As the crypto market continues to mature, the moves made by whales, wallets holding vast sums of digital assets, offer key insights into short-term trends and long-term sentiment. From massive Bitcoin accumulations to strategic altcoin plays and corporate entry into the digital asset space, whale transactions activity between May 25 and 31, 2025, has sent clear signals to investors.

This week’s on-chain data reveals a shift in capital flows, profit-taking behavior, and renewed institutional interest, which could shape the next phase of market momentum.

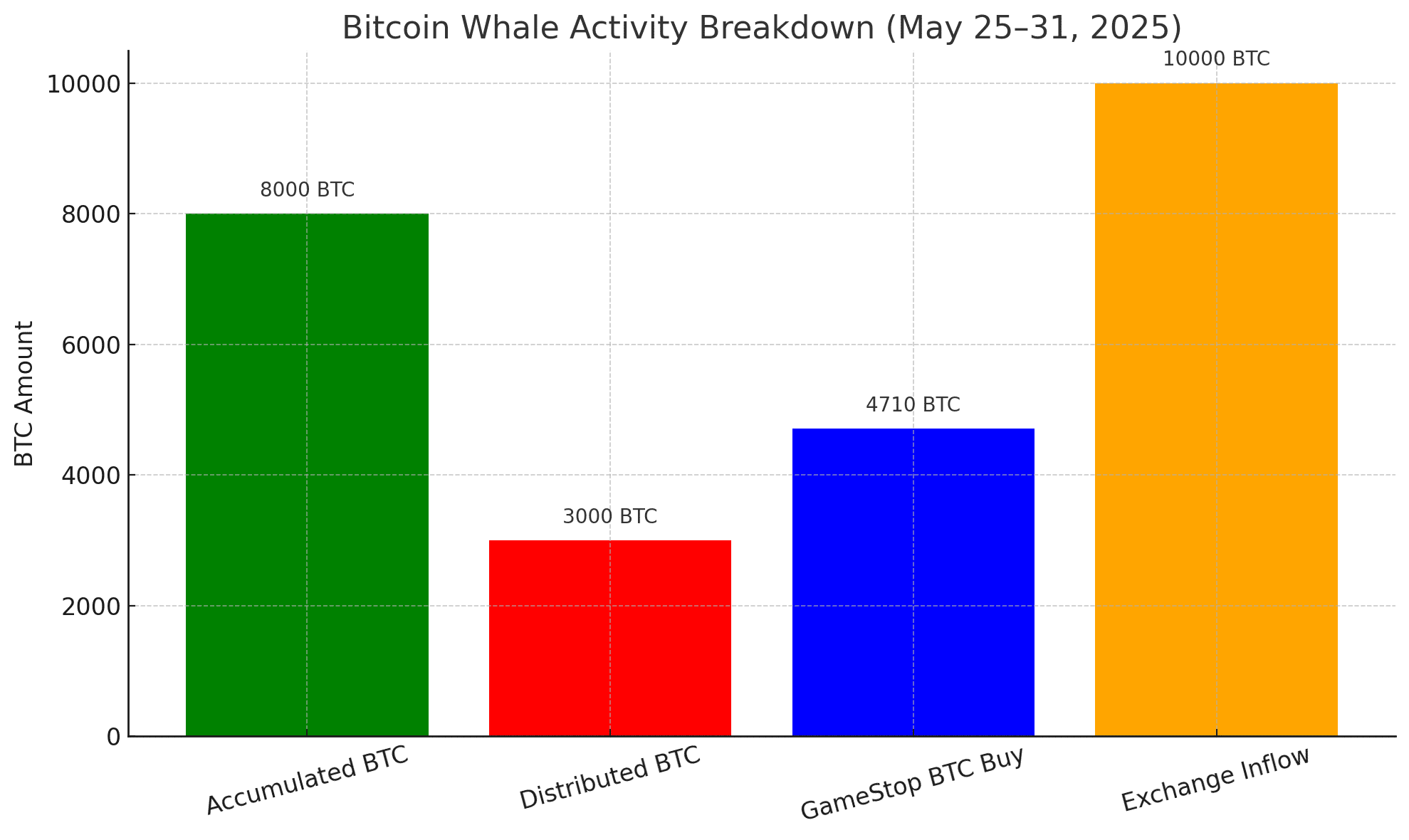

Major Bitcoin Whale Transactions

Bitcoin whales have been particularly active:

A single whale purchased 8,000 BTC, valued at approximately $850 million, on May 30, 2025, coinciding with a 12% surge in trading volume on major exchanges.

