The U.S. Securities and Exchange Commission (SEC) has again delayed its decision on the proposed XRP ETF from 21Shares. This move marks another pause in a regulatory process that has extended across several similar altcoin ETF filings. Despite the delay, the XRP ETF remains at the center of investor interest and institutional attention.

- 21Shares’ XRP ETF Faces Regulatory Pause

- XRP Price Shows Minor Impact

- XRP ETF Delay Mirrors Bitcoin, Ethereum Path

- FAQs

- What is an XRP ETF?

- Why did the SEC delay the XRP ETF?

- Has the SEC approved any altcoin ETFs?

- When will the SEC decide on the XRP ETF?

- Does the delay mean the XRP ETF will be denied?

- Glossary of Key Terms

21Shares’ XRP ETF Faces Regulatory Pause

The SEC has delayed its decision on 21Shares’ spot XRP ETF application, citing the need for further review. The commission process is very structured; it includes public input and in-depth market evaluation before any decision is taken. These are normal delays, often multiple months long.

Delays on spot crypto ETFs are expected. A bunch of XRP ETPs have dates in next few days.

If we're gonna see early approvals from the SEC on any of these assets — i wouldn't expect to see them until late June or early July at absolute earliest. More likely to be in early 4Q.

— James Seyffart (@JSeyff) May 20, 2025

The delay in this case also parallels what the SEC did with previous Bitcoin or Ethereum ETF proposals. These approvals not only went through multiple extensions before issuing the final decisions. This recent pause, therefore, should be standard review procedure.

While the proposal is up for review, the application is alive and progressing through the regulatory channel. The collection of feedback and its internal analysis are part of the process. The SEC is expected to make a final decision later this year.

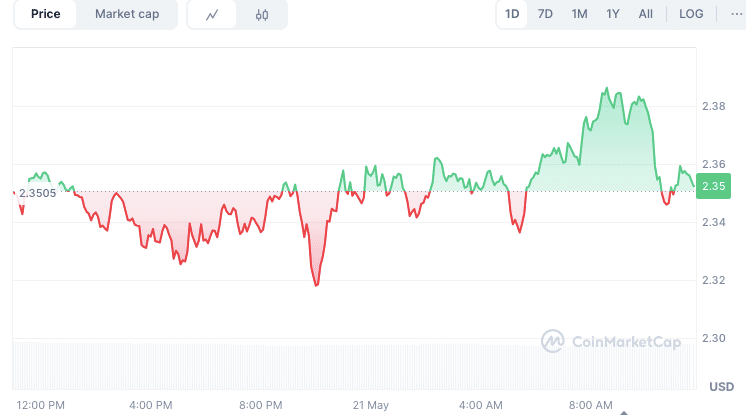

XRP Price Shows Minor Impact

XRP’s market response to the news was muted, with a 0.20% price dip recorded in the last 24 hours. The coin trades around $2.35, maintaining stability despite regulatory uncertainty. This modest reaction suggests that investors were expecting the delay.

Short-term price drops during such developments are common across crypto markets. However, institutional interest in XRP continues to grow. Regulated XRP futures went live this week, indicating increasing adoption.

The token remains actively traded, with strong liquidity and increasing exchange listings. Even without an approved XRP ETF, market infrastructure around XRP is expanding. This sets the foundation for broader participation once approval is granted.

XRP ETF Delay Mirrors Bitcoin, Ethereum Path

So far, the SEC has not approved any spot ETF for altcoins other than Bitcoin and Ethereum. XRP, like Solana and Polkadot, remains under evaluation in the current wave of ETF proposals. Still, the pattern mirrors the SEC’s cautious rollout for earlier crypto assets.

Before Bitcoin and Ethereum ETFs were approved, the SEC delayed them several times. This repetitive timeline is now seen as standard practice for altcoin ETF evaluations. Analysts expect XRP ETF decisions to follow a similar path.

Crypto market analyst James Seyffart predicted that action on XRP ETF applications could come by late June or in Q4 2025. Meanwhile, the SEC is also reviewing ETF filings for Solana and Polkadot. Multiple decisions are expected in the coming months.

FAQs

What is an XRP ETF?

An XRP ETF is a regulated investment product that tracks the price of XRP and trades on traditional stock exchanges.

Why did the SEC delay the XRP ETF?

The SEC delayed the XRP ETF to gather more data, analyze market risk, and allow public feedback on the proposal.

Has the SEC approved any altcoin ETFs?

The SEC has not approved any altcoin ETF except for Bitcoin and Ethereum.

When will the SEC decide on the XRP ETF?

The SEC could announce a decision by late June or during the final quarter of 2025.

Does the delay mean the XRP ETF will be denied?

Delays are a normal part of the process and do not indicate approval or rejection.

Glossary of Key Terms

XRP ETF – An exchange-traded fund that reflects the market price of XRP, allowing investors to gain exposure without directly holding the asset.

SEC (Securities and Exchange Commission) – The U.S. regulatory authority oversees securities markets, including ETFs and crypto products.

21Shares – A global investment firm that applied to launch a spot XRP ETF in the U.S.

Spot ETF – A type of ETF that holds the actual asset (like XRP) instead of futures contracts.

Futures Contracts – Financial agreements to buy or sell an asset at a future date for a fixed price, often used in crypto markets.

Polymarket – A decentralized prediction platform where traders forecast outcomes of real-world events, including crypto ETF approvals.