This article was first published on Deythere.

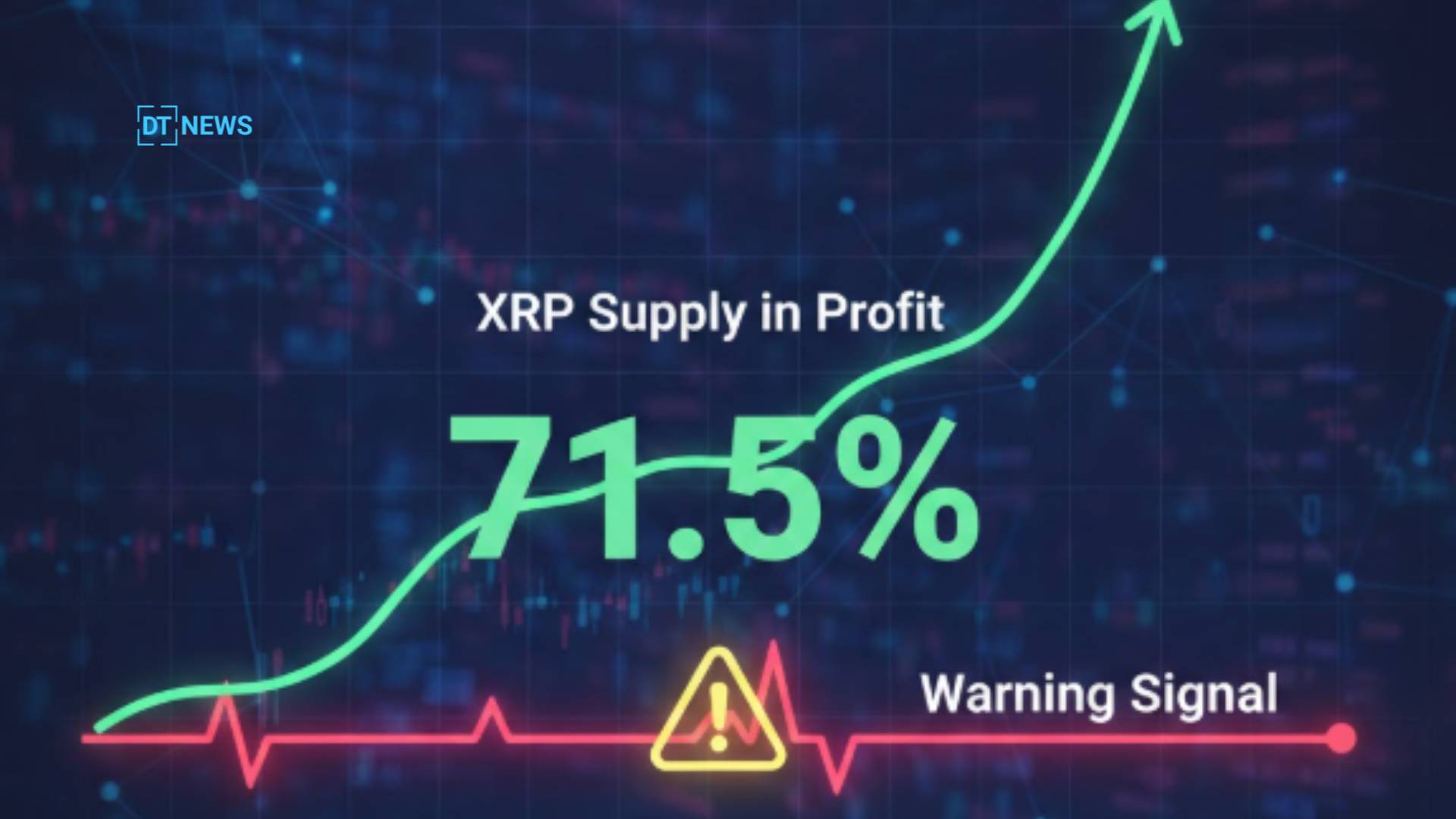

XRP is doing something that looks bullish at first glance and stressful once the data is peeled back. On-chain metrics show that roughly 71.5% of the token supply is currently in profit, a condition that usually supports confidence, stronger dips getting bought, and headlines about momentum returning. Yet a rare cost-basis signal, last observed around the 2022 market reset, is now reappearing and it tends to turn rallies into friction instead of fuel.

