Currently, Litecoin (LTC) top cryptocurrency market is the hot topic of discussion with most of the signs indicating a fading bulls run. A rising wedge formation is a technical pattern that indicates that the price is likely to decline to the level of 7.75% correction could push Litecoin to the crucial support which has potential to be breached. LTC seems vulnerable to a significant bearish trend as the trading volumes decrease and the bullish impact of Bitcoin seems to deteriorate.

Technical Analysis Indicates Bearish Trends

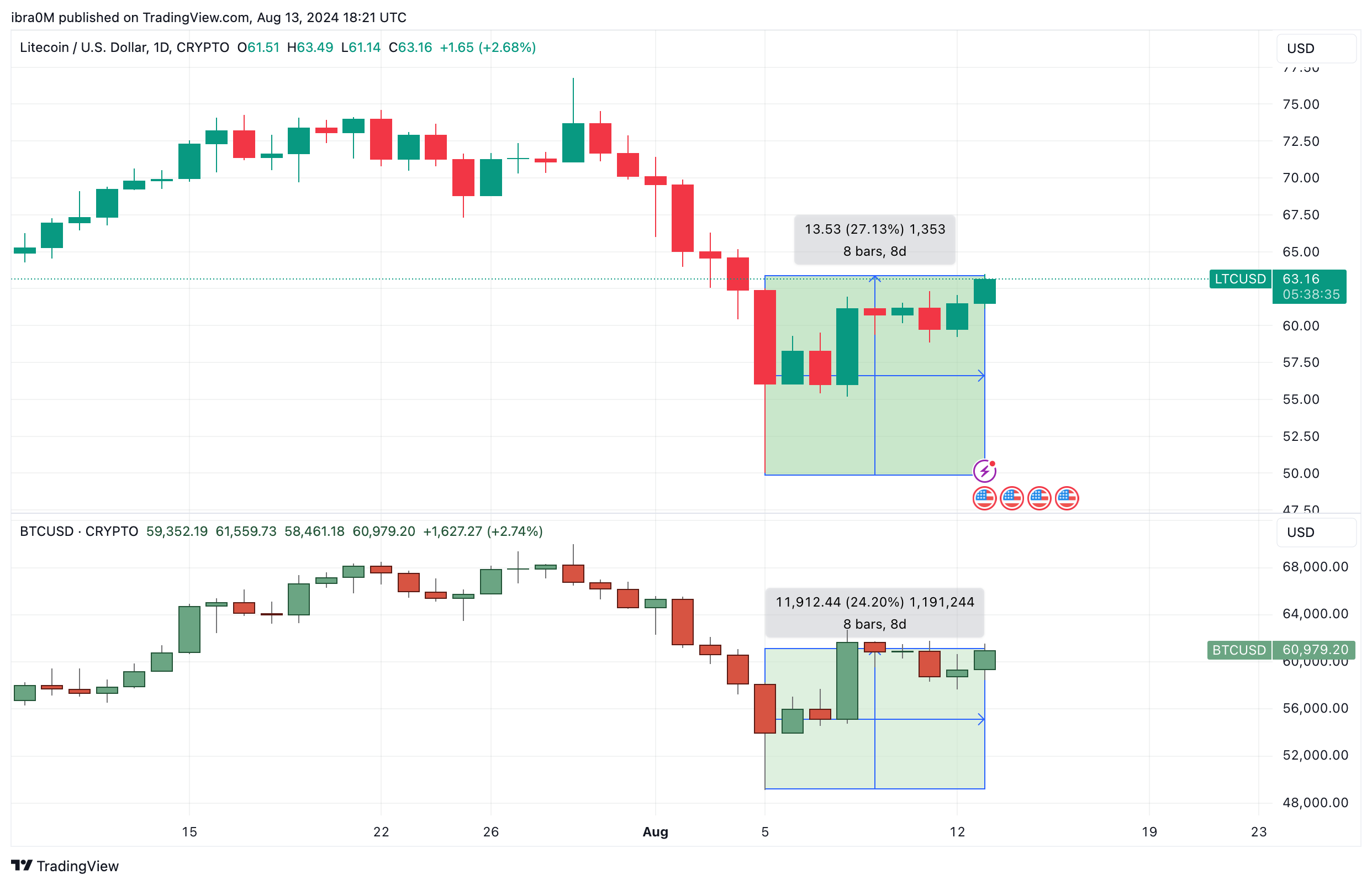

In the recent four-hour chart, Litecoin attempted a recovery following last Monday’s downturn, forming a V-shaped pattern that led to a price surge of 26.87% within nine days. Despite this impressive recovery, technical indicators suggest the price action is set against a backdrop of bearish sentiment. Currently priced at $63.44, Litecoin’s latest trading session has produced back-to-back bearish candles, highlighting increasing selling pressure from the overhead resistance trendline.

The observed rising wedge pattern is indicative of imminent bearish momentum, as it completes a bearish pennant structure. Should the price dip below the rising wedge’s support trendline, a sharp decline could materialize, striking at the heart of Litecoin’s recent recovery efforts.

Key Target Levels and Resistance Struggles

The stochastic RSI has recently crossed over in the overbought zone, indicating that bullish exhaustion might be setting in. This price rally has also surpassed major exponential moving averages (EMAs), which are located at $62.14, $61.75, and $63.33 respectively. Yet, pressure from an impending negative cycle threatens to disrupt this bullish sentiment, especially regarding the 100 EMA.

