Bitmine Immersion Technologies has reportedly bought 128,718 ETH, worth around $480 million, in the days following the liquidation storm. This Bitmine ETH accumulation during extreme volatility as Ethereum’s price dropped by over 15 % and the crypto space saw tens of billions in leveraged positions liquidated.

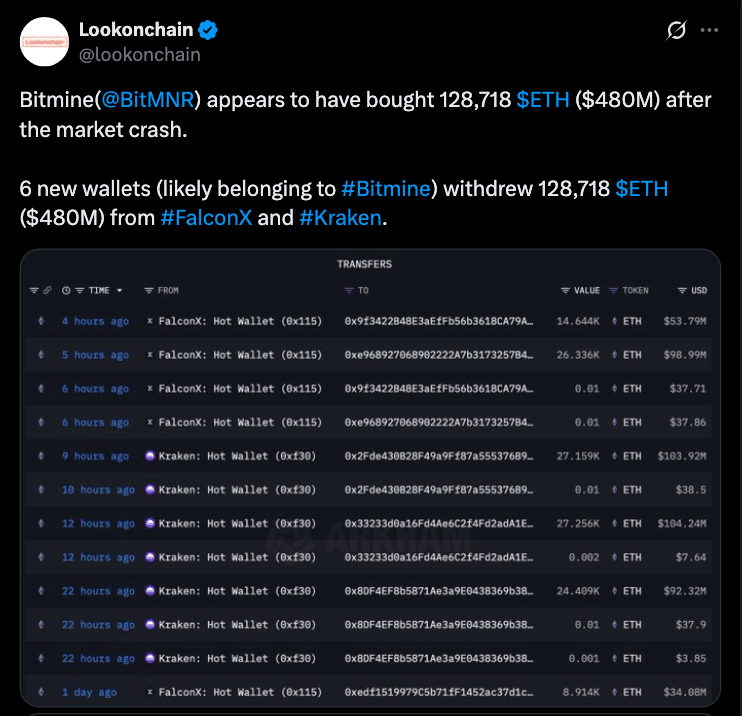

Verified by on-chain data via Lookonchain, the $ETH was withdrawn from major exchanges such as FalconX and Kraken through six new wallets linked to Bitmine, confirming the accumulation.

Crash Backdrop and Timing

The Bitmine ETH accumulation didn’t happen in a vacuum. Days before, US President Trump announced a 100 % tariff on Chinese software imports and stricter export controls on rare earth minerals. The announcement sent ripples to the market and Bitcoin dropped around 13 %, Ethereum fell about 20 % and over $20 billion in derivative open interest was wiped out in hours.

The crash forced liquidations across leveraged positions. In that chaos, Bitmine’s move stood out not as panic buying but as a deliberate capital deployment when others were exiting.

Signals in the transaction logs suggest the company bought $ETH at prices around $3,728, a deep discount during the mess. The timing implies Bitmine saw the crash as an opportunity, not a warning.

Also read: Why Bitcoin and Ethereum ETFs Are Seeing Unprecedented Institutional Inflows in 2025

Mechanics of the Accumulation

The execution of the accumulation shows sophistication and planning. Blockchain tracing via Lookonchain confirmed withdrawals of 128,718 ETH from FalconX and Kraken in six new wallets likely affiliated with Bitmine. These withdrawals coincided with the bottoming price action, consistent with big dip buys.

Sources note the average purchase price was around ETH levels of $3,728, so Bitmine bought at deeply discounted prices. With this move, Bitmine’s total ETH holdings went from 2.83 million ETH to 2.96 million ETH, which is almost 2.5 % of Ethereum’s supply.

Strategic and Treasury Implications

Experts have said Bitmine ETH accumulation is a treasury-focused plan. The company now holds more $ETH than most other corporate treasuries worldwide, second only to MicroStrategy.

Bitmine publicly claims to want to control up to 5% of the total ETH supply which would change the dynamics of ETH distribution. Their model is staking and yield generation. By running validator nodes or deploying $ETH in liquidity protocols, Bitmine could earn extra returns while holding the asset.

Even with over $2 billion in unrealized losses during the price crash, they are not exiting, they are accumulating.

This could also normalize $ETH as a corporate reserve asset, aligning treasury models with utility token economics rather than speculation.

Also read: Ethereum Scarcity Ahead? Bitmine and Ether Machine Snap Up 2.4M ETH

Conclusion

Based on the latest research; the $480M Bitmine ETH accumulation after the biggest crash in history was a big institutional statement. Instead of capitulating, they doubled down, withdrew 128,000 ETH from exchanges at fire sale prices and reinforced their treasury position.

This is a statement of confidence in Ethereum’s path, a challenge to traditional treasury allocations and a signal for how institutions engage with crypto reserves.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

After the biggest crash in history, Bitmine bought 128,718 ETH ($480M) from exchanges like FalconX and Kraken, increasing their holdings to 2.96M ETH (2.5% of supply). Verified on-chain, this shows institutional conviction.

Glossary

Accumulation – Buying and holding over time rather than trading.

Treasury Holdings / Crypto Treasury – Assets held by a company or entity as reserves.

Staking – Locking tokens to validate blockchain transactions and earn rewards in proof-of-stake networks.

Unrealized Loss – Loss of value in held assets that has not been realized by selling.

Proxy Wallets – Wallets set up by an entity (e.g. institution) to hide accumulation or withdrawals for timing purposes.

Frequently Asked Questions About Bitmine ETH Accumulation

Was Bitmine ETH accumulation confirmed?

Yes. On-chain analytics (Lookonchain) showed 128,718 ETH was withdrawn from major exchanges into new wallets linked to Bitmine.

At what price did Bitmine buy?

Data suggests some of the $ETH was bought at $3,728 during the crash.

How much $ETH does Bitmine hold now?

After the accumulation, Bitmine’s holdings went from 2.83 million ETH to 2.96 million ETH; almost 2.5% of ETH’s supply.

What will this do to $ETH’s price?

It may help set price floors, encourage rotation into $ETH, shift narratives around $ETH as a reserve asset and influence other institutions to accumulate.