The Exchange Whale Ratio’s 30-day moving average reached 0.47, the highest in seven months, indicating that nearly half of BTC inflows to exchanges are from large transactions.

Wallets holding over 10,000 BTC have shifted from accumulation to distribution, suggesting potential profit-taking.

Corporate Crypto Investments

Several corporations have made significant crypto investments:

GameStop acquired 4,710 BTC worth approximately $513 million, marking its first major crypto investment.

Trump Media and Technology Group announced plans to raise up to $2.5 billion to invest in cryptocurrencies like Bitcoin.

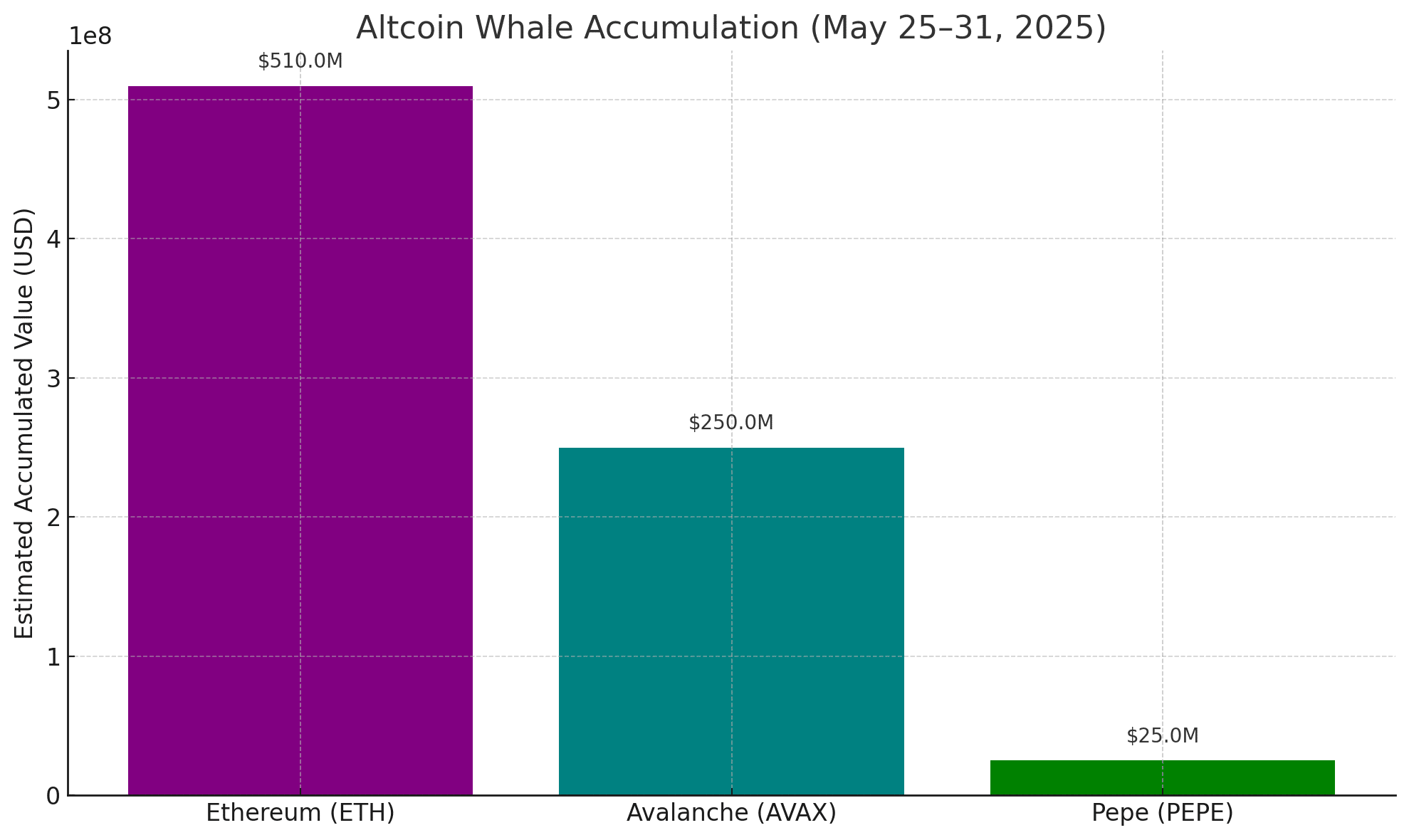

Altcoin Accumulation by Whales

Whales have been accumulating various altcoins:

