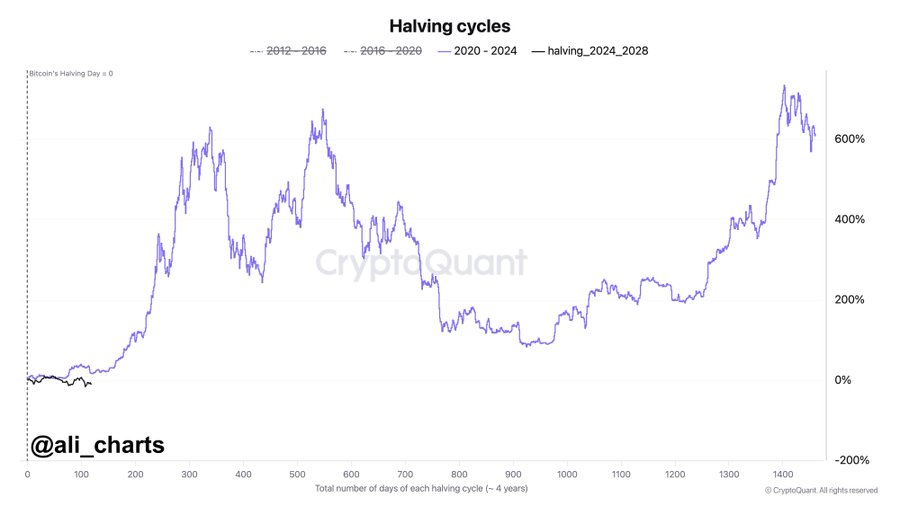

While Saylor emphasizes the current discount on Bitcoin, market analysts are also weighing in on where the cryptocurrency might be headed. Ali Martinez, a respected analyst, shared insights on X, shedding light on the future trajectory of Bitcoin. Martinez noted that it has been 119 days since the 2024 Bitcoin halving, which took place in April.

In his analysis, Martinez pointed out that in previous Bitcoin cycles, the cryptocurrency reached its cycle top around 530 days after the halving. This historical pattern suggests that Bitcoin may still be in the early stages of its current cycle, with significant potential for growth ahead.

Martinez’s analysis aligns closely with Saylor’s view. Despite the recent downtrend, the data suggests that Bitcoin could be on the brink of entering a more explosive phase of its cycle, leading to a substantial rally towards a new market peak. This reinforces the notion that the current market conditions should be seen as an opportunity for investors rather than a reason to panic.

An Optimistic Outlook Amid the Downturn

As Bitcoin continues to navigate the volatile waters of the cryptocurrency market, Michael Saylor’s perspective offers a refreshing sense of optimism. Saylor’s framing of the recent Bitcoin downturn as a “20% discount sale,” urging investors to capitalize on the temporary dip in price.

Saylor’s stance is supported by historical data and market analysis, suggesting that Bitcoin’s current phase could be a precursor to significant future gains. For those who have been waiting on the sidelines, Saylor’s message is clear: the time to buy may be now, before the market rebounds and Bitcoin resumes its upward trajectory.

DeyThere continues to monitor the situation closely, providing updates as the story unfolds.