Metaplanet obtained $1.4 billion in an international share offering to boost its treasury strategy. The growth demonstrates how Metaplanet Bitcoin accumulation is redefining the firm’s identity while also positioning Japan at the forefront of institutional crypto adoption.

Historic Capital Raise for Digital Assets

Metaplanet increased its share offering from 180 million to 385 million shares priced at ¥553 ($3.75) apiece, totaling approximately ¥205 billion. In September and October, about 90% of the revenues, or around $1.25 billion, would be used to acquire Bitcoin.

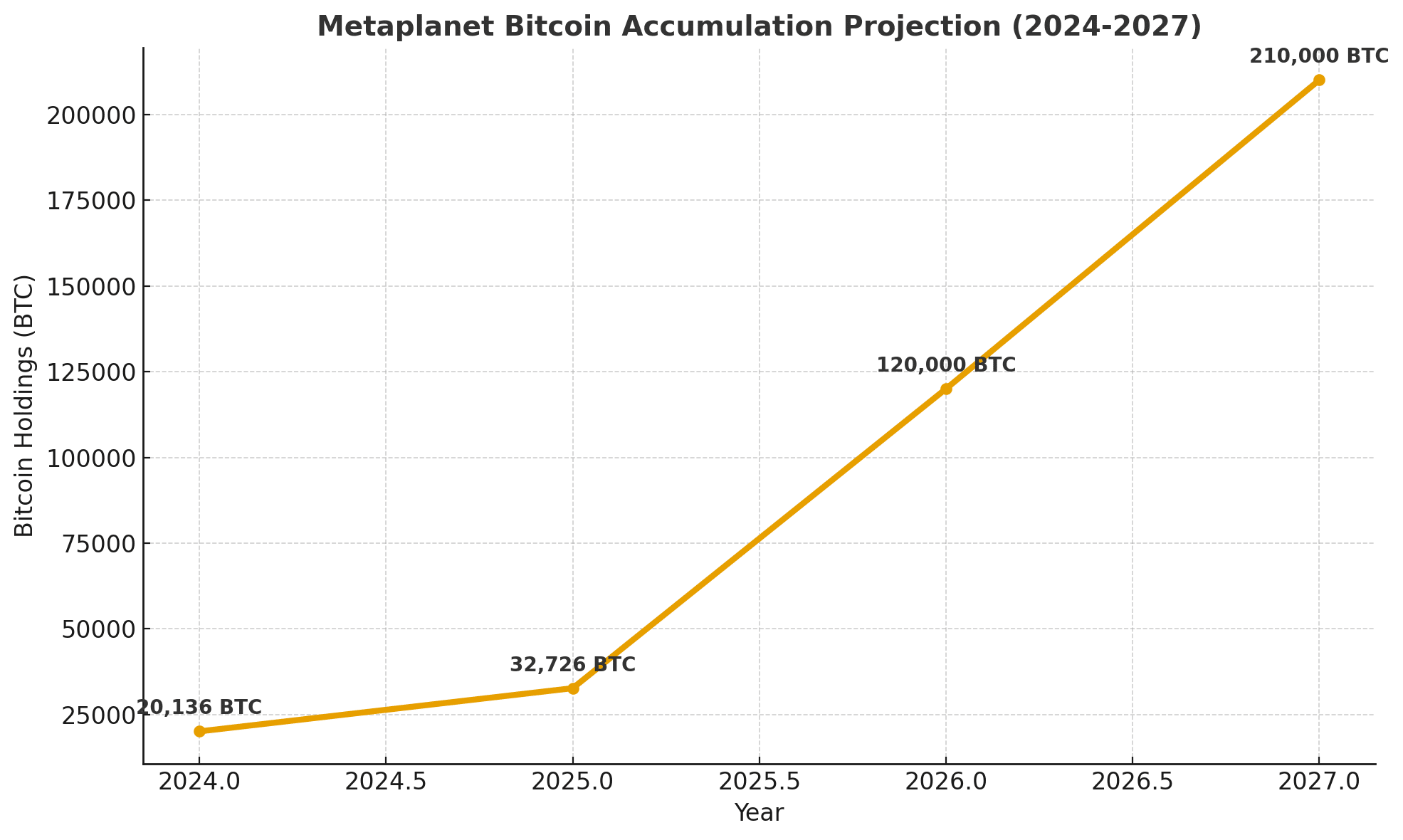

This move might add over 12,500 BTC to its balance sheet, increasing holdings from 20,136 BTC to more than 32,700 BTC. The size of this development demonstrates the scope of Metaplanet Bitcoin accumulation, a business maneuver that challenges long-standing techniques used by US-based corporations.