This is the kind of setup where price action can look calm on the surface, while the holder structure quietly stacks resistance above it.

The “profit majority” statistic is real, but it can mislead

A high share of supply in profit is often treated as a green light, when most holders are above water, panic selling becomes less likely and confidence usually improves. XRP sitting in this zone near $2.01 signals that many buyers have not been trapped at recent levels.

However, profit distribution matters more than a single headline number. Markets do not move on averages. They move on clusters of investors who share similar entry prices and similar emotions. If one major group sits underwater and keeps waiting for relief, that group can turn every bounce into an exit ramp.

The rare inversion that can “cap” XRP rallies

The more interesting signal comes from realized price behavior across holder age bands. It shows that short-term holders, those who bought within roughly the last 1 week to 1 month, have a lower average cost basis than mid-term holders in the 6 to 12 month range.

That may sound technical, but the effect is simple. New buyers are sitting closer to the current market price, while older buyers have higher entry points and are more likely to sell once price returns to their break-even zone. It creates a ceiling made of human behavior.

When that ceiling forms, XRP can still rally, but the rally often runs into supply quickly. The market gets stuck in a loop: small breakout attempt, immediate selling pressure, sideways grind, and repeated frustration. That pattern is why this inversion is often viewed as a “paralysis” signal.

Realized profit spikes hint at selling into strength

Another important piece of the puzzle is realized profit and loss, which measures whether coins are being moved on-chain at a profit or at a loss. Recent volatility produced a sharp jump, with realized profit/loss rising from about 5.15M to around 104.2M within a few days, before cooling back down.

In plain terms, that kind of surge usually means the market gave holders an opportunity to lock in gains and many took it. When profits are realized aggressively during short bounces, it can reduce follow-through and keep price from building clean trends. It is similar to a crowded exit in a stadium. There is nothing wrong with leaving, but the traffic slows everyone down.

Exchange flows suggest quiet accumulation, not panic

While overhead resistance is building, exchange data paints a more measured picture. XRP reserves on major trading venues sit near 5.55B, and recent flow trends show outflows outpacing inflows, with approximate daily outflows near 1.1M XRP compared with inflows around 629.5K XRP.

Outflows tend to be interpreted as coins moving into self-custody, which often reduces immediate sell pressure. It does not guarantee a rally, but it does suggest that the market is not rushing to dump.

This is why the current XRP story is not purely bearish or bullish. It looks more like a tug-of-war between long-term structure and short-term psychology.

Derivatives cooling signals stability, but less breakout fuel

Leverage also matters, especially for fast moves. XRP derivatives metrics show open interest around $3.58B, with a relatively mild funding rate near 0.0041%. Liquidations recently hit about $42.44M over 24 hours, reminding traders that crowded positions can still get punished.

Lower leverage reduces the odds of a liquidation chain reaction, but it can also limit the kind of explosive upside that breaks resistance in one clean push. If XRP is going to trend higher from here, the move may need to be spot-led and patient rather than driven by leverage.

Conclusion

XRP currently sits in a mixed but readable position. A large share of supply is in profit, exchange outflows suggest steady hands, and leverage has cooled. Yet the reappearance of a rare realized price inversion points to heavy overhead resistance from older buyers waiting for a clean exit.

That combination often produces choppy rallies, longer consolidations, and repeated tests of the same levels. For XRP to regain smooth upside momentum, the market will likely need time to absorb that supply and rebuild confidence step by step.

Frequently Asked Questions (FAQs)

What does “71.5% of XRP supply in profit” mean?

It means most coins were last moved at prices below the current market.

Why can XRP rallies stall even when most holders are profitable?

Because a large underwater holder group can sell into bounces near break-even.

What is the rare 2022-style signal XRP triggered?

A realized price inversion across holder age bands that often creates overhead resistance.

Do exchange outflows matter for price direction?

Yes, steady outflows can reduce near-term sell pressure, though they do not guarantee a rally.

Glossary of Key Terms

Realized Price: The average price at which coins last moved on-chain, used as a proxy for cost basis.

Supply in Profit: The share of tokens whose last moved price is below the current price.

Age Bands: Groups of holders categorized by how long they have held their coins.

Exchange Reserves: The amount of a token held on trading venues, often used to gauge sell readiness.

Funding Rate: A periodic payment in perpetual futures that reflects whether traders are mostly long or short.

Open Interest: The total value of active futures positions, indicating how much leverage is in play.

Reference