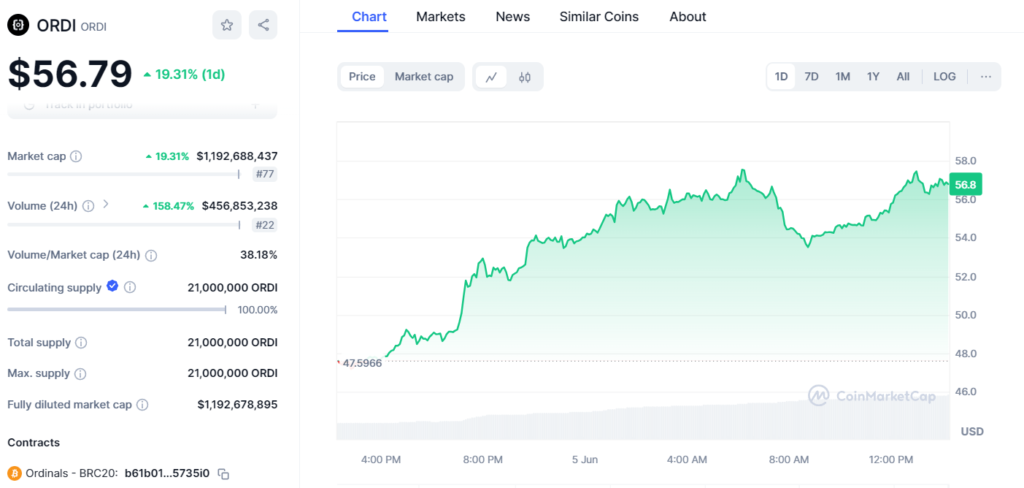

ORDI, the recently popular cryptocurrency in the field of digital currencies, showed a high volatility and its value increased by 19%. By 31% in one day to get to a price of $ 56. 79. This has further placed ORDI’s market capitalization at roughly $1. $197 billion, making it the 77th largest cryptocurrency by total market capitalization. This is coupled with a dramatic rise in trading volumes, which has escalated by 158%. 47% to $456. 85 million during the same time frame. The expansion of total volume to such a degree, especially when it makes up 38 percent, means the possibility of a similar rise in costs. , equivalent to 18% of the market cap, suggests frequent trading activity and possible increased interest among investors or speculative activity.

Similar to Bitcoin, the total token production will be limited to 21 million adopted to maximize value through the principle of scarcity. This fully diluted market capitalisation now resembles its current market capitalisation which indicates none of the issued tokens for the company are still to be issued to the public. This aspect might help attract conservative investors in cryptocurrencies, which do not have inflationary risks due to a rising number of tokens.

There are several possibilities as to why ORDI’s market price has increased recently. It is also possible that, within the ORDI ecosystem, those factors include late modifications to the platform’s underlying blockchain or new partnerships or influential individuals in the field of finance or IT endorsing the project. Other factors that could have led to the high price could be general market trends, where people invest in ‘safer’ or fixed supply securities during period of economic volatilities or downturns.

Therefore, the high fluctuation in trading volume and the market cap showed that ORDI was highly volatile, which investors should consider when investing in ORDI. Though it is possible to achieve high returns, it is also essential to pay attention to the risks associated with high fluctuation in stock valuation. The other factor that prospective investors need to look at is the liquidity of the ORDI. Thus, high liquidity, as indicated by the value of the volume-to-market cap ratio, always enables the quick entry or exit into and out of positions but extreme volatility may be witnessed if large amounts of tokens are bought or sold.

In addition, the long-term sustainability of increasing the price of ORDI may depend on the ongoing and future developments that will take place in its environment. Those interested in investing in Bitcoin should consider looking for constant technological developments, increased community engagement, and increased adoption across the market, which must bolster the price of the respective cryptocurrency in the long run.

All in all, the company’s recent performance can be considered successful, however, the latter implies specific risks associated with the investment in highly risky assets. Market speculators have to analyze the market as well as apply macroeconomic factors when investing in the digital currency. It will be important to observe how the cryptocurrency maintains the uptrend indicator in a volatile market.