Simon Gerovich, the company’s CEO, acknowledged the aggressive effort in a statement on X: “Metaplanet has finalized its international offering, which has been increased from 180 million underwritten to 385 million shares.” Total raise: JPY 205 billion (about USD 1.4 billion). More Bitcoin accumulation are expected.” His statements emphasized that the corporation views digital assets as critical to its financial sheet and long-term prospects.

Strategic Pivot Beyond Traditional Business

Metaplanet, once known largely as a hotel operator, has evolved into a cryptocurrency-focused firm. The decision reflects how macroeconomic factors, notably sustained yen weakening and Japan’s low interest rate environment, have weakened trust in conventional reserves. In this environment, Metaplanet Bitcoin accumulation has emerged as a smart hedge against inflation and currency devaluation.

The corporation is investing ¥20.4 billion ($139 million) in its Bitcoin Income Generation Business, which utilizes options trading to generate income from its assets. This side enterprise generated ¥1.9 billion in income in Q2 2025, proving that Bitcoin can be both a reserve asset and a profit generator when combined with creative financial tactics.

Long-term ambitions to dominate Bitcoin accumulation

Metaplanet’s aspirations go much beyond its present fundraising. By 2027, the corporation plans to purchase 210,000 BTC, or nearly one percent of Bitcoin’s total circulating supply. If met, this milestone would solidify its position as one of the world’s largest public holders of digital assets.

Analysts are already comparing Metaplanet Bitcoin accumulation to the strategy used by U.S. firms to build billion-dollar values through crypto treasuries.

However, such magnitude does not come without hazards. On the news of the dilution of existing shares, Metaplanet’s stock fell roughly 10%. Investors tend to be split between concerns about aggressive capital deployment and confidence about long-term returns. However, the decision represents a significant shift in how firms outside the United States are coming to view Bitcoin as a basic reserve asset.

A Global Signal for Corporate Finance

The larger market consequences are considerable. Metaplanet Bitcoin accumulation exemplifies a developing trend in which organizations use digital assets into treasury management. Metaplanet’s strategy may inspire other Asian enterprises to follow suit as regulatory clarity improves and institutional products such as ETFs become more commonplace. The comparisons to early adopters in the West indicate that corporate Bitcoin adoption is entering a new global phase.

As one industry consultant stated on X, “Metaplanet is illustrating that Bitcoin is no longer simply an American company narrative. Japan is taking a tremendous stride forward, which will transform the game globally.”

The Final Word

Metaplanet’s $1.4 billion fundraising signifies a watershed point in corporate cryptocurrency use. With the goal of becoming one of the world’s largest holders of digital assets, the firm is promoting Metaplanet Bitcoin accumulation as a financial strategy and a cultural statement.

While dilution worries remain, the radical turn signals a larger rethinking of business balance sheets in the digital era. Japan now has a new cryptocurrency champion, and the world is taking notice.

FAQs for Metaplanet Bitcoin accumulation

How much money did Metaplanet raise in its latest offering?

The company raised $1.4 billion by upsizing its share offering to 385 million shares, priced at ¥553 each.

How much Bitcoin does Metaplanet plan to acquire with these funds?

The company expects to purchase over 12,500 BTC, raising its total holdings to more than 32,700 BTC.

What is Metaplanet’s long-term Bitcoin goal?

By 2027, the firm aims to hold 210,000 BTC, about one percent of total circulating supply.

Why did Metaplanet’s stock drop after the announcement?

Shares fell nearly 10 percent due to dilution concerns from the discounted offering, even as investors welcomed the ambitious strategy.

Glossary of Key Terms

Bitcoin Treasury Strategy – Corporate policy of holding Bitcoin as a reserve asset.

Dilution – Decrease in existing shareholders’ ownership percentage due to new share issuance.

Options Trading – Derivatives strategy that allows income generation through contracts tied to asset prices.

Circulating Supply – The number of cryptocurrency coins currently available and circulating in the market.

Macro Headwinds – Economic conditions, such as inflation or currency weakness, that pressure traditional assets.