Ethereum (ETH): Whale addresses holding between 10,000 and 100,000 ETH acquired 280,000 ETH, valued at over $510 million.

Avalanche (AVAX): Large holder netflows increased by 380%, indicating significant accumulation.

Pepe (PEPE): Whales purchased 350 million PEPE tokens, signaling bullish sentiment.

Whale Transactions Activity Summary Table

| Asset | Whale Activity Description | Estimated Value |

|---|---|---|

| BTC | 8,000 BTC purchase by a single whale | ~$850 million |

| ETH | Accumulation of 280,000 ETH by large holders |

|

| AVAX | 380% increase in large holder netflows | Significant accumulation |

| PEPE | Purchase of 350 million PEPE tokens by whales | Not specified |

| GameStop | Acquisition of 4,710 BTC | ~$513 million |

| TMTG | Plans to raise funds for crypto investments | Up to $2.5 billion |

Whale Behavior as a Market Signal: What This Week Tells

This week’s whale transactions activity offers more than just transaction records—it reveals evolving strategies in capital allocation across the crypto landscape. The simultaneous accumulation of Ethereum and Avalanche, paired with distribution among large Bitcoin wallets, suggests a sectoral rotation by high-net-worth investors betting on higher altcoin returns in Q3 2025.

Meanwhile, institutional moves by GameStop and Trump Media signal growing corporate conviction in Bitcoin as a strategic asset, not just a speculative hedge. These shifts highlight the importance of monitoring whale transaction wallets not only for trade timing but also for anticipating macro-level narratives that shape broader investor sentiment.

Market Implications

The surge in whale transactions suggests a bullish outlook for the crypto market. However, shifting from accumulation to distribution among Bitcoin whales could indicate potential short-term corrections. Investors should monitor these movements closely, as they often precede significant market shifts.

Conclusion

Crypto whale transactions activity between May 25 and 31, 2025, underscores the growing influence of both individual and institutional players in shaping market direction.

From Bitcoin acquisitions to large-scale altcoin accumulations and major corporate investments, these moves reflect a strategic reallocation of capital that may foreshadow broader shifts in the crypto landscape.

While whale behavior often precedes price volatility, it also provides valuable signals for retail investors seeking to align with market momentum.

Frequently Asked Questions (FAQs)

What are crypto whales?

Crypto whales are individuals or entities that hold large amounts of a specific cryptocurrency, capable of influencing market prices.

Why do whale transactions matter?

Whales can move prices by executing large trades, triggering market reactions and trend shifts through accumulation or distribution phases.

How can I track whale transactions?

You can use platforms like Whale Alert, Arkham Intelligence, or Etherscan to monitor large on-chain transfers and wallet behavior.

Which assets did whales buy this week?

BTC, ETH, AVAX, and PEPE saw significant whale transactions inflows, alongside institutional interest in Bitcoin from companies like GameStop and Trump Media.

Do whales signal bullish or bearish trends?

Whales accumulating assets often signal bullish momentum, while large exchange deposits or sell-offs may indicate bearish short-term sentiment.

Glossary of Key Terms

Crypto Whale: A wallet or entity holding large amounts of cryptocurrency, often able to influence markets.

On-chain Data: Information recorded directly on the blockchain, used to track transactions and behaviors.

Accumulation: A phase where whales or investors quietly buy assets over time to increase their holdings.

Distribution: The process of selling or offloading assets, often after a price increase.

Exchange Whale Ratio: A metric showing the share of large transactions on exchanges, often used to assess selling pressure.

Institutional Investment: Crypto purchases made by companies, funds, or large organizations rather than individuals.

Sources and References

Disclaimer: The information provided is for educational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

For advertising inquiries, please email . [email protected] or Telegram