This article was first published on Deythere.

Ethereum ETF inflows reached $175 million in just two days, showing strong investor confidence in $ETH despite its short-term price struggles. The surge underlines the growing role of crypto ETFs in the market.

Investors are clearly interested in gaining exposure to $ETH without holding it directly. At the same time, these inflows reflect the ongoing market dynamics shaping $ETH’s performance.

What Are Ethereum ETFs and ETF Inflows?

Ethereum ETFs give people a way to invest in $ETH through the stock market instead of buying the coin themselves. The funds take in money from investors and use it to hold $ETH on their behalf.

When people talk about ETF inflows, they’re simply referring to how much new money has moved into these products. It’s a quick way to gauge whether interest in $ETH is rising or cooling off.

When a fund pulls in a lot of new money, it usually means investors are feeling more confident, and when the money moves out, it often signals caution or people locking in gains. For $ETH, these ETF inflows have become a handy way to read what bigger players are thinking.

They often reveal a shift in interest long before the price shows it. That’s why many traders look at these numbers as a quick check on the mood around $ETH.

How Much Money Flowed Into Ethereum ETFs Recently?

On 24 November, Ethereum Spot ETFs brought in $96.6 million in fresh inflows. Most of that came from BlackRock, which added $92.6 million after two weeks of no activity. The pace didn’t slow the next day.

On 25 November, another $78.6 million moved into ETH ETFs, keeping the streak going. Fidelity’s FETH pulled in the most, bringing $47.5 million on its own.

BlackRock’s ETHA wasn’t far behind with $46.2 million, and Grayscale’s ETH added another $8.3 million. Even with these strong numbers, not every fund moved in the same direction. A few issuers still saw money leaving their products during the same period.

Grayscale’s ETHE had $23.3 million move out of the fund, according to Farside Investors. That outflow stood out against the broader trend of money coming into other ETH products.

Even so, analysts say the recent Ethereum ETF inflows show that larger investors haven’t lost faith in $ETH. They view the current swings as short-term noise rather than a shift in long-term sentiment.

What’s Keeping $ETH From Building on Its Rebound?

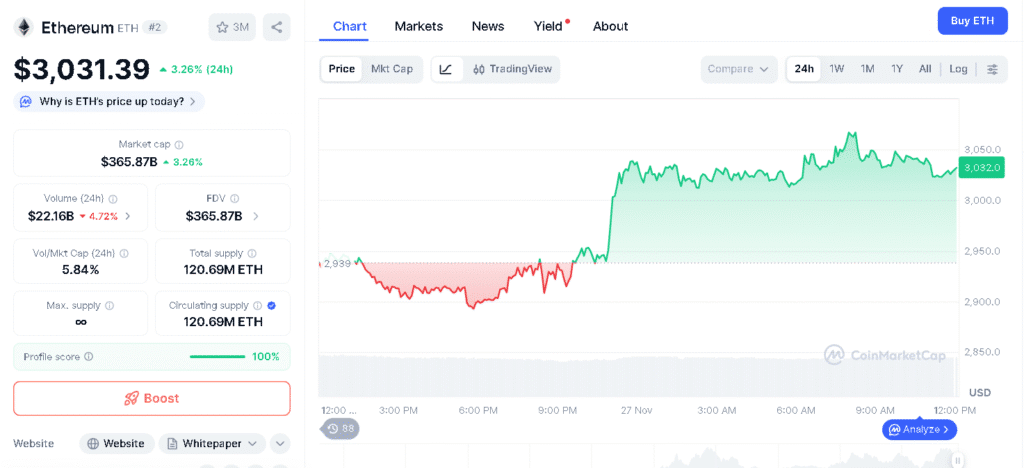

$ETH is now trading around $3,030.46 after climbing 3.01% in the past 24 hours. The modest rebound has pushed the price back above the $3,000 level. This marks a change from the softer levels seen during the recent ETF inflows.

Even with the uptick, traders are waiting to see if $ETH can maintain this momentum. Market experts point to several macro pressures weighing on Ethereum’s price, even with strong Ethereum ETF inflows in recent days.

Concerns over a possible U.S. government shutdown have added uncertainty across risk-assets. Changing expectations around Federal Reserve rate cuts have also kept traders cautious.

On top of that, a broader risk-off mood in global markets has limited upside for $ETH. Technical indicators seem to back up this outlook. Both the RSI and MACD are pointing toward a short-term bearish trend.

Even so, several analysts argue that these signals may not carry long-term weight. They see it as short-term noise rather than evidence of a deeper shift in $ETH’s direction.

Are Ethereum Whales Returning to the Market?

Interestingly, the earlier drop in $ETH drew some of the larger holders back into the market. On-chain data shows that wallets that had been inactive for a while suddenly shifted big amounts of $ETH.

Their activity helped fuel the nearly 9% rebound from the recent low of $2,623 to levels back above $3,000. Traders see this return of whale interest as a sign that some confidence is still in the market.

Many traders take this activity as a bullish sign. The return of large holders often hints at growing confidence in the market. Analysts say that strong Ethereum ETF inflows together with renewed whale activity point to steady demand for $ETH. For many in the market, this combination suggests that interest in $ETH hasn’t faded.

How Are Other ETFs Impacting the Market?

While Ethereum deals with its own volatility, other ETF moves are also influencing the wider crypto scene. VanEck has filed for a Spot Binance (BNB) ETF that is set to list on Nasdaq and follow the MarketVector BNB Index.

The fund won’t offer staking when it launches. There is, however, a possibility that staking could be added later through third-party providers. BNB is trading around $894.28, showing a 3.73% increase over the past 24 hours.

Despite the short-term rise, the token remains down about 20.98% over the past month. Market watchers note that growing interest in new crypto ETFs could support broader attention across the sector, and Ethereum ETF inflows may also benefit as more investors seek regulated ways to gain crypto exposure.

Conclusion

Ethereum ETF inflows of $175 million in just two days show strong interest from big investors. Even with $ETH now trading above $3,000, the steady inflows suggest that institutions still see long-term value in the asset.

This level of demand indicates that confidence in Ethereum remains firm despite recent market swings. Short-term volatility is still present, but the mix of technical recovery signs, whale movement, and strong Ethereum ETF inflows points to steady investor interest.

Some analysts say that even though $ETH may encounter challenges, its support from Ethereum ETF inflows could help keep market confidence intact.

Glossary

Ethereum ETF: A fund that lets you invest in Ethereum through the stock market.

MACD: A tool that shows if prices are going up or down soon.

Spot ETF: A fund that owns real Ethereum coins.

On-Chain Data: Info from the Ethereum blockchain about transactions and wallets.

RSI: A tool that checks if Ethereum is bought or sold too much.

Frequently Asked Questions About Ethereum ETF Inflows

How much money flowed into Ethereum ETFs recently?

In just two days Ethereum ETFs pulled $175 million. BlackRock and Fidelity led the way.

Did all Ethereum ETFs see inflows?

Not all. Some funds like Grayscale’s ETHE saw money leave. But most gained new investments.

Why is Ethereum’s price still weak despite ETF inflows?

Even with big money coming in, Ethereum’s price feels pressure. lLike wider market worries U.S. government uncertainty and financial risks.

What happened to Ethereum’s price recently?

Ethereum price dropped about 25% in the last month. but now has bounced back a bit. It is now above $3,000. There are signs of a small recovery.

What do analysts say about Ethereum’s short-term trend?

Some signals show short-term weakness. But many experts say this is temporary. They are still confident in Ethereum’s long-term future.