In the Queens Bitcoin Heist case that recently took place, a huge update has followed up. Seven individuals have been indicted for their alleged roles in a high-stakes Bitcoin theft from a Queens resident. The charges, which include grand larceny and money laundering, stem from a sophisticated cyberattack that saw over $300,000 in cryptocurrency stolen from a private wallet. This incident highlights the increasing vulnerability of digital assets and the complex challenges faced by law enforcement in the digital age.

The Hack That Led to a Haul

The case basically revolves around a hack that occurred in November 2022, during which 5.75 bitcoins were stolen from a cryptocurrency wallet belonging to a Queens resident. At the time of the theft, the stolen cryptocurrency was valued at approximately $92,000. However, due to Bitcoin’s notorious volatility and subsequent market rise, the value of the stolen assets has now ballooned to over $300,000.

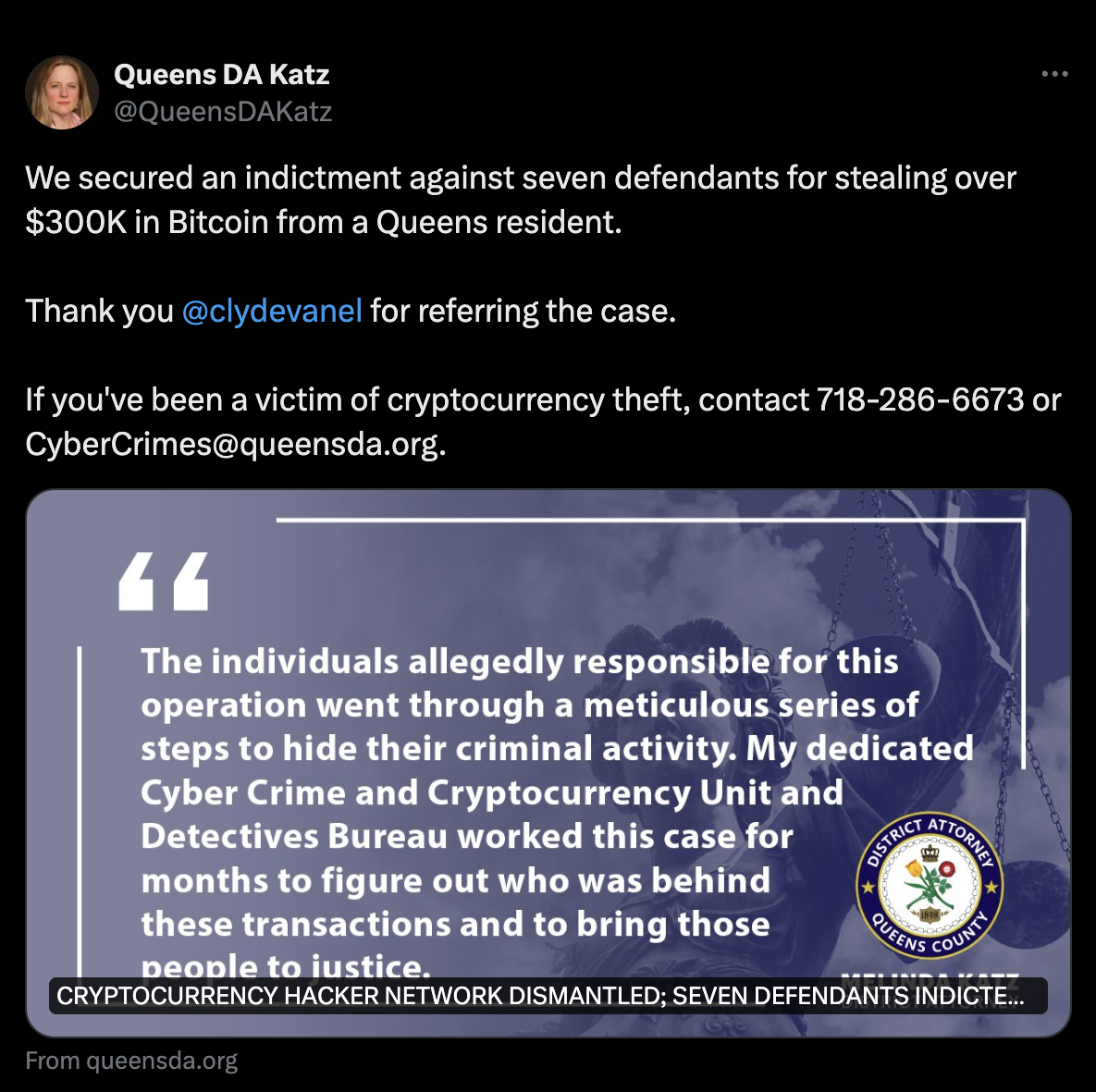

Queens District Attorney Melinda Katz, who announced the indictment, emphasized the severity of the crime and the thorough investigation that led to the arrests. “Bitcoin was removed from the victim’s Blockchain.com wallet through two unauthorized transactions in November 2022,” the District Attorney’s office noted. This seemingly simple statement belies the complex web of criminal activities that followed the initial theft.

A Complex Web of Laundering

What makes this case particularly intriguing is the method allegedly used to launder the stolen Bitcoin. The defendants reportedly employed a technique known as a “peel chain.” This method involves breaking down large amounts of illegally obtained cryptocurrency into numerous smaller transactions, making it significantly harder to trace the funds back to their original source.

The investigation, led by the Cyber Crimes Unit of the District Attorney’s office, was painstakingly detailed. More than 250 transactions were tracked, with many of these funneled into various Cash App accounts. These transactions, while seemingly innocuous on the surface, provided crucial links that ultimately connected the stolen funds back to the suspects.

The alleged ringleader, Aaron Peterson Jr., along with his parents and two other co-defendants, were apprehended in California. They now face a series of charges, including grand larceny in the second degree, money laundering in the second degree, two counts of identity theft in the first degree, computer trespass, and conspiracy in the fourth degree. The seriousness of these charges reflects the gravity of the crime and the sophisticated nature of the alleged operation.

The Legal Implications

For the seven defendants, the future looks bleak. Each faces a potential maximum sentence of 5 to 15 years in prison if convicted of the top count. While the charges are severe, they highlight a growing trend in the criminal world: the increasing use of digital currencies in illegal activities. This enables criminals to operate under the radar, but as this case demonstrates, law enforcement is catching up.

A Case Reflective of a Larger Issue

The Queens Bitcoin theft is not an isolated incident but rather a reflection of a broader issue facing the world today. As digital currencies become more mainstream, they are increasingly becoming targets for hackers and criminals. This case highlights the importance of securing digital assets and the need for continued advancements in cybersecurity measures.

The use of techniques like the peel chain also underlines the lengths to which criminals will go to cover their tracks. It is a cat-and-mouse game between law enforcement and those who seek to exploit the digital landscape for illicit gain.

Conclusion: A Cautionary Tale

In conclusion, the indictment of these seven individuals serves as a cautionary tale for all involved in the cryptocurrency world. It is a reminder that while digital currencies offer immense potential, they also come with significant risks. As the value of cryptocurrencies continues to rise, so too does their attractiveness to criminals.

This case from Queens serves as a sobering example of the dangers that can accompany digital wealth. It also highlights the ongoing need for vigilance, both from individuals who hold cryptocurrencies and the authorities tasked with protecting them. As the legal process unfolds, it will be interesting to see how this case shapes future efforts to combat digital crime in an increasingly online world.