This article was first published on Deythere.

Institutional investors remain careful with digital assets, but they increasingly want them on familiar ground. Sweden illustrates that shift as the main stock exchange now hosts a growing set of crypto ETPs besides ordinary shares and funds.

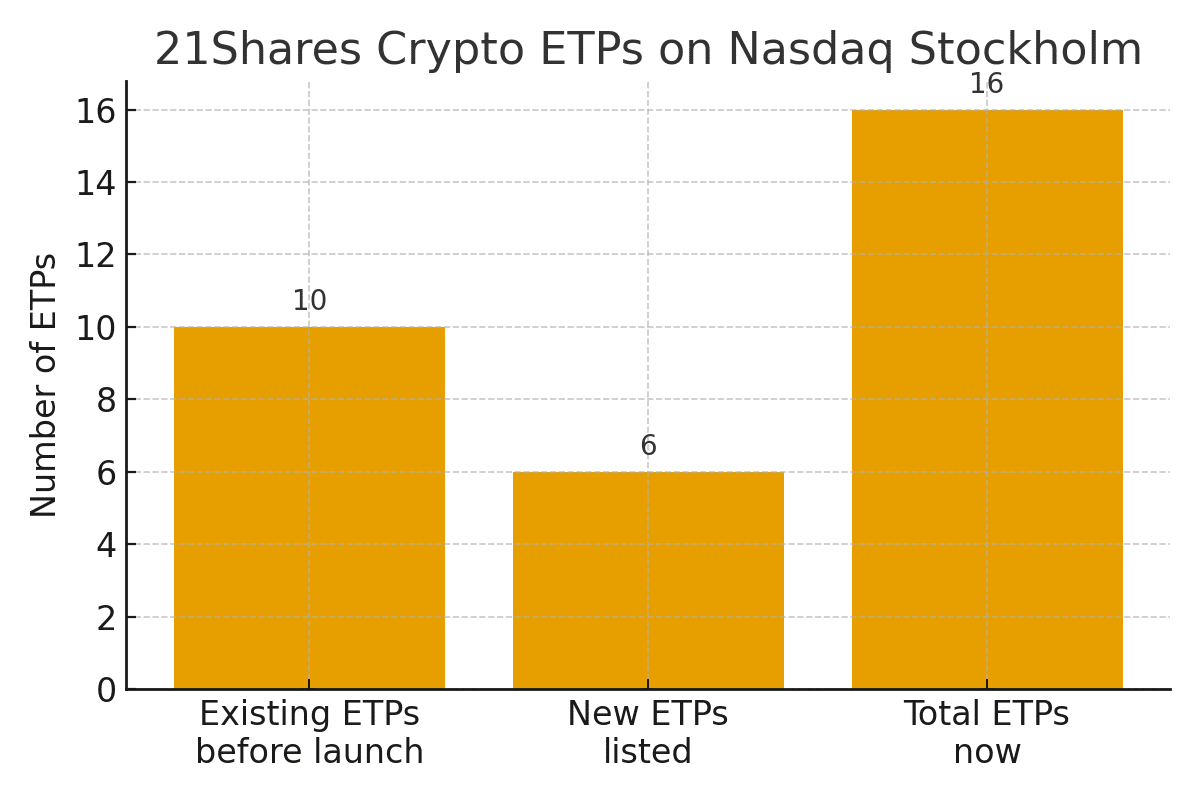

On 20 November 2025, 21Shares cross-listed six new products on Nasdaq Stockholm. The launch extends its mix of single coin and index strategies and folds more crypto ETPs into a regulated venue that pension funds, family offices and retail traders already use for equities and bonds.

Institutional Money Follows Regulated Rails

In earlier cycles, much of the growth in digital assets flowed through offshore or lightly supervised platforms. Now European exchanges list a steady stream of crypto ETPs, and issuers focus on building lasting assets under management. 21Shares already oversees about 8 billion dollars across its products in the region.

Alistair Byas Perry, head of EU investments at the firm, described the Nordic trend in clear language. He said, “We continue to see strong demand from Nordic investors seeking diversified, cost efficient access to digital assets through regulated exchanges.” Local trading data suggests that institutions are gradually moving from watching the market to participating in it.

Six new crypto ETPs for Nordic investors

The new crypto ETPs cover both single assets and diversified baskets. Investors in Stockholm can now buy exposure to Aave, Cardano, Chainlink and Polkadot, together with two index style products that track baskets of major coins by market share and liquidity. All six trade in Swedish krona beside earlier bitcoin, ether and Solana listings.

Each of the six crypto ETPs is physically backed. Every share represents a claim on real coins held in custody with regulated providers, rather than a derivative or swap. For committees that oversee pension or insurance money, that structure matters because it mirrors the way gold and commodity products already work in traditional finance.

Reading The Market Signals

With the new listings, the issuer now offers sixteen crypto ETPs on the Swedish exchange. A broad shelf of products can improve trading spreads and depth and can signal that demand is consistent, not just a reaction to short-term price spikes. On X, market commentator Merlijn The Trader captured the mood after the announcement, writing, “This is how institutional demand scales.”

For professional investors, the launch is about the toolkit, not one coin. A regulated menu of crypto ETPs lets risk teams set limits by asset and venue and track assets under management, spreads, volume and tracking error against traditional funds.

Conclusion

The six new listings on Nasdaq Stockholm will not transform the market in a single step, but they do add another building block to the institutionalisation of digital assets. As more crypto ETPs reach regulated exchanges, investors gain clearer ways to size positions, test strategies and manage risk while staying inside legal and operational frameworks they already understand.

For the Nordic market, this launch reinforces a reputation as one of Europes most active laboratories for regulated digital asset exposure. That mix of caution and curiosity defines this phase for many institutions.

Frequently Asked Questions

Q: What are exchange traded products that track digital assets?

A: They are listed securities that follow one coin or a basket of coins and trade on stock exchanges during normal market hours.

Q: Why do investors care that the products are physically backed?

A: Physical backing means each unit is supported by coins in custody, which reduces counterparty risk compared with derivatives-based exposure.

Glossary Of Key Terms

Exchange traded product (ETP):

A security that tracks an underlying asset, basket or index and trades on stock exchanges throughout the trading day.

Physically backed:

A structure in which each share is supported by holdings of the underlying asset, such as bitcoin or ether, that sit in a regulated custody arrangement.

Tracking error:

The difference between the performance of a product and the performance of the asset or index that it is designed to follow over time.