Litecoin Price Action (LTC/USD) vs Bitcoin (BTCUSD) | TradingView

An analysis of Fibonacci retracement levels indicates that LTC is struggling to break the 50% retracement level at $64.46. The support trendline remains critical; a breach could initiate a drastic decline for Litecoin’s price. If such a bearish trend develops, the next areas of support will be around the 38.20% Fibonacci level at $61.78 and the 23.60% Fibonacci level at $58.46. Should the sell-off accelerate, the ultimate support may be found at the base level of the Fibonacci retracement at $53.11.

Current Price Dynamics and Market Sentiment

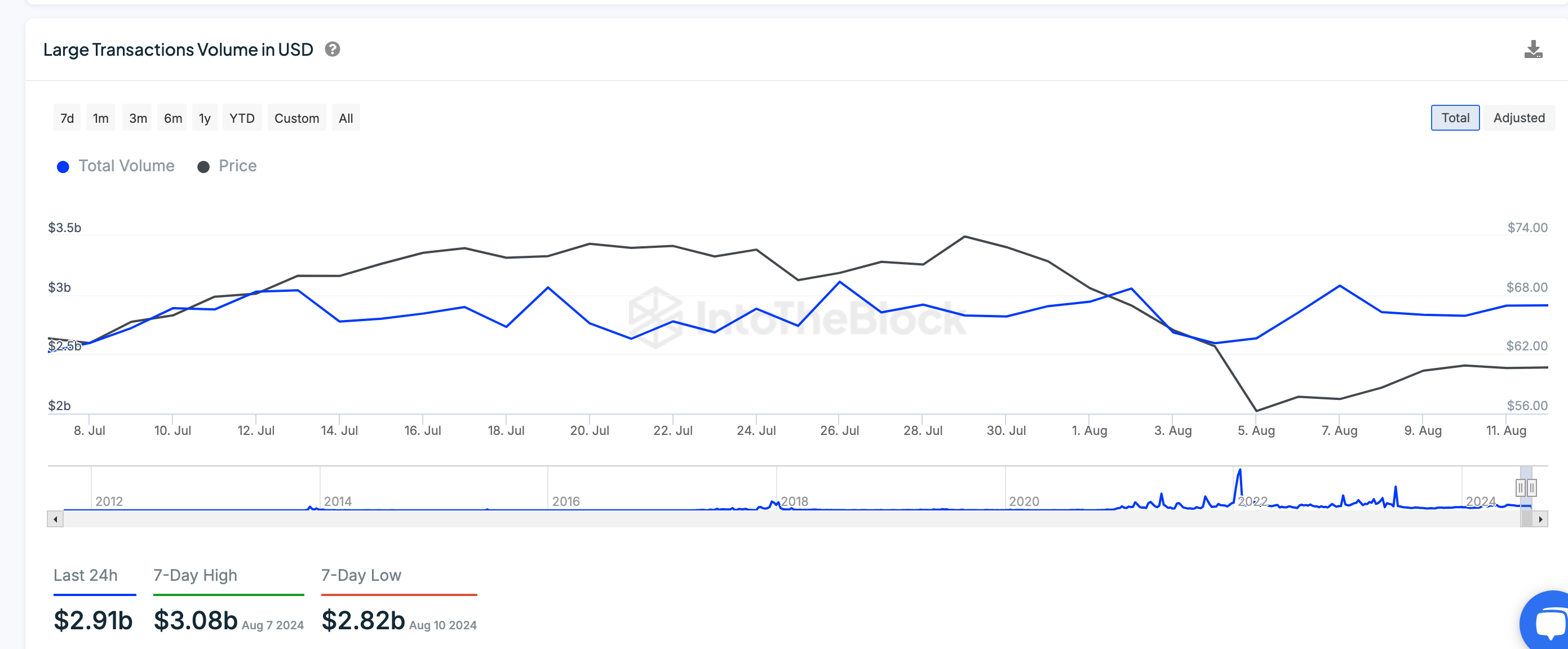

Despite a notable increase in price, with LTC exceeding $62 on August 13, market indicators show a worrying drop in whale activity, suggesting sustainability for the gains may be in jeopardy. On-chain analysis reveals a contraction in whale demand, which has decreased from $3.01 billion to $2.91 billion between August 7 and August 13. This decline in large transactions could impede the liquidity necessary to support price growth.

Litecoin Price vs. Whale Transactions (LTCUSD) | IntoTheBlock

Market Predictions: Critical Support Levels Ahead

While Litecoin has outperformed Bitcoin during this recovery, the reduction in whale demand signals potential challenges ahead. The Relative Strength Index (RSI), a measure of market momentum, currently sits at 46, implying diminishing buying pressure in light of the overall market volatility. With the Bollinger Bands showing signs of contraction, indications build that Litecoin may soon face lower volatility or a potential reversal.

For Litecoin’s bullish narrative to hold, maintaining the $60 support level will be crucial. This level aligns with the lower Bollinger Band, marking it as a significant defense point for the bulls. If LTC fails to remain above this threshold, a deeper correction could follow, targeting the next significant support area around $53.91.

Conclusion: LTC’s Resilience in Question

Altogether, it can be stated that Litecoin has indeed trumped Bitcoin and broader market trends in the last one week or so, but deteriorating whale transaction volume remains a significant threat to its uptrend. Thus, with the crypto market remaining as unstable as ever, Litecoin is on the crossroad in terms of its price movements, and the further days may be crucial.